After three years of law school and passing the bar, you shouldn’t have to watch clients turn to other lawyers when they need help with bankruptcy.

But here’s the harsh reality: If your bankruptcy practice isn’t generating consistent leads, you’re leaving thousands on the table every month. 66% of bankruptcy filers research attorneys online before making a call.

What’s worse? The average person facing financial crisis spends less than 48 hours choosing their bankruptcy attorney. If they can’t find you quickly, they’ll hire whoever shows up first.

In this guide, we’ll reveal 8 battle-tested lead generation strategies that work for bankruptcy attorneys in 2025. No fluff, no theory — just proven tactics to fill your pipeline with qualified leads. Let’s dive in.

Why Bankruptcy Lead Generation Is More Critical Than Ever

Imagine this: It’s 11 PM, and a single parent in your city has just gotten their third foreclosure notice. They’re frantically searching online for a “bankruptcy attorney near me.”

But your practice doesn’t appear in the search results. Instead, your competitor does. And just like that, you lose a client who truly needed your help, while your expertise goes unnoticed.

This isn’t just one story; it happens thousands of times every day across America.

The Numbers Don’t Lie

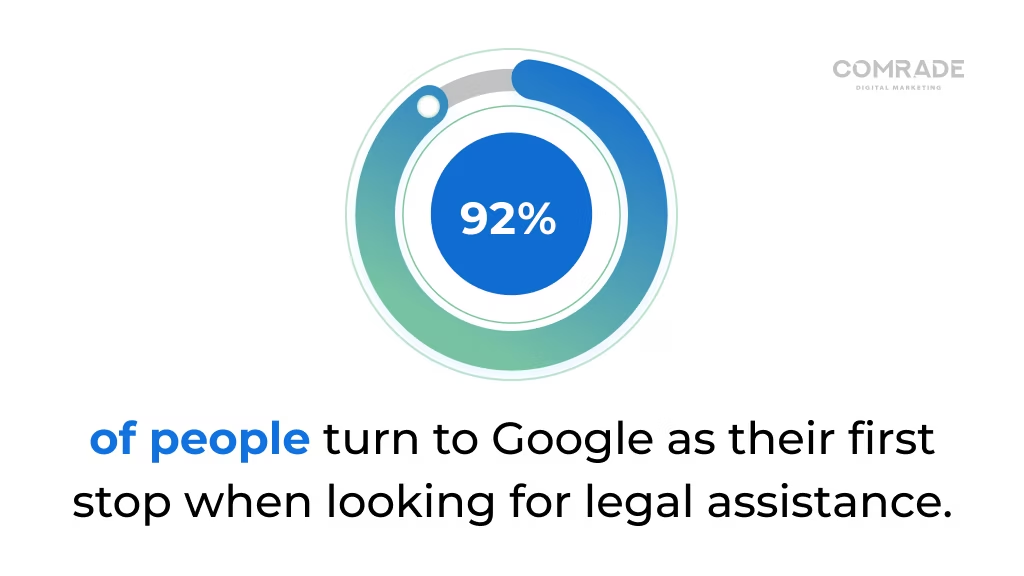

- 92% of people turn to Google as their first stop when looking for legal assistance.

- 70% of clicks from local searches go directly to law firms listed in Google’s Local 3-Pack.

- 75% of users never go beyond the first page of search results.

If your firm isn’t capturing these desperate searches, you’re essentially invisible when clients need you most.

It’s Not Just About Volume — It’s About Quality

Bankruptcy lead generation helps your practice:

- Reach clients at their moment of crisis

When someone’s facing wage garnishment or foreclosure, they need immediate help. Strategic lead generation ensures you’re there when it matters. - Build trust before the first call

Quality content and testimonials establish credibility before prospects even dial your number. - Generate consistent revenue

Unlike referrals that ebb and flow, systematic lead generation creates predictable monthly caseloads.

The Landscape Has Shifted: Digital Dominance Rules

Gone are the days when a Yellow Pages ad and word-of-mouth were enough. Today’s bankruptcy law clients are younger, more tech-savvy, and expect instant answers. They’re comparing attorneys on their phones, reading reviews, and making decisions faster than ever.

