Tax season doesn’t last forever, but your marketing should work year-round.

Here’s the reality: If your tax law practice isn’t visible online when clients need you most, you’re losing cases to competitors who understand digital marketing. 66% of people research tax attorneys online before making their first call, and 75% never scroll past the first page of search results.

Whether you’re handling complex corporate tax disputes, IRS audits, or estate planning, your expertise means nothing if potential clients can’t find you when they’re facing tax troubles.

In this comprehensive guide, we’ll walk through 8 battle-tested digital marketing strategies specifically designed for tax attorneys. These aren’t generic marketing tips — they’re proven tactics that help tax law firms attract higher-value clients, build authority, and grow predictably.

Why Digital Marketing Is Critical for Tax Attorneys Today

Tax law is complex, intimidating, and often urgent. When individuals or businesses face tax issues, they don’t have time to ask around for referrals or flip through the Yellow Pages. They go straight to Google.

The Current Landscape for Tax Legal Services

- Tax season drives massive search volume: Searches for tax attorneys spike 300% between January and April

- Business owners search year-round: Corporate tax issues don’t follow seasonal patterns

- High-stakes decisions require trust: People research extensively before hiring tax representation

- Local expertise matters: Tax laws vary by state, making location-based searches critical

What This Means for Your Practice

Digital marketing isn’t just about getting found — it’s about positioning yourself as the trusted expert when people need tax legal help the most. When done right, online marketing helps you:

- Appear when prospective clients face urgent tax problems

- Demonstrate expertise before the first consultation

- Generate consistent leads without relying solely on referrals

- Build authority in specialized tax niches

- Compete effectively against larger firms

The tax attorneys who understand this are building thriving practices. Those who don’t are watching opportunities slip away to competitors who show up online.

1. Craft a Comprehensive Digital Marketing Strategy

Before you launch any marketing campaigns or optimize a single page, you need a roadmap. A strategic approach to digital marketing isn’t about trying every tactic — it’s about choosing the right channels that align with your practice goals and ideal clients.

Define Your Target Audience and Services

Tax law covers everything from individual tax planning to complex corporate restructuring. Your digital marketing strategy must reflect your specific expertise and ideal client profile.

Ask yourself:

- Do you focus on high-net-worth individuals facing estate tax issues?

- Are you the go-to firm for businesses dealing with sales tax controversies?

- Do you specialize in international tax compliance for multinational corporations?

- Are you building a practice around cryptocurrency tax issues?

Your tax attorney marketing message, content topics, and even your choice of digital channels should align with these specializations.

Set Measurable Goals and KPIs

Don’t just dive into digital marketing—start with a clear destination. When you know exactly what you’re aiming for, it’s easier to see what’s working, fix what’s not, and stay focused on what really matters. Want more leads? Track things like how many people are requesting consultations or calling you after finding you online. Trying to build your authority?

Pay attention to how often people are searching for your brand, how many speaking invites you’re getting, or how fast your newsletter list is growing. And if practice growth is the goal, follow the money—look at revenue from digital channels, how valuable those clients are over time, and whether you’re reaching new markets. Clear website goals aren’t just numbers—they’re your roadmap to real, measurable progress.

Analyze Your Competition

Study the tax attorneys dominating search results in your market:

- What practice areas do they emphasize online?

- How do they structure their service pages?

- What content topics generate the most engagement?

- Which keywords are they targeting successfully?

Tools like SEMrush, Ahrefs, and SpyFu can reveal competitor strategies, but remember — the goal isn’t to copy them. It’s to identify gaps and opportunities where you can provide better, more targeted information.

AI Tip: Use ChatGPT to analyze competitor websites and identify content gaps. For example: “Analyze this tax attorney’s website and suggest 10 content topics they’re missing that would appeal to business owners facing IRS audits.”

Your strategy should be built around what your ideal clients actually need, not just what search engines reward. When you solve real problems, the rankings follow naturally.

