On average, U.S. adults correctly answered 50% of the TIAA Institue-GFLEC Personal Finance Index in 2021. The institute explains the Personal Finance Index “measures knowledge and understanding that [enables] sound financial decision-making and effective management of personal [finances].” If digital marketing is the link between financial institutions, service providers, and consumers, then many opportunities abound to educate consumers on financial literacy through products offered by financial service providers.

Measures knowledge and understanding that [enables] sound financial decision-making and effective management of personal [finances].

Digital marketing strategies can also enhance financial company exposure, visibility and improve customer engagement — all of which are vital elements in the financial sector. Exceedingly, marketing investment, in terms of strategic input, is being spent on customer acquisition and retention. Here are our top 10 digital marketing tips for engaging younger generations, improving financial literacy, and generating leads to maintain long-term customer acquisition.

Educate Your Clients

How do you market financial services products to customers who may not understand their value or what they do? You educate them. While this is the industry norm for content marketing, it’s perhaps even more pertinent to the financial services industry.

The Center for Financial Inclusion report purports that regardless of which side customers fall on the breadline, they all want to know how financial service companies can help their lives. Advantageously, because financial service products naturally require explanation, there’s no dearth of content marketing topics.

The premise behind content marketing is that if financial companies consistently provide their customer base with information about their products and how they can benefit, it’s possible to convert them into quality leads. But, of course, content marketing doesn’t just have to be relegated to blogs, either, although this is a good starting point.

Take Pan-African investment, savings, insurance, and banking group, Old Mutual. Their money management app 22Seven builds customers’ trust by helping them track their finances and simultaneously offers the opportunity to invest in their products, but not without empowering them through education first.

Use All Available Media Channels

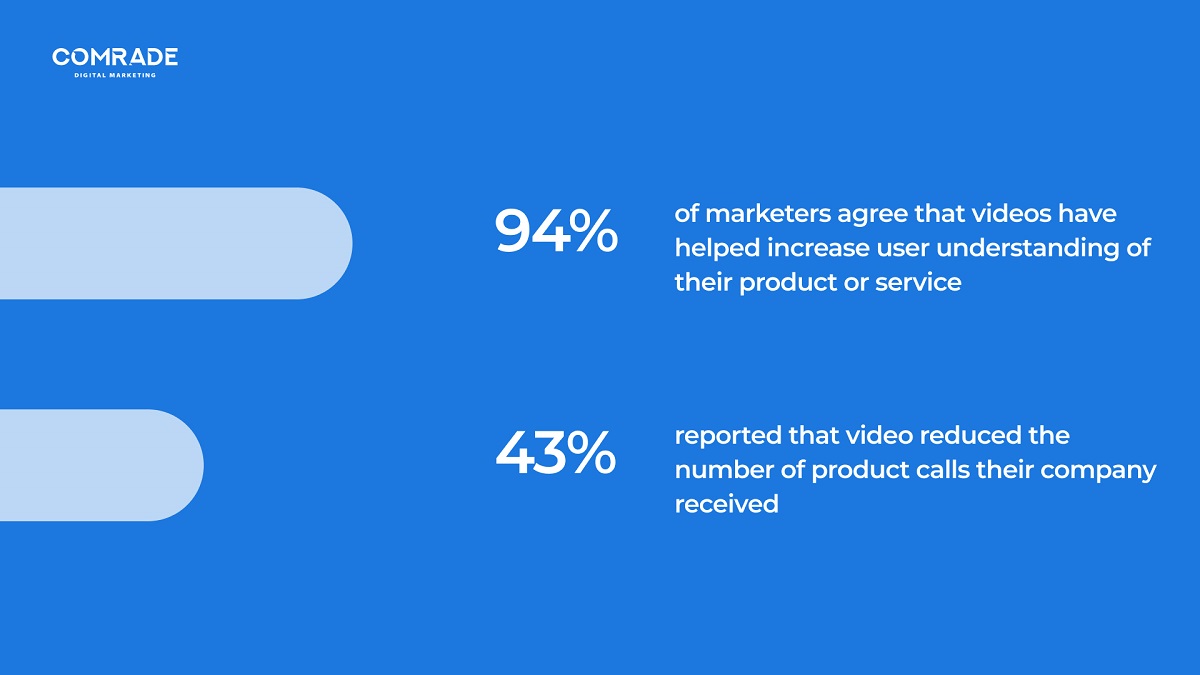

Financial service providers need to be where their consumers are. And, well, they are everywhere from YouTube to Social Media and Google search. Multichannel customers spend 30% more per purchase, and while blogging has a high ROI, not all customers are inclined to read posts. In fact, 94% of marketers agree that videos have helped increase user understanding of their product or service, and 43% reported that video reduced the number of product calls their company received.