Studies show that 60% of bankruptcy filers under 50 start their attorney search on a smartphone. If your lead generation isn’t mobile-first, you’re already behind.

This Guide Is Your Competitive Advantage

We’re about to show you exactly what works in 2025 — from crafting the perfect strategy to leveraging cutting-edge email automation — and teach you how to get bankruptcy leads so your practice can thrive while others struggle.

1. Craft a Results-Driven Lead Generation Strategy

Before you invest a dime in ads or publish your first blog post, you need a rock-solid strategy. Too many bankruptcy attorneys jump from tactic to tactic, hoping something works. When it comes to effective lead generation for lawyers, that’s a fast track to wasted time and money.

Define Your Ideal Bankruptcy Client

Not all bankruptcy cases are created equal. Start by identifying who you want to serve:

- Chapter 7 filers with straightforward cases?

- Complex Chapter 13 reorganizations?

- Small business Chapter 11 filings?

To master how to get bankruptcy leads, you need distinct messaging, keywords, and conversion methods. A clearer target leads to sharper outcomes.

Set Measurable Goals That Matter

Vague website goals produce vague results. Instead of “get more clients,” aim for:

- 20 qualified bankruptcy consultations per month

- 50% conversion rate from consultation to retained client

- Average case value of $1,500+

Track these metrics religiously using tools like Google Analytics, CallRail, or your legal CRM system.

Map Your Client’s Journey to Financial Recovery

Understanding how distressed debtors move from panic to hiring you is crucial:

- Awareness: “Can I keep my house if I file bankruptcy?”

- Research: “Chapter 7 vs Chapter 13 differences”

- Comparison: “Best bankruptcy law firm reviews [city]”

- Decision: “Free bankruptcy consultation near me”

Create content and campaigns that address each stage. Someone just learning about bankruptcy needs education. Someone comparing attorneys needs proof you’re the best choice.

Analyze Your Competition (Then Beat Them)

Study the top 3 bankruptcy firms in your market:

- What keywords do they target?

- How do they structure their intake process?

- What makes their value proposition unique?

Tools like SEMrush and Ahrefs reveal their entire playbook. Find gaps they’re missing and fill them aggressively.

Pro Tip: Many bankruptcy attorneys ignore Spanish-language keywords and content. If your market has a significant Hispanic population, this could be your secret weapon for untapped leads.

Keep in mind: having a strategy without putting it into action is just daydreaming. But going all in on execution without a strategy? That’s nothing but costly chaos.

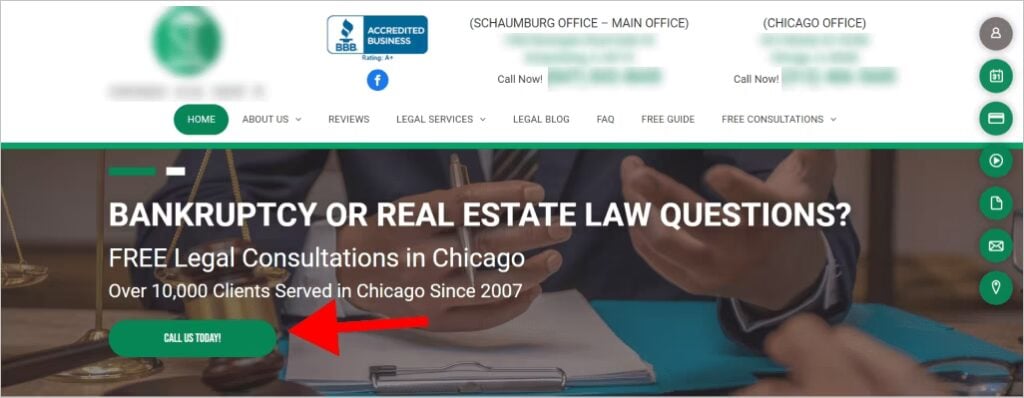

2. Design a High-Converting, Professional Website

Your lawyer website is working 24/7 — or it should be. For bankruptcy prospects in crisis, your site needs to convey trust, expertise, and accessibility instantly. A mediocre website doesn’t just lose leads; it loses desperate people who genuinely need your help.