2. Optimize for Search Engines (SEO) to Boost Visibility

Search engine optimization is the foundation of long-term digital marketing success for tax attorneys. Unlike paid advertising, law firm SEO keeps working 24/7, bringing qualified leads to your practice even while you sleep.

Target High-Intent, Location-Specific Keywords

The key to standing out is realizing that not all Google searches are created equal, and that’s where keyword research for lawyers comes in. Someone looking up “what is tax law” is just gathering info. But a person typing “tax attorney IRS audit help Chicago”? They’re ready to pick up the phone.

That’s why it’s so important to focus on high-intent, location-specific keywords. Phrases like “tax attorney [city]” or “IRS audit lawyer near me” attract clients who aren’t just curious—they need help now, and they’re looking for someone local they can trust.

Want to go even deeper? Target long-tail keywords that match urgent, specific problems. If someone’s searching “how to respond to IRS notice CP2000” or “cryptocurrency tax attorney,” they’re already dealing with a tax issue—and actively looking for expert support.

Speak their language. Show up when it matters. That’s how you turn searchers into clients.

Create Comprehensive Service Pages

Give each area of your tax practice the spotlight it deserves with its own dedicated page—because your clients aren’t all looking for the same thing, and Google knows that too. These pages aren’t just about keywords; they’re about connection. Speak your clients’ language with clear, benefit-focused headlines and easy-to-understand explanations.

Show them you get what they’re going through by highlighting real-life situations where your help made a difference. Share your experience, your results, and—if allowed—let your happy clients do some of the talking. And most importantly, guide visitors toward action with a clear, inviting path to reach out for a consultation.

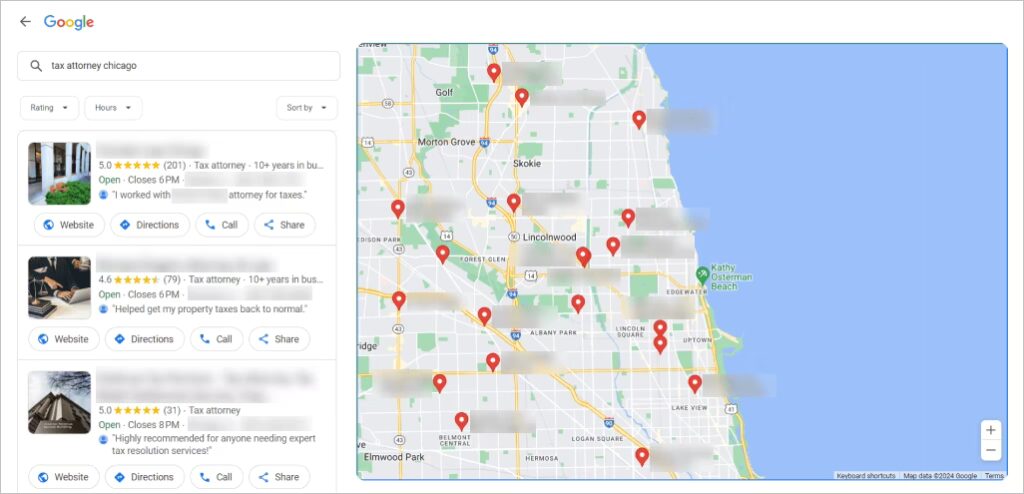

Optimize for Local Search

Understanding state-specific tax law is crucial, and local SEO for lawyers helps ensure visibility where it matters most. When someone searches for tax help, they usually need an attorney licensed in their jurisdiction.

Local SEO Essentials:

- Claim and optimize your Google Business Profile

- Ensure consistent NAP (Name, Address, Phone) across all legal directories

- Create location-specific landing pages if you serve multiple areas

- Generate and respond to client reviews

- Publish locally-relevant content about state tax issues

The key to SEO success isn’t just ranking — it’s ranking for searches that turn into consultations and clients.

3. Design and Launch a High-Impact Professional Website

Your lawyer website is often the first impression potential clients have of your practice. In the legal field, especially tax law, trust and credibility are paramount. A poorly designed or outdated website can cost you clients before they even pick up the phone.

