Most people searching for bankruptcy help are in crisis mode—under intense financial pressure and ready to act fast. In fact, PPC traffic converts 50% better than organic search, making it one of the most powerful tools for connecting with high-intent clients when timing matters most.

For bankruptcy attorneys, this isn’t just a marketing opportunity—it’s a chance to reach the right clients at exactly the right moment. With paid search ads, law firms can bypass slow SEO gains and land directly in front of people actively seeking legal solutions to urgent financial problems.

This guide breaks down 8 highly effective PPC strategies tailored specifically for bankruptcy lawyers—so you can boost visibility, attract qualified leads, and turn ad clicks into real clients.

Why Bankruptcy Attorneys Can’t Afford to Ignore PPC in 2025

Imagine this: It’s 11 PM on a Sunday. A small business owner has just opened their third foreclosure notice, and panic is setting in.

Desperate, they grab their phone and search “emergency bankruptcy lawyer near me.” But your firm doesn’t show up. Your competitor does.

In that moment, you’ve lost a client who was ready to hire right now.

Why PPC for Bankruptcy Lawyers is Crucial for Success

- 65% of small to mid-sized law firms are already running PPC campaigns.

- 46% of all clicks go straight to the top three PPC ads.

- For every $1 spent on PPC, law firms earn $2 back.

If your firm isn’t investing in PPC for bankruptcy lawyers yet, you’re invisible at the exact moment potential clients are searching for help. But here’s the thing…

It’s Not Just About Being Visible — It’s About Being There First

PPC helps your bankruptcy firm do more than just appear; it also helps you:

- Capture clients at their moment of crisis

When someone’s wages are being garnished or their home is in foreclosure, they need help NOW. Law firm PPC ensures you’re the first solution they see. - Build trust through strategic messaging

Well-crafted ads with the right trust signals (free consultations, payment plans, emergency filing) instantly position you as the understanding expert they need. - Generate immediate ROI

Unlike SEO, which takes months, PPC for bankruptcy lawyers delivers leads today, critical when you need cash flow to keep your practice running.

The Competition Is Fierce: Standing Out Is Survival

Bankruptcy law is one of the most competitive PPC markets. Cost-per-click can reach $50-100+ in major cities. That means every click counts, and amateur campaigns will drain your budget fast.

Major bankruptcy mills are spending thousands daily on ads. National chains dominate generic keywords. If your campaigns aren’t laser-focused and professionally managed, you’re burning money.

That’s exactly what we’re about to fix.

This Guide Is Your Competitive Advantage

We’re about to show you what works in 2025 — from finding profitable keywords your competitors miss to crafting ads that convert desperate searches into grateful clients.

1. Identify Top Keywords Driving PPC for Bankruptcy Lawyers

The key to a successful bankruptcy PPC campaign is smart keyword research for lawyers—specifically, finding the terms people use when they’re ready to file, not just gathering information. Miss the mark here, and you’ll waste your budget on curious browsers instead of real potential clients.

Target “Ready to File” Keywords

If someone’s searching “what is bankruptcy,” they’re likely still in the research phase—hiring an attorney could be months away. But a search like “bankruptcy attorney consultation today” or “emergency Chapter 7 filing” signals immediate need and high intent.

Your goal? Show up for those urgent, action-driven searches.

Prioritize high-converting phrases like:

- “File bankruptcy this week [city]”

- “Stop foreclosure attorney near me”

- “Emergency bankruptcy lawyer open now”

- “Chapter 7 attorney free consultation”

These are the moments where showing up means getting hired.

Mine Your Intake Calls for Golden Keywords

Skip the guesswork and listen to what clients actually say:

- Review intake forms and call recordings

- Note exact phrases clients use to describe their situation

- Track which search terms led to your best cases

- Ask new clients specifically what they searched for

Pro tip: Your intake staff hears the exact words distressed debtors use. Those emotional, specific phrases like “bankruptcy lawyer who takes payments” or “will bankruptcy stop wage garnishment tomorrow” are PPC gold.

