Bankruptcy filings surged 14.2% in 2024, topping 517,000 cases nationwide. But even with rising demand, bankruptcy attorney marketing has become increasingly competitive as more law firms vie for visibility online. For bankruptcy lawyers, effective digital marketing is no longer optional—it’s essential for practice growth.

The reality? 93% of people looking for bankruptcy help start with a search engine, not a referral. If your firm isn’t ranking high, you’re virtually invisible. And since 75% of users never scroll past the first page, missing those top spots means missing clients. The impact is real: firms that invest in smart digital marketing see, on average, 17% more cases and 14% more revenue.

But the game is changing. With AI-driven search, virtual courtrooms, and shifting client expectations, the digital landscape for bankruptcy law is being redefined in 2026.

This guide covers 8 proven digital marketing strategies designed specifically for bankruptcy attorneys—from building a high-converting website to using AI tools for smarter outreach. Get ready to stand out, connect with more clients, and grow your practice in today’s digital-first world.

The Current State of Bankruptcy Law Firm Marketing

Picture this: It’s late at night. A stressed-out person is frantically Googling “bankruptcy lawyer near me,” hoping for help.

Your competitor pops up in the results. You’re nowhere to be found. That’s a client gone—before you ever had a chance.

Why Bankruptcy Law Firm Marketing Matters More than Ever

- 70% of clicks from local searches go to law firms featured in Google’s local 3-pack.

- 92% of people head straight to Google when looking for legal help.

- 66% of potential clients research online before reaching out to a lawyer.

For bankruptcy attorneys, these numbers speak volumes. Your clients are often overwhelmed, under pressure, and in urgent need of help. They’re not scrolling through pages — they’re choosing the first trustworthy attorney they find. If you’re not visible online, you’re missing out.

How People Connect with Bankruptcy Lawyers These Days

The path to hiring a bankruptcy attorney has fundamentally shifted:

- Financial distress triggers an online search rather than asking for personal referrals (which many are reluctant to do due to financial stigma)

- Quick comparison of attorneys based on reviews, website professionalism, and perceived expertise

- Immediate contact attempts via phone, form, or chat with attorneys who appear trustworthy and accessible

And now there’s a new factor: AI-powered search is completely changing how potential clients find bankruptcy attorneys.

How AI Is Reshaping Legal Search

Search has changed — and fast. Legal AI tools like Google SGE, Bing AI, and ChatGPT now deliver instant, AI-generated answers. No more scrolling through pages or clicking on links — just quick results. For bankruptcy attorneys, that means the old marketing playbook isn’t enough anymore.

These AI systems decide which firms to feature based on how clear, well-structured, and trustworthy their content is. If your bankruptcy law firm website isn’t optimized for AI-driven search, your firm could be overlooked, no matter how experienced you are.

This Guide Is Your Competitive Edge

We’re about to show you what actually works in 2026 for bankruptcy attorneys — from creating a results-driven strategy to monitoring your digital reputation. These aren’t generic marketing tips; they’re specialized tactics that acknowledge the unique challenges and opportunities in bankruptcy law marketing.

Let’s begin with building your foundation.

1. Craft a Results-Driven Digital Marketing Strategy

Before diving into specific tactics, you need a cohesive strategy that aligns with your firm’s goals and target audience. Without one, you’re essentially throwing money at random marketing channels hoping something sticks.

Identify Your Ideal Bankruptcy Legal Services Clients

Start by defining exactly who your bankruptcy services best serve. Are you targeting:

- Individuals facing Chapter 7 liquidation

- Families needing Chapter 13 reorganization

- Small businesses requiring Chapter 11 restructuring

- Specific industries facing financial distress

Each audience requires different messaging, channels, and approaches. For instance, business clients might be reached through LinkedIn and industry publications, while individual filers might be found through local Google searches and Facebook.

Set Clear, Measurable Goals

Vague web design goals like “get more clients” won’t cut it. Instead, establish specific targets:

- Increase bankruptcy consultation bookings by 35% within six months

- Generate 15 qualified bankruptcy leads monthly

- Improve conversion rate from website visitor to consultation by 20%

- Rank in Google’s top three results for “bankruptcy attorney [your city]”

These concrete goals create accountability and allow you to measure your marketing ROI.