Build for Trust and Conversion

When it comes to taxes, people want clarity and confidence—fast. Your website should feel like a handshake: firm, professional, and reassuring. Warm, professional headshots and well-written bios help visitors connect with the real people behind the practice. Share your story, your credentials, and why clients trust you. Add in testimonials, results, and any media features or awards, and you’re not just building a website—you’re building trust from the very first click.

Prioritize User Experience

User experience can make or break your tax attorney website. People don’t have time to wait for slow pages or hunt for basic info—they want answers fast. That’s why your site should load quickly, look great on any device, and guide visitors effortlessly. From clear menus to easy-to-spot contact buttons and attorney profiles, everything should feel intuitive. When your site is simple to use, it builds trust and makes it easier for potential clients to take action.

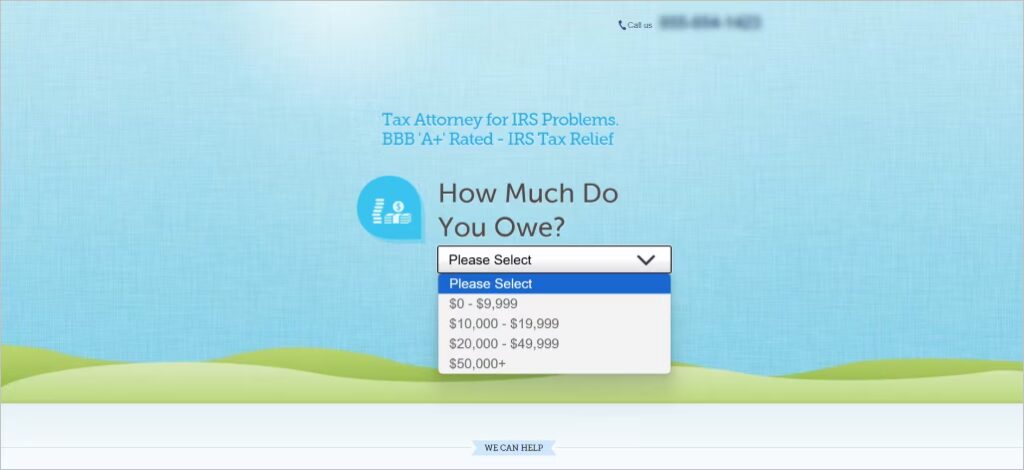

Create Converting Landing Pages

Different visitors have different needs. Create targeted landing pages for your most important tax services and traffic sources.

High-Converting Landing Page Elements:

- Compelling headlines that address specific pain points

- Clear value propositions (“25+ years defending against IRS audits”)

- Risk-reversal offers (free consultations, no upfront fees)

- Social proof and credibility indicators

- Multiple ways to contact you (phone, form, chat)

Implement Smart Technology

Modern websites can work as lead generation engines with the right technology integration.

Technology Enhancements:

- Live chat or legal chatbots for immediate visitor engagement

- Appointment scheduling integration

- Email capture for newsletters and updates

- Client portal access for existing clients

- Document upload capabilities for new inquiries

Your website isn’t just a digital brochure — it’s your most important marketing asset. Invest in making it work as hard as you do to attract and convert potential clients.