Don’t Ignore Situation-Specific Long-Tails

Broad keywords like “bankruptcy lawyer” are expensive and competitive. Instead, target specific situations like:

- “Can I keep my car in Chapter 7 bankruptcy”

- “File for bankruptcy with no money down”

- “Bankruptcy attorney for small business debt”

- “Stop creditor harassment lawyer [city]”

Tools like ChatGPT or Claude can be great for brainstorming keyword ideas based on real-life situations. For example, try asking: “What are 20 urgent searches someone might make before filing for bankruptcy in Florida?” It’s a quick way to tap into what potential clients are searching for—and gain a serious edge in PPC campaigns.

2. Craft a Clear and Compelling Unique Value Proposition

In a sea of bankruptcy ads touting “experienced attorneys” and “free consultations,” your unique value proposition (UVP) is the key to standing out—and it’s at the heart of effective conversion rate optimization for lawyers. It’s what compels desperate debtors to choose YOU over the dozen other options staring back at them.

Make Your Difference Crystal Clear

Your UVP isn’t about being a good lawyer — every attorney claims that. It’s about the specific, tangible benefit that sets you apart. What can you offer that others can’t (or won’t)?

Weak UVP examples:

- “Experienced bankruptcy attorneys”

- “We care about our clients”

- “Affordable legal services”

Strong UVP examples:

- “File Chapter 7 in 24 Hours — No Money Down”

- “Open Weekends for Emergency Bankruptcy Filing”

- “$0 Down Payment Plans — Stop Collections Today”

- “Flat Fee Guarantee — No Hidden Costs Ever”

Address Their Biggest Fear Immediately

When it comes to bankruptcy, clients care most about:

- How much it costs and whether payment plans are available

- How quickly they can get relief

- Whether they’ll be able to keep their home or car

- Keeping things private and avoiding judgment

Make sure your unique value proposition speaks directly to at least one of these. If you offer flexible payments, lead with that. If you can file the same day, don’t keep it quiet—make it known loud and clear.

Test Different Angles for Different Audiences

Your Chapter 7 clients have different needs from Chapter 13 filers. Small business owners face different fears than individuals. Create targeted UVPs for each segment:

- Individual Chapter 7: “Keep Your Car, Lose Your Debt — File Today”

- Chapter 13: “Save Your Home From Foreclosure — Custom Payment Plans”

- Business Owners: “Business Bankruptcy Without Personal Liability”

Pro tip: Your UVP should appear in your ad headline, description, and landing page hero section. Consistency across all touchpoints builds trust and improves Quality Score.

3. Design Targeted Landing Pages for Maximum Engagement

You’ve spent $75 on a click from someone searching “emergency bankruptcy filing.” They click your ad… and land on your generic lawyer website homepage. Confused, they hit the back button. Your money? Gone. Your lead? Calling a competitor.

This scenario kills more bankruptcy PPC campaigns than any other mistake.

One Ad Group = One Landing Page

Never send PPC traffic to your homepage. Each ad group needs its dedicated landing page that:

- Matches the exact keyword and ad copy

- Addresses the specific situation they searched for

- Removes all navigation distractions

- Has one clear goal: schedule a consultation

If your ad targets “Chapter 7 bankruptcy attorney,” your landing page headline should say exactly that, not “Welcome to Smith Law Firm.”

Build Trust in the First 5 Seconds

Bankruptcy clients are often overwhelmed and looking for someone they can trust. Your landing page should feel like a steady hand in a stressful time.

A warm, professional headshot helps visitors connect with you right away. Show your credentials and bar memberships clearly—they need to know you’re the real deal.

Let past clients do the talking with honest testimonials that address the same fears your audience has. Trust badges like BBB ratings or peer awards quietly reinforce your credibility. And a simple, transparent disclaimer shows you’re upfront and professional from the start.