But video marketing is no longer just about creating online ad campaigns, it’s become an essential part of digital strategy that produces impactful performance marketing. It can take the form of explainers, vlogs, tutorials, interviews, product videos, social media content, and presentations. After watching online reviews or explainers, new leads and even existing customers are more swayed to purchase products and services.

Financial marketers know if they cater to target audience demands, they boost engagement and receive as much as 300% more traffic. Social media platforms like Instagram, Facebook, and TikTok offer convenient plug-and-applications for video content, appealing to new customers. Contrary to most other companies, every adult needs financial services, so target audiences remain large — there will never be a shortage of demand!

Yet, one of digital marketing challenges for financial services is making a financial brand appealing to younger audiences. For example, AIB, one of Ireland’s leading banks, released an ad campaign on TikTok, which according to the case study, yielded 2.13 million impressions. Having a marketing team that understands the nuances of video marketing can help financial companies shake Gen-z’s prehistoric and sometimes stiff perception of traditional financial services.

Invest Time Into Building a Social Media Account

Our case study example of AIB wonderfully illustrates the importance of social media marketing. However, it’s not as simple as setting up social media accounts for financial institutions and posting content about their latest product offerings. Generating quality leads entails providing meaningful content with substance. In addition, building trust with today’s clients requires a demonstration and commitment to social awareness and responsibility.

The digitally sophisticated are wise to platitudes of government and big corporates and only really want to support financial services they believe are somehow making the world a better place. The rise of cancel culture on social media today has shown that customers will fiercely protect brands they believe in and quickly shun other financial institutions that betray their values.

The four pillars of social media marketing are relevance, resonance, reference, and reach. Most financial services are aware that social media builds brand awareness, credibility and boosts website traffic. But how do you make sure your social media marketing for financial services remains engaging, relevant, and hits the mark?

The rise of cancel culture on social media today has shown that customers will fiercely protect brands they believe in and quickly shun other financial institutions that betray their values.

Strong visuals, personalized stories, and taking a stand on issues that matter count; For example, Bank of America’s successful Instagram post in support of Pride Month. Customer testimonials are also another classic yet effective digital marketing strategy. Digital marketing for financial services on social media offers the perfect way for financial companies to build trust, real connections and reinforce the human side of financial organizations, which customers want to see.