Trust is Key in How to Get Clients for a Bankruptcy Lawyer

Bankruptcy clients are vulnerable. They’re embarrassed, scared, and skeptical. Your website must overcome these emotions immediately:

- Display attorney photos and bios prominently

- Feature bar admissions and certifications above the fold

- Include bankruptcy-specific trust badges (NACBA membership, ABI certifications)

- Showcase genuine client testimonials with full names when possible

Research indicates that bankruptcy websites with attorney photos convert 45% better than those without.

Optimize for Crisis-Mode Visitors

When someone’s about to lose their home, they’re not casually scrolling — they’re in full-blown crisis mode. Your solo attorney website needs to meet them there. Lead with a clear, powerful message like “Stop Foreclosure in 24 Hours — Free Consultation.”

Make your phone number easy to find and even easier to call. Keep the layout clean and simple — just the info they need, nothing extra. And since most people are searching from their phones, make sure your site works flawlessly on mobile. In moments like this, every second — and every click — counts.

Speed and Security Are Non-Negotiable

A slow website is like a locked office door—potential clients won’t stick around waiting. If your site takes more than 3 seconds to load, you’re already losing business. It needs to feel safe (yes, that little padlock matters), be easy for everyone to use, and look like you care. Skip the cliché judge stock photos and go with a clean, modern design that shows you’re the real deal.

Create Urgency Without Being Pushy

Bankruptcy has real deadlines — wage garnishments, foreclosure dates, and creditor lawsuits. Your site should reflect this urgency:

- “Foreclosure Sale Date Approaching? We Can Help Today”

- “Emergency Same-Day Bankruptcy Filings Available”

- “Stop Wage Garnishment in 24-48 Hours”

Conversion Tip: Add a floating “Text Us Now” button for younger clients who prefer messaging over calling. Text-enabled firms capture 23% more bankruptcy leads.

Your website should be more than just a digital business card — it needs to be your hardest-working employee, especially if you’re figuring out how to get bankruptcy leads.

3. Create Purpose-Driven Landing Pages that Convert

Generic content doesn’t convert. When someone searches for “Chapter 7 bankruptcy lawyer,” they’re not looking for a generic homepage — they want clear, specific answers to their legal problem. That’s why targeted landing pages are essential in effective search engine marketing for lawyers — they meet intent, build trust, and drive results.

One Problem, One Page, One Solution

Create dedicated landing pages for each bankruptcy scenario:

- “Stop Foreclosure in [City]”: For homeowners in crisis

- “Eliminate Credit Card Debt Through Chapter 7”: For overwhelming unsecured debt

- “Keep Your Car in Chapter 13 Bankruptcy”: For those worried about transportation

- “Small Business Chapter 11 Protection”: For struggling business owners

Knowing how to generate bankruptcy leads means creating pages that hone in on the specific fears or goals your audience faces.

Structure for Scanners and Readers

When someone’s drowning in debt, they don’t read — they scan, fast. Your headline needs to hit them right between the eyes: “Chapter 7 Bankruptcy Attorney in [City] – Debt Relief in 90 Days.”

Follow up with a quick, clear message of hope: keep your home, stop creditor harassment, and finally get a fresh start.

Make the next step effortless. A short, friendly contact form — just name, phone, email, and the best time to reach them — is all you need.

And don’t forget trust. Show them you’re legit with your bar license, years of experience, and real case numbers. They’re not just looking for help — they’re looking for someone they can believe in.

Write Copy That Connects Emotionally

Bankruptcy isn’t just financial — it’s deeply emotional. Address both:

- “Tired of dodging creditor calls?”

- “Imagine sleeping soundly without financial stress”

- “You’re not alone — we’ve helped 1,000+ neighbors get fresh starts”

Avoid legal jargon. Write like you’re explaining to a stressed friend, not arguing before a judge.

Test, Measure, Optimize, Repeat

Landing pages aren’t “set and forget.” Use A/B testing for:

- Headlines (fear-based vs. benefit-based)

- Form placement (above fold vs. after content)

- Call-to-action buttons (“Get Help Now” vs. “Free Consultation”)

- Color schemes (trust-building blue vs. urgent red)

Tools like Unbounce, ClickFunnels, or even WordPress with Elementor make testing simple. The firms that test consistently see 50-100% improvements in conversion rates over time.