Create an Irresistible Call-to-Action

Your landing page has one job: get them to take the next step. Make it simple:

- Prominent “Get Your Free Bankruptcy Evaluation” button

- Multiple contact options (form, phone, chat)

- Urgency without pressure (“Speak to an Attorney Today”)

- Remove all friction (minimal form fields)

Mobile-First or Lose First

60% of bankruptcy searches happen on mobile devices. If your landing page isn’t thumb-friendly, you’re hemorrhaging leads:

- Large, tappable buttons

- Click-to-call phone numbers

- Short forms (name, phone, email only)

- Fast load times (under 3 seconds)

- No pop-ups or auto-play videos

Remember: Your landing page is often their first real interaction with your firm. Make it count, or your PPC budget becomes a donation to Google.

4. Utilize Ad Extensions to Enhance Visibility and Clicks

Your bankruptcy ad might be perfectly written, but without extensions, it’s like showing up to court in sweatpants — you’re not presenting your best case. In law firm advertising, ad extensions make your ads bigger, more informative, and more clickable — often doubling your click-through rate.

Sitelink Extensions: More Options, More Clicks

Don’t just send everyone to one page. Sitelinks let you showcase multiple options:

- “Chapter 7 Bankruptcy Info”

- “Chapter 13 Payment Plans”

- “Stop Foreclosure Now”

- “Free Consultation”

Each sitelink can have its own landing page, letting anxious searchers choose their specific concern. This self-selection improves conversion rates by 10-15%.

Call Extensions: The Direct Line to Relief

For someone facing wage garnishment tomorrow, filling out a form feels too slow. Call extensions put your phone number directly in the ad:

- Shows during business hours (or 24/7 if you have an answering service)

- Tracks calls as conversions

- Mobile users can tap to call instantly

- Builds trust by showing you’re available

Pro tip: Use call tracking numbers to measure which keywords drive phone leads and record calls for quality training.

Callout Extensions: Highlight What Matters

Callout extensions are a simple way to show prospective clients exactly why they should choose you, right from the start. With phrases like “No Upfront Fees,” “Payment Plans Available,” or “Same Day Filing,” you can instantly build trust and make your services more approachable. It’s about making sure the right details stand out, so people feel confident clicking your ad.

Location Extensions: Prove You’re Local

Clients looking for bankruptcy help almost always prefer working with a local attorney they can meet in person.

That’s why location extensions are so powerful—they highlight your office address, show exactly how close you are to the person searching, provide an easy-to-follow map with directions, and display trusted reviews from your Google Business Profile.

This combination makes a huge difference, especially for searches like “bankruptcy lawyer near me,” where being nearby isn’t just convenient—it’s essential.

Price Extensions: Transparency Builds Trust

While you can’t guarantee outcomes, you can be transparent about consultation fees:

- “Free Initial Consultation”

- “Chapter 7: From $899”

- “Payment Plans Starting at $0 Down”

Remember: Extensions are free to add and only cost when clicked. There’s zero downside to maxing them out. The more real estate your ad occupies, the less room competitors have to steal your clients.

5. Write Persuasive Ad Copy That Captures Attention

You have 90 characters in your headline to convince someone drowning in debt that you’re their lifeline. No pressure, right? In law firm PPC, emotionally intelligent ad copy is what separates a quick click from a lasting client relationship.