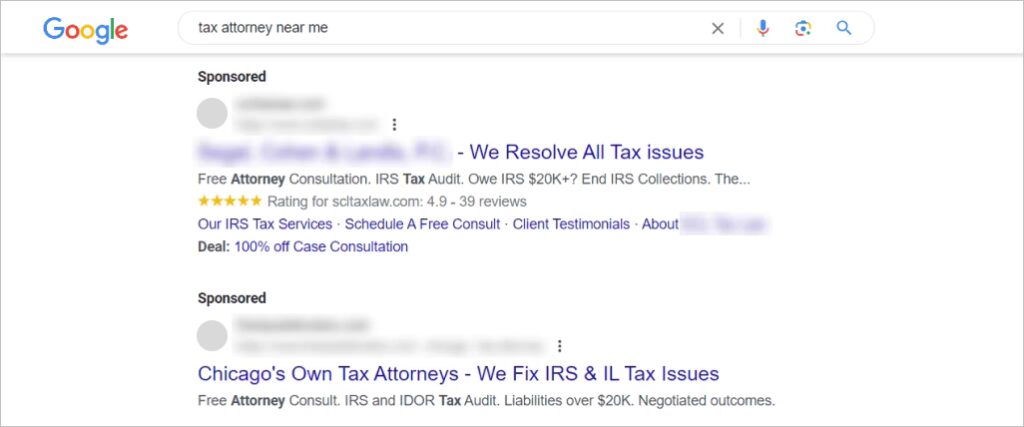

4. Maximize ROI with Strategic Pay-Per-Click (PPC) Advertising

While SEO builds long-term visibility, law firm PPC advertising delivers immediate results. For tax attorneys, strategic PPC campaigns can capture high-intent searches and generate qualified leads within days of launch.

Focus on High-Intent, Emergency Keywords

Tax problems are often urgent. Someone facing an IRS audit or tax controversy needs help immediately, making them ideal PPC prospects.

High-Converting PPC Keywords:

- “IRS audit attorney”

- “Tax lawyer near me”

- “Emergency tax help”

- “IRS notice response”

- “Tax controversy lawyer”

Location-Based Modifiers:

- Add your city, state, or service area to increase relevance

- Use “near me” variations for mobile searches

- Target specific neighborhoods for competitive advantage

Structure Campaigns for Success

Organize your PPC campaigns around your core services and practice areas for better control and optimization.

Campaign Structure Example:

- Campaign 1: IRS Audit Defense

- Campaign 2: Business Tax Issues

- Campaign 3: Individual Tax Planning

- Campaign 4: Tax Controversy & Litigation

Create Compelling Ad Copy

In today’s crowded legal market, your ads need to do more than just exist—they need to speak directly to the people who need you most. Start by highlighting what makes your firm different. Is it your track record? Your approach? Make it clear right away.

Don’t be afraid to get emotional—lines like “Stop IRS stress today” tap into what your clients are really feeling. Be direct about what action you want them to take next, and always mention your location so potential clients know you’re close by and ready to help. The right words can turn a glance into a call.

Example Ad:

- Headline 1: IRS Audit? Get Expert Defense Now

- Headline 2: 20+ Years Fighting Tax Controversies

- Description: Former IRS attorney now representing taxpayers. Free consultation. Immediate response to urgent tax matters.

Optimize Landing Pages for Conversion

Driving traffic is only half the battle. Your landing pages must convert visitors into leads.

Landing Page Essentials:

- Match the message from your ad

- Remove navigation distractions

- Focus on one clear action (consultation request)

- Include trust signals and social proof

- Make contact forms short and simple

PPC works best when combined with your overall digital marketing strategy. Use PPC data to inform your SEO keyword targeting, and retarget PPC visitors with content marketing to nurture long-term relationships.

5. Develop Engaging, Value-Driven Content

Legal content marketing positions you as the go-to expert in tax law while attracting potential clients who are researching their options online. Quality content builds trust, demonstrates expertise, and keeps your firm top-of-mind when legal needs arise.

Create Content That Serves Your Ideal Clients

Craft content that speaks their language, not everyone’s. In the world of tax law, generic messaging falls flat. If you want to connect, focus on what keeps your ideal clients up at night.

Business owners crave clarity on sales tax nexus across states, worry about red flags that might trigger audits, and need to know the tax impact of changing business structures. Meanwhile, high-net-worth individuals are thinking ahead—estate tax planning, foreign asset reporting, and making charitable donations work smarter, not harder.

If tax controversy is your niche, offer guidance on how to face the IRS head-on—from navigating collection actions to securing innocent spouse relief and challenging audit results. Let your content become the go-to guide that answers the questions your ideal clients haven’t even asked yet.

Build Authority with Educational Resources

Use legal blogging to position yourself as the expert by crafting thorough guides and resources that potential clients find valuable enough to bookmark and share.