Advanced Tactic: Create Spanish-language landing pages for “bancarrota capitulo 7” and similar terms. Many markets have untapped Hispanic populations facing bankruptcy who prefer native-language content.

When someone lands on your page in a moment of stress, your one job is to guide them toward booking a consultation. Keep everything else out of the way.

4. SEO Tips on How to Get Clients for Bankruptcy Lawyer Fast

When someone types “bankruptcy attorney near me” at midnight, they’re not browsing — they’re desperate. Law firm SEO ensures you’re the solution they find. But ranking for bankruptcy terms requires strategic precision in an ultra-competitive field.

Target Local, High-Intent Keywords

Forget broad terms like “bankruptcy.” Focus on buyer-intent keywords:

- “Chapter 7 bankruptcy lawyer [city]”

- “Stop foreclosure attorney [neighborhood]”

- “Emergency bankruptcy filing [county]”

- “Wage garnishment lawyer near me”

Use tools like Google Keyword Planner and AnswerThePublic to uncover what distressed debtors search.

Optimize Your Google Business Profile Aggressively

For bankruptcy attorneys, local SEO is everything. Your law firm Google Business Profile needs:

- Complete business information with bankruptcy-specific categories

- Real photos of your office (not stock images)

- Regular posts about bankruptcy topics and success stories

- Respond to ALL reviews within 24 hours — especially negative ones

Studies show bankruptcy firms with optimized GBP listings receive 3x more calls than those without.

How to Get Clients for Bankruptcy Lawyer With Helpful Content

Blog posts should address real client fears:

- “Will I Lose My House in Chapter 7 Bankruptcy in [State]?”

- “Can Bankruptcy Stop a Wage Garnishment Tomorrow?”

- “What Happens to My Car Loan in Chapter 13?”

Each piece should be 1,500+ words, locally optimized, and end with a clear call-to-action.

Build Authoritative Backlinks

Google puts trust in sites that others trust. Strengthen your authority by earning quality backlinks from local bar associations, legal directories, community financial counselors, and local news outlets where you can share your expert take on bankruptcy trends. These connections not only build your reputation but also help Google see you as a reliable source.

Pro Tip: Create a free “Bankruptcy Means Test Calculator” for your state. Other sites will link to this valuable resource, boosting your authority naturally.

Technical SEO Can’t Be Ignored

You can’t ignore technical SEO if you want your site to succeed. Make sure your pages load in under 3 seconds, look great on any device, have secure SSL protection, and include an XML sitemap. Adding schema markup—especially for attorneys and local businesses—gives you that extra boost to stand out. It’s all about making your site fast, friendly, and easy to find.

Here’s the truth: SEO takes patience. A lot of bankruptcy firms give up too early — usually around the 3-month mark. But if you hang in there for 6 to 12 months, you’ll see results that last for years.

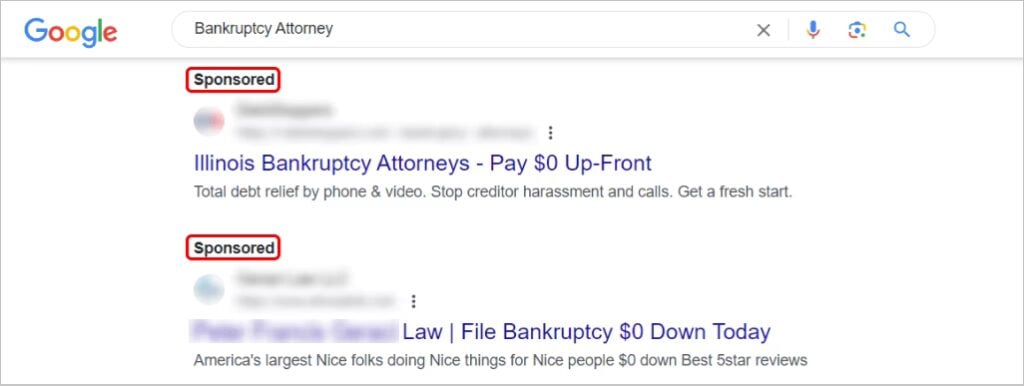

5. Run Targeted PPC Campaigns That Deliver Fast Leads

SEO builds long-term dominance, but PPC generates bankruptcy leads today. For bankruptcy attorneys, pay-per-click advertising can fill your pipeline while organic rankings grow. But beware — done wrong, law firm PPC burns cash faster than a gambling addiction.

