How Our Law Firm SEO Process Delivers Real Results

At Comrade Digital Marketing, we’ve developed a comprehensive, results-driven SEO process specifically tailored for law firms. Our systematic approach ensures your practice gains the online visibility needed to attract high-quality clients in your practice areas.

Phase 1: Discovery & Strategic Analysis

We begin with an in-depth consultation to understand your firm’s unique position in the legal market. This crucial first phase involves examining your practice areas, target demographics, and competitive landscape. We analyze your current digital footprint, identifying strengths to build upon and gaps that need addressing.

Phase 2: Comprehensive SEO Audit

Our technical experts perform a detailed audit of your website’s current SEO health. This examination covers:

- Site architecture and crawlability issues

- Page load speeds and mobile responsiveness

- Content quality and keyword optimization

- Backlink profile strength and quality

We create a prioritized roadmap based on these findings, focusing first on issues that will deliver the quickest wins for your firm’s visibility. Every recommendation is backed by data and aligned with your business objectives.

Phase 3: Keyword Research & Mapping

Effective law firm SEO requires understanding exactly how potential clients search for legal services. Our keyword research goes beyond basic terms to uncover high-intent phrases that drive qualified leads.

We identify relevant keywords across multiple categories:

- Practice area-specific terms (e.g., “personal injury law firm,” “divorce attorney”)

- Location-based searches (“criminal defense lawyer Chicago”)

- Problem-focused queries (“what to do after a car accident”)

- Question-based searches (“how much does a DUI lawyer cost”)

Each keyword is mapped to specific pages on your site, ensuring comprehensive coverage without keyword cannibalization. We prioritize terms based on search volume, competition level, and conversion potential. This relentless approach puts us in league with the best SEO companies in the nation.

Phase 4: On-Page Optimization

With our keyword strategy in place, we optimize every element of your website for maximum search visibility. This includes crafting compelling title tags and meta descriptions that encourage clicks from search results. We optimize heading structures to improve readability and keyword relevance.

Our team enhances your content with strategic keyword placement while maintaining natural, engaging language that resonates with potential clients. We also implement schema markup specifically designed for law firms, helping search engines better understand your practice areas, locations, and attorney information. This is how you achieve SEO success.

Phase 5: Content Strategy & Creation

Quality content establishes your firm as an authority in your practice areas. Our SEO strategists develop a content calendar addressing common legal questions, recent law changes, and topics that demonstrate your expertise.

Our content team creates compelling, informative pieces that serve dual purposes – educating potential clients while improving your search rankings. Each piece is optimized for search while maintaining the professional tone expected from a law firm.

Phase 6: Technical SEO Implementation

Behind-the-scenes technical improvements often yield significant ranking improvements. Our developers implement:

- Schema markup for rich snippets in search results

- Site speed optimizations for better user experience

- Mobile-first design principles

- Secure HTTPS protocols

These technical enhancements ensure search engines can efficiently crawl, understand, and rank your content. We handle the complex technical details so you can focus on practicing law.

Phase 7: Authority Building & Link Development

Building your firm’s online authority requires earning high-quality backlinks from reputable sources. Our lawyer SEO experts develop relationships with legal directories, industry publications, and relevant websites to secure valuable links to your site.

Comrade’s ethical link-building approach focuses on creating genuine value through guest posts, legal guides, and professional profiles. We avoid risky tactics that could harm your firm’s reputation or search rankings.