High-Value Content Formats:

- Step-by-step guides for common tax situations

- Tax law updates and analysis

- Frequently asked questions with detailed answers

- Case study breakdowns (following ethical guidelines)

- Video explanations of complex tax concepts

Optimize Content for Search and Conversion

Every piece of content should serve dual purposes: providing value to readers and improving your search engine visibility.

Content Optimization Checklist:

- Target specific keywords naturally throughout the content

- Use clear, descriptive headlines and subheadings

- Include internal links to relevant service pages

- Add calls-to-action for consultations or newsletter signups

- Optimize meta descriptions for click-through rates

Establish a Consistent Publishing Schedule

When it comes to building trust and staying visible online, consistency is everything. Set a content schedule that not only works for you but also meets your audience where they are, especially during key times like tax season.

Post weekly during the height of tax time to stay top of mind, share in-depth articles each month that dive into niche topics your readers care about, and offer clear quarterly updates that break down new laws and regulations. And don’t forget an annual planning guide to help your audience feel prepared—not panicked, when tax season rolls around again.

AI Content Tip: Use legal AI tools like ChatGPT or Jasper to generate content ideas, outlines, and first drafts. However, always review and revise AI-generated content to ensure accuracy, compliance, and your professional voice. Tax law requires precision that only human expertise can guarantee.

Content marketing is a long-term investment that compounds over time. Each valuable piece you publish builds your reputation, improves your search rankings, and establishes your firm as the trusted resource for tax legal guidance.

6. Manage and Enhance Your Online Reputation

In tax law, reputation is everything. Effective attorney reputation management is essential because potential clients entrust you with their financial future and often their freedom. Your online reputation can make or break their decision to choose your firm over a competitor.

Monitor Your Digital Footprint

These days, your first impression happens long before a phone call or email—it’s happening online. When someone searches your name, they’re not just looking at your website. They’re diving into Google results, scrolling through reviews, browsing your legal profiles, and checking out your presence on social media. Even old news articles or public records can shape how you’re perceived.

If you’re not keeping an eye on your digital footprint, someone else is defining your reputation for you. Stay one step ahead—make sure what people find online reflects who you truly are.

Proactively Generate Positive Reviews

Don’t wait for reviews to happen organically—encourage satisfied clients to share their experiences on attorney review sites by making the process simple.

Review Generation Strategies:

- Follow up with clients after successful case resolution

- Provide direct links to your preferred review platforms

- Create simple instructions for leaving reviews

- Consider using review management software

- Always respond professionally to all reviews

Sample Review Request: “We’re grateful for the opportunity to help resolve your tax matter. If you were satisfied with our service, we’d appreciate if you could share your experience on Google. Your feedback helps other taxpayers find the legal help they need.”

Handle Negative Reviews Professionally

Let’s face it—negative reviews are part of doing business. But the way you respond can speak volumes. A prompt, respectful reply shows you care. Even if you disagree, acknowledge the person’s feelings and keep the conversation calm and professional.

Invite them to continue the discussion privately—sometimes a simple gesture can turn frustration into appreciation. Remember, your response isn’t just for the reviewer; it’s for everyone reading along. Show them you’re listening, you’re thoughtful, and you’re committed to doing right by your clients.

Build Thought Leadership

Want to be seen as a true expert in your field? Start building real thought leadership by getting your voice out there in meaningful ways. Speak at top tax and legal conferences, share your insights in respected journals, and lend your expertise in media interviews. Host webinars that educate and engage, and write compelling op-eds that shape the conversation around tax policy. It’s not just about visibility—it’s about influence. Let people know you’re the one to watch.

Leverage Client Success Stories

When ethically permissible, client success stories demonstrate your expertise and build confidence with potential clients.

Success Story Elements:

- The client’s challenge or tax problem

- Your approach and strategy

- The successful outcome or resolution

- Client testimonial (with permission)

- Lessons learned or key takeaways

Your reputation precedes you in every potential client interaction. Manage it proactively, and it becomes your most powerful marketing asset.