Lead With Their Pain, Not Your Credentials

Nobody cares about your 20 years of experience when creditors are calling nonstop. They care about stopping the harassment. Your headlines should reflect their immediate need:

Weak headlines:

- “Experienced Bankruptcy Attorney”

- “Smith Law Firm – Bankruptcy Services”

- “Chapter 7 and Chapter 13 Lawyer”

Strong headlines:

- “Stop Creditor Calls Today – File Bankruptcy”

- “Drowning in Debt? Fresh Start in 24 Hours”

- “Keep Your Home – File Chapter 13 Now”

- “Medical Bills Crushing You? We Can Help”

Use Emotional Triggers (Ethically)

Bankruptcy searchers are experiencing fear, shame, and desperation. Acknowledge these emotions while offering hope:

- Fear: “Facing Foreclosure? Emergency Filing Available”

- Shame: “Confidential Bankruptcy Help – No Judgment”

- Desperation: “Out of Options? Free Consultation Today”

- Hope: “New Beginning Starts Here – Call Now”

Create Urgency Without Being Pushy

Your clients need quick help, but being pushy just turns them off. The trick is to create urgency that feels real and caring, not frantic or scary. Instead of yelling “CALL NOW OR LOSE EVERYTHING!!!,” try something like “Stop wage garnishment before Friday’s paycheck” or “Foreclosure sale coming up Tuesday? We can help today.” Genuine urgency shows you understand what they’re going through and are ready to support them right away, without the pressure.

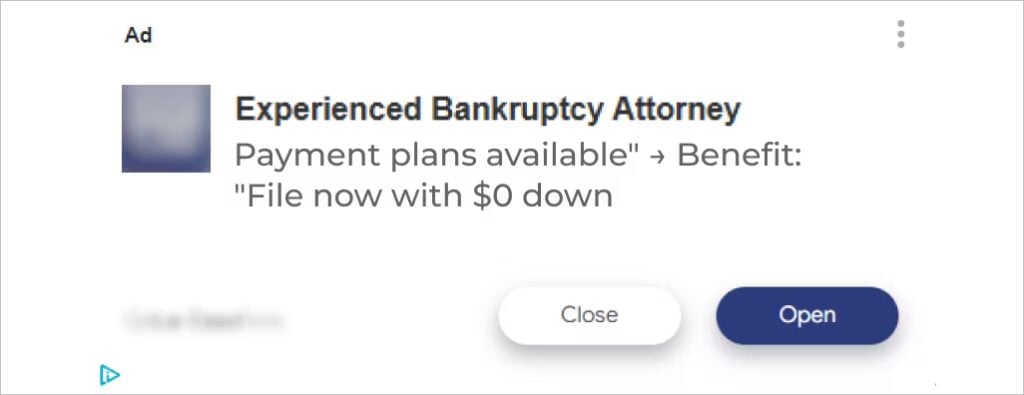

Include Specific Benefits, Not Features

Features tell, benefits sell. Transform boring features into client-focused benefits:

- Feature: “Payment plans available” → Benefit: “File now with $0 down”

- Feature: “Emergency filing” → Benefit: “Stop collections in 24 hours”

- Feature: “Asset protection” → Benefit: “Keep your home and car”

- Feature: “Free consultation” → Benefit: “Get answers today at no cost”

Pro tip: Test different emotional angles in your ad copy. Some audiences respond to empowerment (“Take Control of Your Finances”), while others need reassurance (“You’re Not Alone – We’ll Guide You Through”).

6. Implement Smart Retargeting to Re-Engage Visitors

Here’s a tough reality: 96% of visitors to bankruptcy websites leave without reaching out. They’re often overwhelmed, scared, or simply still exploring options. With effective SEM for lawyers, retargeting can bring those prospects back exactly when they’re ready to take action.

Segment Your Retargeting by Intent Level

Not all website visitors are equal. Someone who spent 5 minutes reading your Chapter 7 guide shows higher intent than someone who bounced from your homepage. Create different retargeting campaigns for:

- High intent: Visited contact page but didn’t submit

- Medium intent: Read multiple practice area pages

- Low intent: Single-page visit under 30 seconds

- Hot leads: Started but abandoned a form

Each segment needs different messaging and urgency levels.

Craft Retargeting Ads That Address Hesitation

Turn hesitation into confidence with retargeting ads that truly get where your audience is coming from. If someone started your form but didn’t finish, reach out with a friendly, “Still thinking about bankruptcy? Let’s chat,” or “Have questions about filing? I’m here for a free phone consultation.”