Keep Track of Reviews

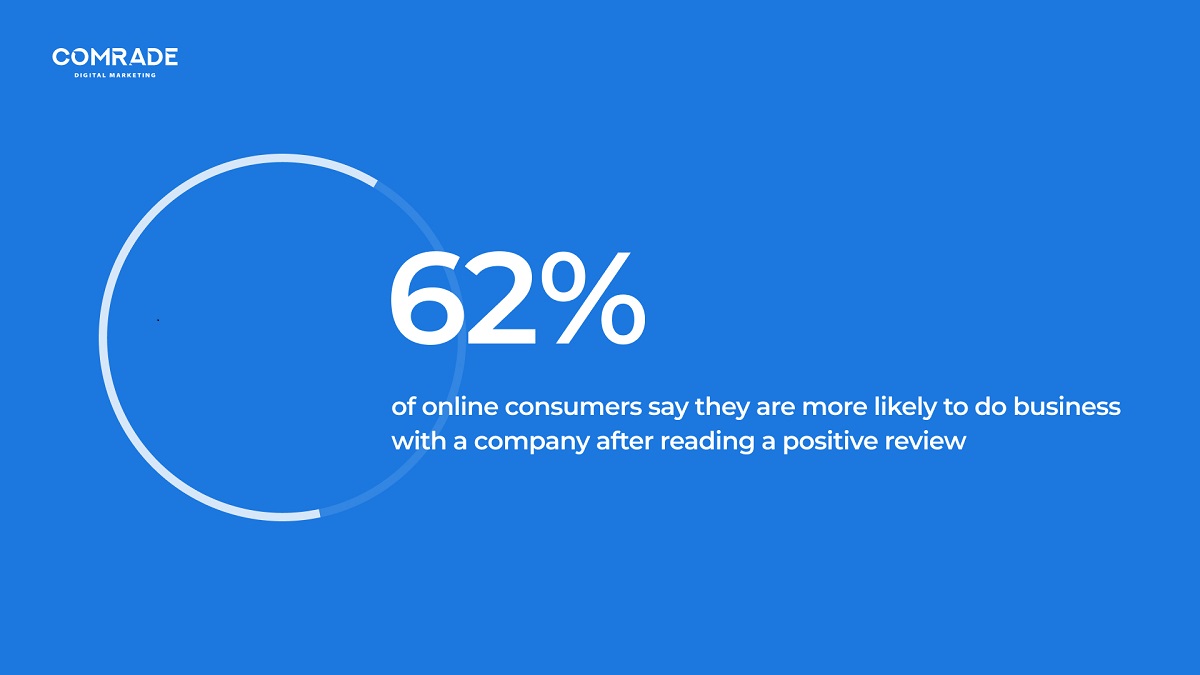

During normal and times of crises, financial industry customers seek trust, reassurance, and dependability. Financial services are uniquely positioned to be a calming influence with digital marketing, so long as they focus on building robust customer relationships. Positive customer reviews affect brand loyalty and generate quality leads.

Without sounding superficial, a financial company requires esteemed reviews, especially in an industry and world where trust in media, business, and the government is generally low. Thus, reviews also play a significant role in digital marketing for financial services because they support positive reputation management.

McKinsey classifies Covid-19 as a generational event with the potential to damage the reputation of financial services companies. Therefore, it is crucial that a financial institution positions itself as a mitigant and not cause of crises. One of the best digital marketing strategies to gain favor, based upon credibility, is customer reviews.

62% of online consumers say they are more likely to do business with a company after reading a positive review. Getting feedback online can be incorporated into an app or as a part of an email follow-up service. The benefit of reviews is that they provide actionable insights for financial service companies to improve their customer experience and better meet their needs.

Make Your SEO and PPC Work Together

SEO and PPC are closely linked digital marketing strategies that should be used together to bring in more leads. For example, search engine optimization entails techniques used to increase a website or webpage’s visibility on unpaid search engine results, i.e., when a user types a query into an online search engine.

PPC or pay-per-click is a search engine feature whereby advertisers pay a fee each time a user clicks on their ad. Additionally, they are rewarded for the relevance of their pages. Pay-per-click ads include display advertising, search advertising, social media advertising, remarketing, sequential remarketing, and Google Shopping.

The key difference is that SEO drives organic traffic, and PPC is a paid-for digital marketing strategy. Combining SEO and PPC advertising delivers better exposure and boosts search visibility, helping to establish a solid online presence in the financial services market. If paid ads appear consistently in specific online searches, digital marketing teams can refine on-page SEO to rank better in organic results.

User-friendly landing pages move websites up search engine rankings, improving quality scores and reducing the cost-per-clicks. Moreover, the A/B testing of PPC ad and landing page copy determines which keywords work best and informs long-term search engine optimization strategies for digital marketing success.