Build a Multi-Channel Approach

Successful bankruptcy attorneys don’t rely on a single marketing tactic. Instead, they create an integrated strategy where channels complement each other:

- SEO drives organic traffic to your website

- PPC delivers immediate visibility for urgent searches

- Content marketing builds credibility and trust

- Social proof through reviews reinforces your expertise

- Email nurtures leads who aren’t ready to file immediately

According to recent marketing studies, 65% of law firms allocate most of their budget to digital marketing, with the most successful firms using an average of four different digital channels simultaneously.

With clear goals and a multi-channel strategy in place, you’ll avoid the scattershot approach that wastes marketing dollars and fails to generate qualified bankruptcy attorney leads.

2. Improve Organic Visibility with Proven SEO Techniques

In the highly competitive field of bankruptcy law, appearing at the top of search results is more than just an advantage—it’s a necessity. Potential clients seeking bankruptcy assistance are often in urgent need and unlikely to look past the first few listings. That’s why effective law firm SEO is critical to capturing their attention at the moment they need help most.

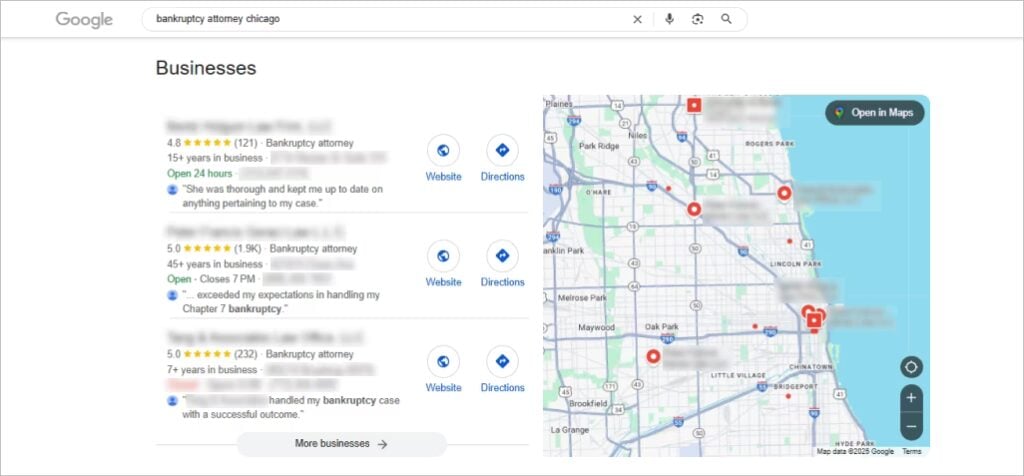

Focus on Local SEO Domination

For bankruptcy lawyers, local search visibility is crucial since most clients seek Chapter 7 bankruptcy and Chapter 13 bankruptcy attorneys within their jurisdiction. To dominate local search:

- Fully optimize your Google Business Profile with accurate business information, bankruptcy-specific categories, and regular updates

- Create city-specific landing pages that address local bankruptcy laws and exemptions

- Build citations on legal directories like Avvo, Justia, FindLaw, and Martindale-Hubbell

- Embed a Google Map on your contact page showing your office location

- Gather location-specific reviews mentioning your city and bankruptcy services

Research shows that 46% of all Google searches have local intent, making this strategy especially powerful for law firms targeting specific geographical areas.

Target High-Intent Bankruptcy Keywords

Not all keywords are created equal. Focus on search phrases that indicate someone is actively seeking bankruptcy help rather than just researching the topic:

- “Bankruptcy attorney near me”

- “Chapter 7 lawyer in [city]”

- “How to file bankruptcy in [state]”

- “Stop foreclosure bankruptcy attorney”

- “Emergency bankruptcy filing [city]”

These terms tend to have higher conversion rates because they come from people activel y seeking legal representation, not just information.

Optimize On-Page Elements

Turn each bankruptcy page into a powerful conversion tool by refining its on-page elements. Start with titles and meta descriptions that don’t just describe — they connect, speaking directly to the worries and questions your clients are searching for. Break up your content with clear, easy-to-follow headers so visitors can quickly find the answers they need.

Mention your location in a natural way to help locals discover you more easily, and use bankruptcy-specific schema to give your site a boost in search visibility. Most importantly, make sure every page works beautifully on mobile—because when financial stress hits, people reach for their phones first.

Focusing on core SEO principles and the critical Google ranking factors for lawyers will elevate your presence at the moment prospective clients need bankruptcy assistance most, making you their go-to and only call.