For those who are just looking for answers, offer something helpful like, “Grab our free bankruptcy guide” or “Wondering if it’s time to file? Get a free assessment.”

And if they’re comparing options, show them why you’re different: “Over 500 happy clients gave us 5 stars” or “Flexible payment plans you won’t find anywhere else.”

Make your ads feel like a helpful hand, not a hard sell.

Time Your Retargeting Strategically

Deciding on bankruptcy is a serious step, so your retargeting should feel thoughtful and well-timed. Match your outreach to where they are in their decision process:

- Days 1-3: Soft reminders — gently nudge them 2-3 times a day

- Days 4-7: Tackle their specific concerns — reach out 1-2 times a day

- Days 8-14: Increase urgency — send messages once a day

- Days 15-30: Offer last-chance deals — every other day

- After 30 days: Ease off to 2-3 times per week

This way, your ads stay relevant without overwhelming them.

Use Dynamic Retargeting for Specific Situations

Show ads related to the exact pages they visited:

- Viewed Chapter 7 page → “Chapter 7 Filed in 24 Hours”

- Viewed foreclosure page → “Stop Foreclosure This Week”

- Viewed pricing page → “Bankruptcy From $0 Down”

This personal touch can increase conversion rates by 50%+.

Pro tip: Exclude converted clients from retargeting immediately. Nothing annoys new clients more than seeing ads after they’ve hired you. Set up proper conversion tracking and exclusion lists to maintain professionalism.

7. Run A/B Tests to Optimize Performance and ROI

Your bankruptcy lawyer PPC campaign may bring results, but is it truly optimized? Without A/B testing, you risk wasting ad spend and missing out on clients. Local Service Ads for lawyers, combined with data-backed testing, help maximize every dollar and lead.

Test One Element at a Time

The biggest testing mistake? Changing everything at once. You won’t know what improved performance. Focus on one variable:

Headlines to test:

- “File Bankruptcy Today” vs. “Fresh Financial Start Today”

- “Stop Creditors Now” vs. “End Collection Calls Today”

- Price-focused vs. Emotion-focused headlines

Description lines to test:

- Mentioning fees vs. not mentioning fees

- “Free consultation” vs. “$0 to start”

- Professional tone vs. conversational tone

Landing Page Tests That Move the Needle

Your ads might be spot-on, but if your landing page doesn’t do its job, all that effort could go to waste. The real game-changer is tweaking key parts of your landing page to boost conversions.

Play around with your hero headline to find the perfect hook, experiment with where your form sits and how many fields it asks for, and try different calls-to-action to see what clicks.

Don’t forget to test where you place trust signals and whether adding a video helps keep people engaged. These small but smart changes can make a huge difference in turning visitors into customers.

Beyond Click-Through Rate: Test for Quality

More clicks don’t always mean more bankruptcy clients. Track deeper metrics:

- Cost per qualified lead (not just any lead)

- Consultation shows rate

- Client acquisition cost

- Average case value by keyword

- Lifetime value by traffic source

A keyword with lower CTR but higher case values might be your hidden goldmine.

Create a Testing Calendar

Random testing produces random results. Structure your experiments:

- Week 1-2: Test ad headlines

- Week 3-4: Test landing page headlines

- Week 5-6: Test form variations

- Week 7-8: Test bid strategies

Document everything. What seems like a small 5% improvement compounds into massive gains over time.

AI Tip: Use Google’s machine learning features like Responsive Search Ads to automatically test combinations. But don’t go full autopilot — human insight plus AI optimization delivers the best results.

8. Develop a Strategic Bidding Approach for Better ROI

Simply spending Google Ads credit on keywords isn’t a plan—it’s a giveaway. Smart bidding helps you invest wisely, paying the optimal price for clicks that convert. For bankruptcy attorneys facing CPCs over $100, making each dollar count is essential.