Improve Your Customer Support

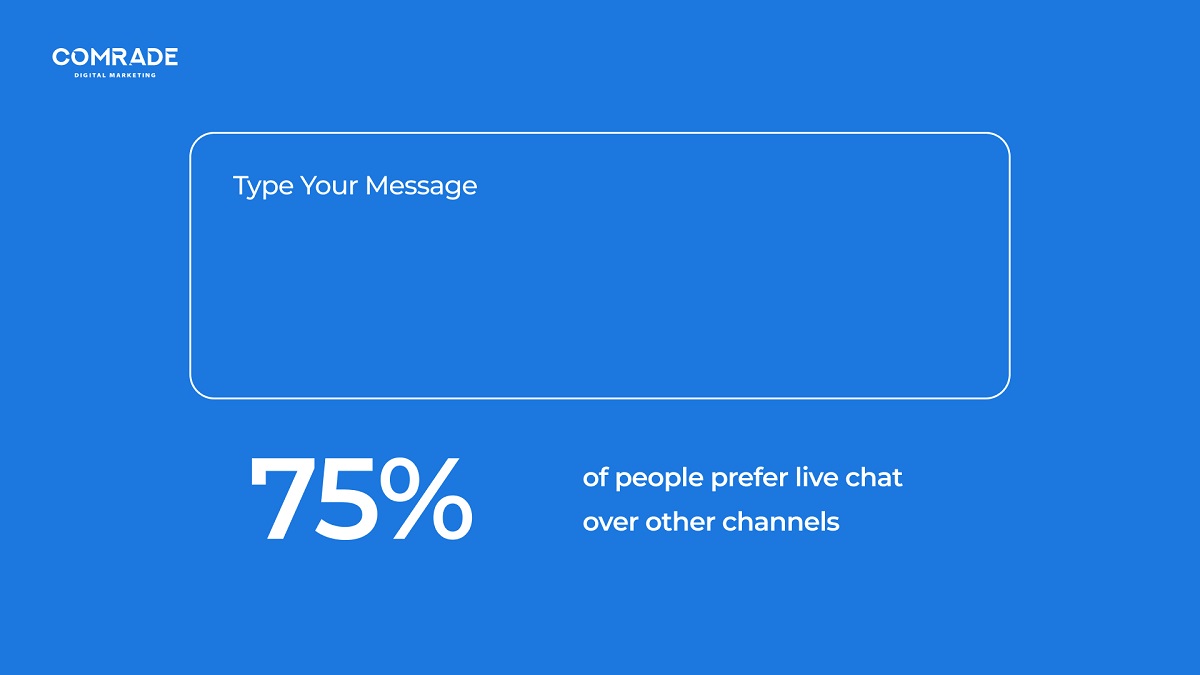

Because the financial services industry is a competitive space with little room to differentiate product offerings, customer service remains a true competitive advantage. Customers want personalized experiences and are treated as they matter, not just like another number to grow the bottom line. Today, there are many touchpoints for customers to interact with financial institutions; online, over the phone, and in person.

Consistent customer service matters across all channels, especially online, since most people prefer using apps and email where possible. Providing multiple contact options ensures communication with your customers on their preferred channel and enhances their overall experience with your company. There are multiple ways to maximize your customer service if you have an eCommerce site.

Email options or ‘Contact Us’ forms are useful if customer communication concerns multiple steps or complex solutions, so long as the forms are easy to find without having to scroll through an entire website. Live chat support channels are also popular, with 75% of people prefer this channel over others as the response is quicker without staying on the phone.

Social media and eCommerce sites often integrate live chat options into their platforms. At the same time, companies’ marketing teams or community managers must respond to social media comments and direct messages to help build community and make customers feel heard. To optimize customer support, there’s also the option of chatbots.

Chatbots

According to Invespcro, chatbots can reduce customer support costs by 30%. In addition, they save time because they can be programmed to answer 80% of product or service FAQs. While it’s true that customers still prefer face-to-face interactions, for simple issues, chatbots can be just as effective. To stay head, most companies using chatbots still provide other direct contact channels if a more complex issue needs to be solved.

Email Marketing — The Key to Customer Retention

Email marketing is one of the most powerful ways to retain customers in the financial sector. Digital marketing for financial services is essentially about increasing profits. And how does a company increase profits? Through customer retention. With digital marketing, there is always tension between customer acquisition vs. retention.

As digital marketing strategy begins to yield ROI, there’s a tendency to boost efforts into acquiring more customers. However, it’s customer retention that provides consistent growth and aids financial strategy. Why? Great commitment from customers makes it easier to implement budgetary decisions.

When it comes to digital marketing for financial services, email marketing is the most effective tactic for customer retention. The success rate of selling to a customer who’s already interested or invested in your product is far higher than selling to a new lead. In addition, email marketing allows your business to work smarter instead of harder.

If you already have the email addresses of your current clients, it’s easy to send promotional newsletters with content marketing material, added perks, and special offers. However, iThrough email marketing for financial services, clients are reminded of your brand and nudged further down the buyer’s funnel.

Invest Into Your Financial Services Industry Website

Is your website able to accommodate your marketing strategy? There are various layers to an optimized website. For starters, your website should reflect your company’s corporate identity through an appealing and functional design. It must be easy to navigate, and every section should have a clear call to action. Finally, you want potential customers to understand exactly what they need to do on each page, which leads them to make a purchase or opt for your services.

Because most leading financial service providers like banks have mobile apps, customers expect to have a pleasant experience using your website via smartphone. In marketing terms, we call this mobile-friendly, yet it also includes ease of use on tablets. For example, a pop-up ad may work well on a desktop but annoy a smartphone user. These incremental considerations play a role in developing a positive customer experience.

Then, of course, there is search engine optimization of the website copy and its structure to make it easy for search engines to crawl your website, understand its relevancy and rank it. If you want more in-depth info, you can read one of our many blogs on the topic. The higher the ranking, the more website traffic and potential leads. Website development is a complex undertaking, and in most cases, it’s worthwhile to hire professionals. If anything, it should be your first digital marketing investment.

Professional Help With Digital Marketing Strategies

Because the financial services industry is not like others, it faces the great challenge of educating its customers and rebuilding their trust. Digital marketing can play a beneficial role in amplifying your brand’s values and improving customer acquisition. Comrade, as a full-service Digital Marketing Agency, Comrade focuses on creating online content, website development, and of course, digital marketing. Let us help your brand stay ahead with innovative strategies backed by data and research. Learn more about our digital marketing for financial services.