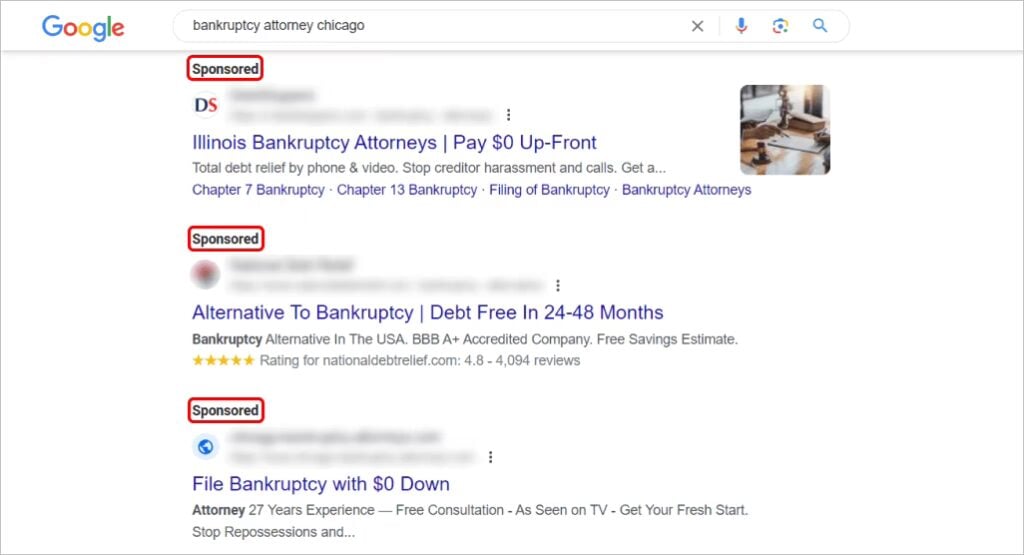

3. Launch Targeted PPC Campaigns That Deliver ROI

While SEO lays the groundwork for future visibility, PPC marketing for lawyers delivers immediate exposure—strategically positioning your bankruptcy firm before high-intent prospects who are ready to hire.

Focus on High-Converting Bankruptcy Keywords

Unlike SEO where you might target a broad range of terms, Bankruptcy lawyer PPC should laser-focus on keywords with clear hiring intent:

- “Emergency bankruptcy lawyer”

- “File Chapter 7 bankruptcy today”

- “Stop wage garnishment attorney”

- “Foreclosure defense lawyer near me”

- “Same day bankruptcy consultation”

These searches come from people in financial crisis who need immediate assistance—making them more likely to convert into paying clients.

Create Crisis-Responsive Landing Pages

Generic homepages don’t cut it when someone’s in a financial crisis. To drive real PPC results, you need landing pages that speak directly to the emergency at hand—offering fast solutions, showcasing real case outcomes, and making it easy to get in touch. With the right trust signals and relatable testimonials, these focused pages can convert up to three times better than your average service page.

Implement Strategic Ad Scheduling

Not all hours are equally valuable for bankruptcy attorney ads. Analyze when your most qualified leads tend to search and adjust your ad schedule accordingly:

- Evenings (7-10pm) when people research financial options after work

- Weekends when families discuss major financial decisions together

- Early mornings when people facing financial stress may be unable to sleep

- Days following major bill due dates when financial pressure peaks

By concentrating your budget during these high-converting periods, you’ll maximize your campaign’s effectiveness while reducing wasted ad spend.

While PPC requires a higher initial investment than other channels, the immediate results make it essential for bankruptcy practices looking to generate cases quickly rather than waiting months for SEO efforts to mature.

4. Design and Launch a Professional, User-Friendly Website

Your website isn’t just a digital brochure—it’s often the first impression potential clients have of your bankruptcy practice. In a practice area where trust is paramount, an outdated or confusing website can immediately disqualify your firm from consideration.

Prioritize Mobile-First Design

Over 60% of legal service searches now happen on mobile devices. People in financial distress often research bankruptcy options discreetly on their phones, making mobile optimization non-negotiable. Your site must:

- Load completely in under 3 seconds on mobile devices

- Feature tap-friendly navigation and contact buttons

- Use legible text sizes without requiring zooming

- Implement click-to-call functionality for immediate contact

- Offer simplified consultation booking forms for mobile users

A mobile-responsive site is no longer enough—bankruptcy attorney websites must be built with mobile users as the primary audience.

Implement Trust-Building Elements

Bankruptcy clients are often navigating one of the most stressful periods of their lives, so your website needs to immediately instill trust and comfort. A clean, calming design with professional yet approachable visuals—like real photos of your team—can go a long way.