How to Get Clients for Bankruptcy Lawyer Using Targeted Google Ads

When conducting keyword research for lawyers, focus on high-intent, location-specific phrases that signal a strong intent to hire. Examples include:

- “Bankruptcy attorney [city]”

- “Chapter 7 lawyer near me”

- “Stop foreclosure [city] today”

- “Emergency bankruptcy filing”

Avoid overly broad terms like “bankruptcy” or “debt help” — these tend to draw in low-quality leads who are just browsing or looking for free advice.

Write Ad Copy That Speaks to Pain Points

Your ads have microseconds to connect. Make them count:

Headline 1: Stop Foreclosure Today — [City]

Headline 2: Emergency Bankruptcy Filing

Description: Board-certified attorney. File in 24 hours. Stop creditor calls immediately. Free consultation.

Include urgency, authority, and clear benefits. Test emotional triggers like “Sleep Tonight Without Debt Stress.”

Use Ad Extensions to Dominate Screen Space

Boost your law firm advertising with ad extensions that make your ads larger and more engaging:

- Call extensions: Direct dial from the ad

- Location extensions: Show your proximity

- Sitelink extensions: Chapter 7 info, testimonials, free consultation

- Price extensions: “Chapter 7 from $999” (if your state allows)

Set Up Conversion Tracking Properly

Get your conversion tracking right, so you’re not just guessing what’s working. Keep an eye on things that really matter—like phone calls that last over a minute, form fills, live chat starts, and clicks on “Get Directions.” That’s how you figure out your true cost per loyal customer, not just cost per click.

Don’t Ignore Microsoft (Bing) Ads

Bing users skew older and more desktop-focused — perfect for bankruptcy demographics. Competition is lower, costs are cheaper, and conversion rates often beat Google.

Advanced Strategy: Create separate campaigns for Spanish-language terms. “Abogado de bancarrota” searches have less competition but strong conversion rates in many markets.

Retargeting: Your Secret Weapon

For bankruptcy attorneys, knowing how to generate bankruptcy leads means using retargeting, as most prospects take days to research before calling:

- Show ads to website visitors who didn’t convert

- Target specific pages (visited Chapter 7 info but didn’t call)

- Use different messages based on time delay (gentle day 1, urgent day 7)

Budget Reality Check: Bankruptcy PPC isn’t cheap. Budget $2,000-$5,000/month minimum in competitive markets. But with average bankruptcy fees of $1,500+, just 2-3 cases cover your monthly spend.

Don’t forget: PPC can make a huge impact, but it requires care. Start small, monitor everything, and double down on what’s working. The attorneys who truly master PPC often control their market space.

6. Leverage Social Media Marketing for Lead Growth

Social media marketing for lawyers may feel counterintuitive—after all, bankruptcy is a sensitive subject. Yet, using social platforms strategically can help you build trust and generate a steady flow of qualified leads within your community.

Facebook: The Hidden Key to How to Get Clients for Bankruptcy Lawyer

Facebook is a powerful tool for reaching people going through bankruptcy quietly and respectfully. With its smart targeting based on financial habits and life changes, plus an older audience that fits those who need help most, it’s perfect for this kind of outreach.

The trick is to share content that’s helpful and reassuring—like “5 Myths About Bankruptcy in [State],” “How to Rebuild Credit After Chapter 7,” or “Know Your Rights: Stopping Creditor Harassment”—so you can connect with people in a way that feels supportive, not awkward.

Use Facebook Ads to Reach Crisis Points

Target users showing financial stress signals with Facebook ads for lawyers:

- Recent searches for payday loans

- Visits to credit counseling sites

- Life events: divorce, job loss, medical issues

- Geographic targeting around courthouses

Want to know how to get bankruptcy leads? Start with compassionate ad copy: “Financial fresh start available. Confidential consultation. Local attorneys who understand.”

LinkedIn for Business Bankruptcy Leads

If you’re looking for business bankruptcy leads, LinkedIn is where you want to be. Share useful tips and stories about restructuring, reach out to local business owners and accountants, and join groups where entrepreneurs and small business owners hang out. It’s an easy way to build trust and become known as the go-to expert in business bankruptcy.