Choose the Right Bidding Strategy for Your Goals

Google offers multiple bidding options, but only a few make sense for bankruptcy law:

For new campaigns:

- Manual CPC: Full control while gathering data

- Maximize Clicks: Build initial traffic (use cautiously)

For established campaigns:

- Target CPA: Optimize for consultation bookings

- Maximize Conversions: Best for consistent lead flow

- Target ROAS: If you track case values

Avoid “Target Impression Share” — visibility without conversions bankrupts your marketing budget.

Adjust Bids by Intent Signals

Not all clicks are equal, so adjust your bids to match intent and timing.

Give mobile users a 20% boost—they’re searching with urgency. Keep desktop bids steady since people are in research mode, and dial down tablets by 20% because they convert less.

Bump up bids by 30% in the evening when people are winding down but ready to act, and increase by 50% late at night when intent is strongest. Weekends deserve a 25% lift, while business hours stay steady.

Location plays a big role—push bids up 40% for clicks within 5 miles, 20% for 5 to 15 miles, keep it baseline for 15 to 30 miles, and completely drop bids outside your service area. This way, every bid works smarter and harder.

Set Budgets That Scale With Success

Start conservative, then scale what works:

- Begin with $50-100/day test budget

- Identify profitable keywords/times/locations

- Gradually increase the budget on winners

- Cut spending on underperformers

- Reinvest savings into proven campaigns

Pro tip: Set up automated rules to pause keywords that are spending a lot but not bringing in any conversions. For example, automatically pause any keyword that costs twice your target CPA without delivering results.

Know When to Pay More (And When to Walk Away)

Some expensive keywords are worth it:

- “Emergency bankruptcy filing today”: High intent, pay premium

- “Chapter 7 attorney free consultation”: Strong commercial intent

- “Stop foreclosure this week”: Urgent need, higher case value

Others are money pits:

- “What is bankruptcy?”: Information stage, low conversion

- “Bankruptcy forms”: DIY seekers won’t hire

- “Bankruptcy court”: Could be anyone, too broad

The key? Calculate your true cost per case, not just cost per click. A $100 click that converts at 10% costs $1,000 per case. If your average case value is $1,500, that’s profitable. Do the math, not the guessing.

You Invested Everything in Your Law Degree — Is It Paying Off?

Years were sacrificed and six figures of student debt taken on to become an attorney.

Right now, someone in financial crisis is searching for a “bankruptcy lawyer near me” — and hiring a competitor instead because their ad showed up first, not yours.

At Comrade Digital Marketing Agency, bankruptcy attorneys stop losing revenue to firms with bigger ad budgets. Our team of PPC specialists, digital marketing strategists, and conversion experts puts your firm exactly where it counts — at the top of Google when desperate debtors need help immediately.

As a trusted bankruptcy law PPC agency, attorneys across the U.S. have seen up to 300% ROI with our strategies.

If watching potential clients in crisis call other firms has become frustrating:

Make sure the next person seeking a fresh start finds you.

Frequently Asked Questions

-

How long does it take to see results from PPC campaigns?

You can typically begin seeing results from a Google Ads campaign within a few days to a couple of weeks, depending on factors like targeting, competition, and ad quality. For a bankruptcy law firm website, performance tracking should begin immediately, but meaningful insights and ROI trends usually take a few weeks to establish.

-

Do I need a large budget to succeed with PPC advertising?

No, you don’t need a massive ad spend to run a successful campaign. The key is strategic targeting and continuous optimization. For instance, PPC for bankruptcy lawyers can be highly effective even with a moderate budget if you’re targeting the right keywords and locations.

-

Should I hire a PPC expert to manage my campaign?

Hiring a PPC expert can help your firm stand out in a crowded search engine results page, especially if you’re in a competitive legal market. An expert understands nuances like bidding strategies, ad copy testing, and conversion tracking—essential for maximizing ROI.