Highlighting your credentials, recognitions, and real client testimonials builds credibility, while transparent details about fees and your process offer much-needed clarity. Think of your website as a digital sanctuary—welcoming, reassuring, and never overwhelming.

Streamline the Consultation Booking Process

Each additional step in your contact process causes potential clients to drop off. Optimize your conversion path by:

- Placing prominent contact forms on every page

- Implementing live chat for immediate assistance

- Offering online scheduling for consultations

- Providing clear information about consultation costs and expectations

- Using confirmation messages that set expectations for next steps

The most effective bankruptcy attorney websites convert visitors to leads at rates of 8-12%, significantly higher than the 3-5% industry average, by implementing these streamlined consultation processes.

A well-designed website serves as the foundation for all your other marketing efforts—if it fails to convert visitors into consultations, even the best traffic-generating strategies will underperform.

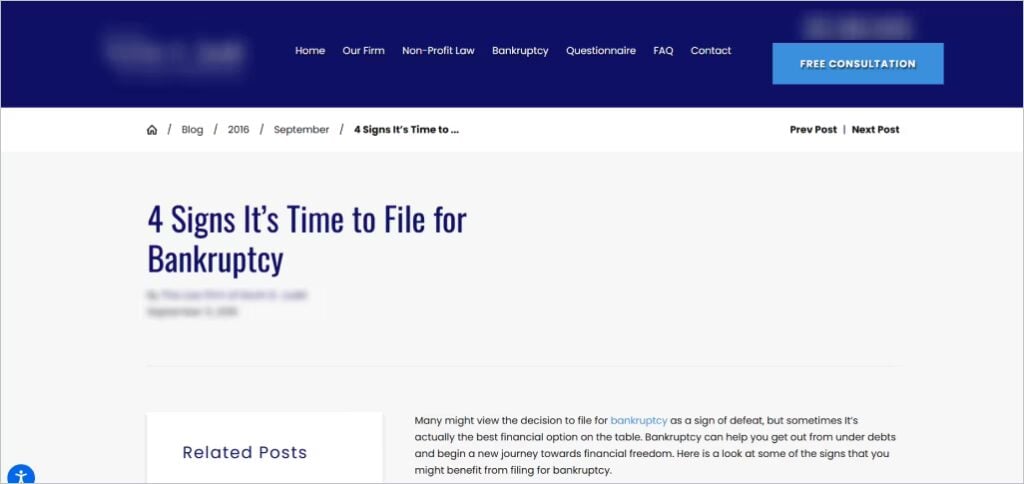

5. Craft Compelling Content Tailored to Your Audience

Content marketing for lawyers isn’t just about SEO benefits—it’s about establishing yourself as a trusted advisor who understands the emotional and financial challenges your potential clients are experiencing. For bankruptcy attorneys, effective content must balance legal expertise with compassionate guidance.

Create a Comprehensive Bankruptcy Resource Center

Use professional legal copywriting to transform your website into more than just a collection of service pages—build a complete knowledge hub that answers every bankruptcy question:

- Step-by-step guides for navigating the bankruptcy process

- Calculators to help determine Chapter 7 eligibility

- Checklists of documents needed for bankruptcy filing

- Explanations of state-specific exemptions and protections

- Post-bankruptcy credit rebuilding strategies

This approach positions your firm as not just a bankruptcy filer, but a comprehensive financial recovery resource—expanding your value proposition beyond the initial filing.

Address Emotional Barriers with Sensitive Content

Many people delay seeking bankruptcy help due to shame, fear, or misconceptions. Create content that directly addresses these emotional barriers:

- “Will my employer find out if I file bankruptcy?”

- “How to explain bankruptcy to family members”

- “Life after bankruptcy: What really happens to your credit”

- “Common bankruptcy myths and realities”

- “Signs that bankruptcy might be your best financial option”

By proactively acknowledging and addressing these concerns, your blogging efforts will resonate more deeply with potential clients than competitors who focus only on technical legal aspects.

Leverage Multiple Content Formats

Different people absorb information in different ways—some like to read, others prefer to watch or interact. That’s why it’s smart to offer a mix of content formats. Pair in-depth blog posts with short, clear videos that walk viewers through the bankruptcy process.

Add helpful downloads like prep guides and worksheets, plus easy-to-understand infographics and tools like debt-to-income calculators. This kind of variety doesn’t just make your content more accessible—it keeps people engaged and leads to better results. In fact, lawyers’ websites that offer multiple content types see up to 30% more engagement and generate more qualified leads.