YouTube: The Untapped Goldmine

For those wondering how to generate bankruptcy leads, video is the key to fast trust-building. Create videos addressing:

- “What to Bring to Your Bankruptcy Consultation”

- “Chapter 7 vs. Chapter 13: Which Is Right for You?”

- “Day in the Life of a Bankruptcy Attorney”

Optimize titles for search and embed videos on your website for SEO benefits.

Instagram and TikTok: Proceed Carefully

Younger platforms require nuance:

- Share financial literacy tips, not bankruptcy ads

- Build authority through education

- Use stories for Q&A sessions

- Never directly solicit bankruptcy clients

Ethical Consideration: Always follow state bar advertising rules. Include required disclaimers and avoid creating attorney-client relationships through social media interactions.

The Social Proof Strategy

Across all platforms, showcase success without violating confidentiality:

- “Helped another family save their home today #FreshStart”

- Share Google reviews (with permission)

- Post about community involvement and financial education seminars

Pro Tip: Create a private Facebook group for “Financial Fresh Start [City]” where you share resources and build community. Members often become clients when ready.

Social media won’t replace SEO or PPC, but it helps foster trust that turns prospects into clients. Knowing how to get bankruptcy leads starts with mastering one platform before expanding further.

7. Produce High-Value Content That Captures Leads

Content marketing for lawyers isn’t about blogging for blogging’s sake. It’s about creating resources so valuable that distressed debtors gladly exchange their contact information, then trust you with their financial future.

Create Lead Magnets That Solve Immediate Problems

Forget generic “Guide to Bankruptcy” PDFs. Create specific, actionable resources:

- “Stop Foreclosure Checklist: 7 Steps to Take Today” (for homeowners)

- “Wage Garnishment Calculator for [State]” (interactive tool)

- “What to Do 24 Hours Before Filing Bankruptcy” (urgent guidance)

- “Chapter 7 vs. 13 Comparison Chart” (decision-making tool)

Each resource should provide genuine value while positioning you as the obvious next call.

Build a Content Library That Ranks and Converts

Want to create a content strategy that truly connects?

Focus on the bankruptcy journey your audience is going through. Start by sparking curiosity and trust with topics like “Is Bankruptcy Right for Me? A Self-Assessment” and “Warning Signs You Need Bankruptcy Protection” to help people recognize when they might need help.

Next, walk them through the process with clear, reassuring content like “How to Choose a Bankruptcy Attorney in [City]” and “Bankruptcy Timeline: From Filing to Discharge,” answering their questions and easing their worries.

Finally, help them feel confident and ready to take the next step with practical guides like “Questions to Ask Your Bankruptcy Attorney” and “Why Choose [Your Firm] for Your Fresh Start.” This way, your content feels like a helpful conversation, not just information on a page.

Gate Your Best Content Strategically

The key to how to generate bankruptcy leads is following the 80/20 rule—email isn’t always the answer:

- 80% freely accessible (builds trust and SEO)

- 20% gated behind email capture (highest-value resources)

Use exit-intent popups offering relevant downloads: “Leaving? Download our Free Foreclosure Prevention Guide first!”

Video Content Converts Better

Written content attracts search traffic, but attorney video marketing builds trust faster:

- Record FAQ videos answering top 10 bankruptcy questions

- Create “Client Success Stories” (with permission and anonymity)

- Film office tours to humanize your practice

- Host monthly “Bankruptcy Q&A” livestreams

Transcribe videos for SEO and embed on relevant pages.

If you’re wondering how to generate bankruptcy leads, the key is to consistently address real issues and concerns. Leads will follow as you solve problems through your content.

8. Use Email Marketing to Guide Leads Through the Sales Funnel

Bankruptcy prospects often spend time researching, worrying, and delaying before they decide to file. Leveraging email marketing, aligned with Google ranking factors for lawyers, helps you stay connected through this critical window, transforming hesitant leads into loyal clients.