7. Drive Engagement and Conversions with Email Marketing

For tax attorneys, email marketing is a cost-effective way to reach and retain clients, offering an average ROI of $42 for every $1 invested. When combined with conversion rate optimization for lawyers, it becomes an even more powerful tactic for building lasting client connections.

Build Your Email List Strategically

Your email list is a valuable asset that grows over time. Focus on attracting subscribers who are genuinely interested in tax legal guidance.

Lead Magnets for Tax Attorneys:

- “2025 Tax Law Changes: What You Need to Know” (PDF guide)

- “IRS Audit Checklist: Protect Yourself Before It’s Too Late”

- “Business Tax Deduction Guide” for entrepreneurs

- “Estate Tax Planning Worksheet” for high-net-worth individuals

- Monthly newsletter with tax tips and legal updates

Segment Your Audience for Relevance

Not all subscribers have the same needs. Segmentation allows you to send targeted, relevant content that resonates with specific groups.

Segmentation Strategies:

- By client type (individual vs. business)

- By service interest (audit defense, tax planning, controversy)

- By engagement level (highly engaged vs. occasional readers)

- By geography (especially important for state tax issues)

- By referral source (website, speaking events, other attorneys)

Create Valuable Email Content

Forget the pushy promos—your emails should help people. When you consistently send useful, relevant content, subscribers start to see you as someone they can trust, not just another name in their inbox.

Keep it real with things like simple tax law updates (minus the jargon), smart planning tips they can actually use, answers to the questions they’re already Googling, and quick breakdowns of real-life cases (shared ethically, of course). Toss in timely reminders when deadlines are coming up, and maybe a thought or two on what’s happening in tax policy right now.

When your emails feel more like a conversation and less like a sales pitch, people don’t just read them—they look forward to them.

Nurture Leads with Automated Sequences

Not everyone is ready to hire an attorney immediately. Automated email sequences keep you top-of-mind while providing ongoing value.

Welcome Series Example:

- Email 1: Welcome and introduction to your firm

- Email 2: “Common Tax Mistakes That Cost Thousands”

- Email 3: “When to Call a Tax Attorney: 5 Warning Signs”

- Email 4: Client success story and testimonial

- Email 5: “How to Choose the Right Tax Attorney”

Include Clear Calls-to-Action

Every email you send is an opportunity to connect—and the best way to do that is by giving your reader a clear, easy next step. Whether it’s inviting them to schedule a free consultation, download a useful guide, or simply ask their questions, a strong call-to-action shows you’re ready and eager to help.

Think of it like extending a genuine invitation: making it simple for them to reach out, get the support they need, or start a conversation that could make a real difference. When you make the next step obvious and approachable, you turn interest into trust and action—because people want to know exactly how to move forward.

Measure and Optimize Performance

Track key metrics to understand what resonates with your audience and continuously improve your email marketing results.

Key Email Metrics:

- Open rates (aim for 20-25% in the legal industry)

- Click-through rates (target 2-5%)

- Unsubscribe rates (keep below 2%)

- Conversion rates (consultation requests, phone calls)

- List growth rate

Email marketing works best as part of an integrated digital strategy. Use email to nurture relationships that start with content marketing, SEO, or PPC advertising, and convert subscribers into long-term clients and referral sources.

8. Build Your Brand with Strategic Social Media Marketing

Many tax attorneys underestimate the potential of social media marketing for law firms, but with a targeted strategy and consistent professionalism, it can become a vital part of your client acquisition efforts.

Choose Platforms That Align with Your Audience

To grow your tax-related legal services, focus on the platforms where your ideal clients and referral sources naturally spend their time. LinkedIn is the perfect place to connect with business owners, executives, and professionals by sharing valuable tax insights, joining industry conversations, and highlighting your achievements and speaking engagements.

Facebook is ideal for engaging with local business communities, offering clear and friendly advice, and building genuine relationships that can lead to referrals. Meanwhile, YouTube gives you the chance to explain complex tax topics through easy-to-follow videos and interactive Q&A sessions, helping you build lasting authority and trust. By choosing the right platforms that truly align with your audience, you create meaningful connections that grow your business organically.