With a strategic content approach, you’ll not only attract more potential bankruptcy clients but also pre-educate them before consultations—making your client acquisition process more efficient and effective.

6. Amplify Your Firm’s Presence with Social Media Marketing

Social media marketing for lawyers may seem unconventional, but it’s a powerful way to build brand awareness and connect with potential clients. By showcasing empathy and professionalism online, you create a safe space for individuals facing financial hardship to trust your firm.

Choose Platforms Strategically

Not every social platform is equally valuable for bankruptcy attorneys. Focus your efforts where potential clients actually spend time:

- Facebook: Ideal for targeting consumers considering personal bankruptcy

- LinkedIn: Effective for reaching business owners facing financial challenges

- YouTube: Perfect for educational content explaining bankruptcy options

- X (Twitter): Useful for sharing bankruptcy news and legal updates

- Instagram: Can humanize your practice through behind-the-scenes content

Rather than stretching yourself thin across all social media platforms, master one or two that best align with your target client profile.

Share Educational Content, Not Just Promotions

The most successful bankruptcy attorneys don’t just promote their legal services—they educate, engage, and earn trust. Instead of flooding their social feeds with salesy content, they follow the 80/20 rule: 80% helpful insights, 20% promotion.

They break down legal jargon, explain recent changes in bankruptcy law, share real success stories, and offer tips to stay financially healthy. This human, value-driven approach positions them as trusted advisors—not just another firm chasing clients.

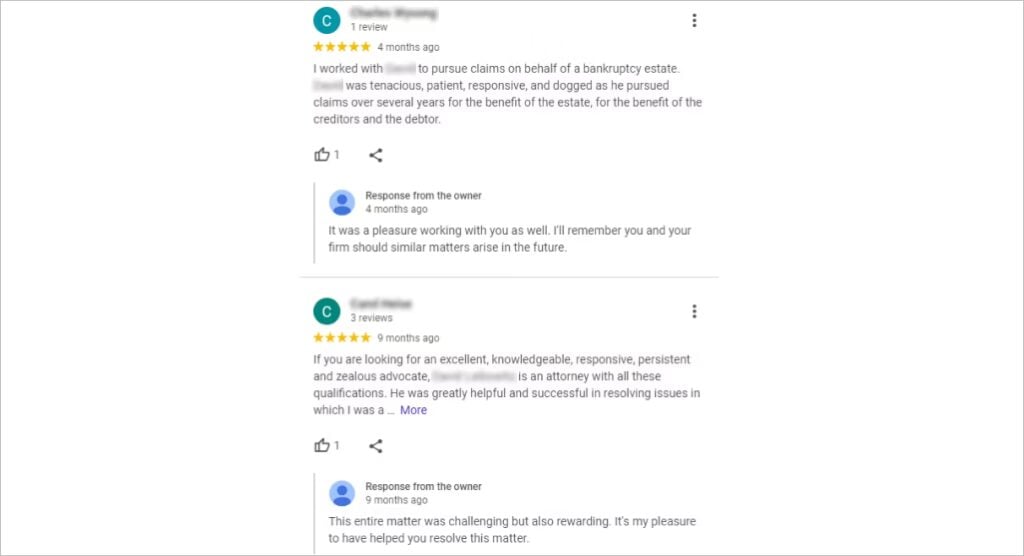

Leverage Social Proof to Build Credibility

Social platforms excel at showcasing authentic client experiences. With proper permissions, share:

- Client testimonial videos describing their financial fresh start

- Reviews from clients who successfully completed the bankruptcy process

- Before/after financial situations (anonymized) showing debt relief

- Recognition and awards from legal organizations

- Community involvement and pro bono bankruptcy assistance

According to recent legal marketing research, 71% of attorneys report generating new clients through social media, with those sharing authentic client stories seeing the highest conversion rates.

While social media typically won’t be your primary lead generator, it plays a crucial supporting role in your overall digital marketing ecosystem by building trust and recognition that supports your other channels.

7. Monitor and Improve Your Digital Reputation for Growth

Trust is the foundation of any successful bankruptcy practice—and your online reputation is often the first impression. Without effective attorney reputation management, negative reviews or minimal feedback can deter potential clients. A strong, well-managed reputation sets you apart in a field where credibility counts.

Implement a Systematic Review Generation Strategy

Don’t leave your reviews up to chance—create a simple, reliable way to collect feedback from your clients consistently. The best time to ask is right after their bankruptcy discharge, when they’re feeling the biggest relief and are most likely to share their experience. Make it easy for them by sending a quick follow-up email with a direct link to your Google Business Profile.