Build Your List With Empathy

Grow your email list by building trust, not pressure. People facing bankruptcy are already overwhelmed, so meet them with empathy and real help. Offer something they need, like a simple script to stop creditor calls, a practical budget worksheet to prepare for filing, or a short video series on how to bounce back. Skip the scare tactics and aggressive pop-ups—being human works better.

Segment for Relevance

Not all bankruptcy situations are equal. Segment your list:

- Foreclosure facing: Send home-saving content

- Wage garnishment: Focus on immediate relief

- Business owners: Chapter 11 vs. 7 comparisons

- Post-bankruptcy: Credit rebuilding tips

Targeted emails get 3x higher engagement than generic blasts.

Create a Nurture Sequence That Converts

Design a 10-email automated sequence for new subscribers:

Email 1: Welcome and immediate value (downloadable resource)

Email 2: Your bankruptcy story — why you help people start fresh

Email 3: Common bankruptcy mistakes to avoid

Email 4: Client success story (anonymized)

Email 5: Asset protection strategies

Email 6: Timeline expectations — from filing to discharge

Email 7: Cost breakdown and payment plans

Email 8: What makes your firm different

Email 9: Limited-time consultation offer

Email 10: Final urgency — statutory deadlines approaching

Space emails 2-3 days apart. Monitor opens and clicks to optimize timing.

Write Subject Lines That Get Opened

Want your emails to get opened? Focus on real urgency without sounding like spam. Think subject lines like “Sarah saved her home (you can too)” or “3 things to do before Friday’s garnishment”—they feel personal and timely. Even something simple like “Quick question about your situation” can work wonders. Emojis like ⚖️🏠⏰ can help too, but use them where they make sense.

Include Clear Calls-to-Action

To get real results from your emails, always include one clear, simple call-to-action. It could be inviting people to “Schedule your free consultation,” encouraging them to “Download the worksheet,” or asking them to “Text us for immediate help.” Whatever it is, make sure it stands out—use big, colorful buttons that look great on any device. When it’s easy to see and tap, people are much more likely to take that next step and connect with you.

Track What Matters

Focus on what counts—like how many people book consultations after your emails, how quickly they call back, how many turn into clients, and the revenue each subscriber brings. Then, make it personal: if someone keeps visiting your pricing page, send them a friendly note about payment plans.

If they download your Chapter 7 guide, follow up with an easy comparison to Chapter 13. And if they’ve opened a bunch of emails but haven’t reached out, just ask, “What’s holding you back?”—sometimes a simple question is all it takes to start the conversation.

Compliance Note: Always include unsubscribe options and follow CAN-SPAM laws. Add attorney advertising disclaimers as required by your state bar.

Email marketing isn’t glamorous, but it works. The attorneys who master patient, helpful email sequences convert 50% more leads than those who rely on one-and-done contact attempts.

Conclusion: Your Next Steps to Bankruptcy Lead Generation Success

Generating leads is crucial for bankruptcy attorneys who want to reach people going through tough financial times. Using smart legal marketing strategies, SEO, and targeted content helps you get noticed and connect with clients who truly need your expertise.

At Comrade Digital Marketing Agency, we focus on creating personalized digital marketing plans that help bankruptcy attorneys grow their practice. We understand the challenges you face and know how to make your legal services stand out in a crowded market.

If you’re ready to attract more clients and grow your practice, let’s chat. Book a consultation with Comrade Digital Marketing Agency today and start turning potential leads into real cases.

Frequently Asked Questions

-

What should I budget for lead generation as a bankruptcy attorney?

Your budget will depend on the scale of your practice and the type of lead generation services you choose. Typically, allocating 10-20% of your annual revenue to legal lead generation businesses is a good starting point. Focusing on high-quality leads might require a larger investment in digital marketing strategies.

-

Should I consider outsourcing my lead generation efforts?

Outsourcing can help you tap into specialized expertise for more effective bankruptcy lead generation services. It allows you to focus on client services while experts handle your marketing. If you’re looking for a steady stream of quality leads, outsourcing can often yield faster and better results.

-

How long does it typically take to see results from lead generation efforts?

Results can vary, but typically, it takes 3-6 months to see substantial outcomes from digital marketing strategies. Initial leads may come in sooner, but long-term success depends on consistent efforts and optimization. For law bankruptcy services, conversion rates can improve as your campaigns gain traction.