Develop Professional, Educational Content

Through strategic legal copywriting, your social media content can reflect your legal expertise while remaining accessible and engaging to your audience.

Content Categories:

- Educational Posts: Simple explanations of complex tax concepts

- News Analysis: Your take on current tax law developments

- Practice Updates: Professional achievements, speaking engagements, and awards

- Client Success Stories: Appropriately anonymized case outcomes

- Behind-the-Scenes: Professional photos, team introductions, office culture

Engage Authentically with Your Network

Social media is so much more than just sharing updates—it’s about truly connecting with people. Take the time to join conversations that matter, share your honest thoughts on articles that resonate, and be there to cheer on your connections when they achieve something great. When you offer helpful advice or weigh in on trending topics, you’re not just adding noise—you’re building genuine relationships that can grow and last. It’s these meaningful interactions that turn your network into a real community.

Maintain Professional Standards

As a tax attorney, your social media presence is an extension of your professional practice. Maintain the same ethical standards online that you follow in your legal work.

Professional Guidelines:

- Avoid giving specific legal advice on social platforms

- Include appropriate disclaimers about attorney-client relationships

- Respect client confidentiality at all times

- Stay neutral on controversial political topics

- Maintain professional language and demeanor

Leverage Social Proof and Credibility

Showcase your credibility on social media by highlighting the moments that truly set you apart. Share your experiences speaking at key conferences, your insights featured in the media, and the trusted positions you hold in professional organizations.

Celebrate your awards and recognitions, and let your published articles and thought leadership pieces speak for your expertise. When you put these real achievements front and center, you naturally build trust and attract the right clients who appreciate genuine authority.

AI Social Media Tip: Leverage AI analytics tools to identify trending topics and optimal posting times across platforms. Use these insights to tailor your content strategy—then enhance AI-generated posts with your unique brand tone and visual style for maximum impact and authenticity.

Social media marketing for tax attorneys isn’t about going viral or accumulating followers — it’s about building professional relationships, demonstrating expertise, and staying visible when your network needs tax legal services.

Conclusion: Transform Your Tax Practice with Strategic Digital Marketing

While other tax attorneys are still waiting for referrals, the smart ones are using these eight strategies to build client-attracting machines that work around the clock. Digital marketing isn’t just about being online — it’s about being found when someone desperately needs your help at 2 AM after getting that scary IRS notice.

Start small, but start now. Pick one or two strategies that feel right for your practice and nail them before expanding. The attorneys winning today aren’t necessarily the smartest — they’re the ones who show up consistently where their clients are looking.

At Comrade Digital Marketing, we’ve watched hundreds of law firms transform from struggling to find clients to having more qualified leads than they can handle. We get the legal world, the compliance headaches, and what actually works. Ready to stop losing cases to competitors? Let’s talk.

Frequently Asked Questions

-

Should tax attorneys consider outsourcing their digital marketing efforts?

Tax attorneys should strongly consider outsourcing their digital marketing efforts to specialized agencies or freelancers. These professionals bring expertise in online visibility, SEO, and content marketing specific to legal services. This allows attorneys to focus on client work while ensuring their digital presence attracts and retains clients effectively.

-

How much should you spend on digital marketing annually?

Annual digital marketing budgets for tax attorneys can vary widely based on firm size and goals. Typically, smaller law firms might allocate $10,000-$20,000 annually, while larger firms could invest $50,000-$100,000 or more. This budget covers expenses like law firm website maintenance, SEO services, content creation, and digital advertising aimed at enhancing visibility and client acquisition.

-

How often should you review and adjust your digital marketing strategy?

Tax attorneys should review and adjust their digital marketing strategy at least quarterly. This frequency allows for timely adjustments based on performance metrics and market changes. By assessing metrics like website traffic, lead generation, and conversion rates every three months, attorneys can optimize their strategies for better ROI and adapt to evolving client needs and competitive landscapes.