A little guidance on what to mention can go a long way in helping them share meaningful insights about your service. If you want to save time, consider using reputation management software to automate this whole process. The most successful bankruptcy attorneys stay ahead by consistently gathering 3 to 5 authentic client reviews every month, building trust and growing their reputation naturally.

Protect yourself—know how to spot a fake law firm on a Google Business Profile.

Monitor All Review Platforms, Not Just Google

While Google reviews carry the most weight, potential bankruptcy clients check multiple sources before making decisions. Maintain active profiles and monitor reviews on:

- Google Business Profile

- Avvo

- Yelp

- Better Business Bureau

- Lawyers.com and Martindale-Hubbell

Research indicates that 84% of people trust online reviews as much as personal recommendations, with potential clients typically checking at least 2-3 review sources before contacting a bankruptcy attorney.

Respond Professionally to All Reviews—Especially Negative Ones

How you handle criticism speaks volumes about your professionalism. When facing negative reviews:

- Respond promptly (within 24-48 hours)

- Thank the reviewer for their feedback

- Address concerns without getting defensive

- Take the conversation offline by providing contact information

- Never share client details or confirm they were a client (maintain confidentiality)

Bankruptcy attorneys who thoughtfully respond to negative feedback on lawyer review sites can transform potential reputation damage into a powerful demonstration of their dedication to client satisfaction.

Your digital reputation isn’t just about star ratings—it’s about creating confidence that you’ll handle sensitive financial matters with professionalism and care, making it one of your most valuable marketing assets.

8. Maximize Client Retention with Personalized Email Marketing

While acquiring new bankruptcy clients is important, nurturing existing relationships through targeted email marketing provides tremendous value at minimal cost. For bankruptcy attorneys, a strategic email approach can generate referrals, cross-sell additional services, and maintain connections for future legal needs.

Develop Post-Bankruptcy Support Sequences

The bankruptcy discharge isn’t the end of a client’s financial journey—it’s a new beginning. Create email sequences that support clients through post-bankruptcy recovery:

- Credit rebuilding strategies after bankruptcy

- Budgeting tools to maintain financial stability

- Explanations of how to respond to future creditor inquiries

- Investment and savings strategies for financial rebuilding

- Annual bankruptcy discharge anniversary check-ins

These valuable touchpoints demonstrate ongoing commitment to client success while maintaining a warm relationship for future referrals.

Segment Your Email List for Targeted Communication

Not all bankruptcy clients have the same needs or interests. Segment your email list by:

- Bankruptcy chapter filed (7, 11, 13)

- Business vs. personal bankruptcy clients

- Stage in the bankruptcy process

- Special circumstances (foreclosure, medical debt, etc.)

- Geographic location

Segmented campaigns typically generate 30-50% higher open and engagement rates than generic email blasts, allowing for more personalized communication.

Create a Value-First Newsletter That Builds Authority

Want to keep your firm top of mind and build real trust with your clients? A great bankruptcy attorney newsletter does just that by sharing useful, relevant content people want to read. Think clear updates on bankruptcy law changes, practical money-saving tips, uplifting success stories, and straightforward answers to the questions your clients are asking.

Plus, including helpful community resources shows you genuinely care beyond the courtroom. It’s no surprise that newsletters focused on education—not just promotion—see open rates of 25-30%, way higher than your average marketing email. It’s all about creating value that keeps people coming back.

Email marketing offers the highest ROI of all digital channels—up to $42 for every $1 spent—making it an essential component of a comprehensive bankruptcy marketing strategy, particularly for nurturing long-term client relationships and generating referrals.

The Digital Marketing Edge Your Bankruptcy Practice Needs

The landscape of marketing for bankruptcy attorneys is evolving rapidly, requiring law firms to adapt their digital strategies to stay competitive in both Chapter 7 bankruptcy and Chapter 13 bankruptcy services, with regulatory changes, technological advancements, and economic shifts creating both challenges and opportunities for attorneys in this practice area.

You invested years building your legal expertise. Now it’s time to ensure that investment pays off by making your bankruptcy practice visible exactly when and where potential clients are searching for help.

At Comrade Digital Marketing, we specialize in helping bankruptcy attorneys transform their digital presence into a consistent source of high-quality leads. Our team of legal marketing specialists understands the unique challenges and opportunities in the bankruptcy space.

Ready to take your bankruptcy practice to the next level?

Book your free digital marketing consultation today, and let’s build a strategy that puts your firm at the top when clients need you most.