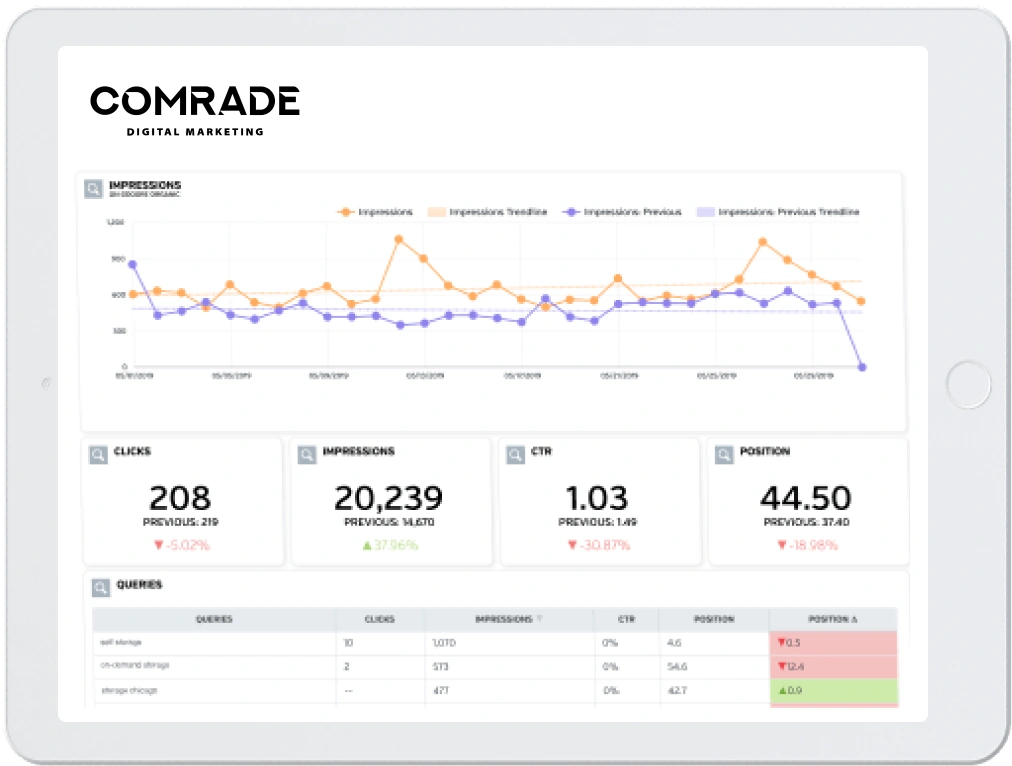

Phase 8: Monitoring & Continuous Optimization

SEO success requires ongoing attention and refinement. We continuously monitor your rankings, traffic patterns, and conversion metrics to identify new opportunities and address emerging challenges.

Monthly reporting keeps you informed of progress, with clear metrics showing:

- Ranking improvements for target keywords

- Organic traffic growth trends

- Lead generation increases

- ROI on your SEO investment

We adjust strategies based on performance data, algorithm updates, and changes in your competitive landscape. This iterative approach ensures your firm maintains and improves its search visibility over time. This is why we rank among the best SEO agencies out there.

How We Help Law Firms Win with Local SEO

At Comrade Digital Marketing, a Chicago-based agency, we help law firms dominate their local markets by optimizing for clients searching right in their community. Local SEO is one of the most powerful ways attorneys can connect with nearby prospects and generate consistent, high-quality leads.

Our law firm local SEO process includes:

- Optimizing Google Business Profile for maximum visibility

- Building and managing local citations across trusted directories

- Crafting location-specific content that attracts nearby clients

- Implementing review generation and reputation management strategies

- Strengthening local link-building opportunities

While local SEO is part of our broader law firm SEO strategy, we treat it as a specialized service because ranking in your own city or region requires its own unique approach. By doing so, we ensure your firm doesn’t just appear online, but stands out above local competitors.

With our proven local SEO campaigns, law firms gain more visibility in map results, improve local rankings, and most importantly, attract clients who are actively searching for legal help in their area.

What Makes Legal SEO Different from Regular SEO?

Legal SEO is different from regular SEO because law firms face stricter advertising regulations, higher competition in local markets, and require content that balances professionalism with accessibility. Unlike general SEO, the stakes are higher—potential clients are often in urgent situations, making trust and authority vital.

| Aspect | Regular SEO | Legal SEO |

|---|---|---|

| Competition | Broad across industries | Extremely high among local law firms |

| Regulations | Few industry-specific restrictions | Must comply with strict legal advertising guidelines |

| Content Strategy | General informative and sales-focused content | Authoritative, trust-building, and legally accurate |

| Keywords | Wide range, often product/service-oriented | Highly localized, practice-area specific |

| Conversion Goals | Purchases, sign-ups, brand awareness | Securing consultations and case evaluations |

| Reputation Factor | Helpful, but not always central | Critical — reviews, authority, and credibility drive more leads |

And because legal topics fall under Google’s Your Money or Your Life (YMYL) category, law firm websites must demonstrate exceptional trust, experience, and legal accuracy. This makes building E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) essential for ranking and conversion.

At Comrade, a Chicago-based digital marketing agency, we specialize in helping law firms dominate their local SEO landscape with tailored strategies that meet both legal standards and search engine expectations.

The Difference in Our SEO Methodology Across Legal Fields

SEO strategies for law firms can’t be one-size-fits-all. Different legal practices face unique challenges online — from how clients search for their services to the competitive landscape they operate in. That’s why Comrade Digital Marketing, a top SEO firm based in Chicago, adapts its methodology to each legal niche.

| Legal Field | Unique SEO Challenge | Our Tailored Approach |

|---|---|---|

| Personal Injury Law | Highly competitive search environment | Aggressive content strategy + local SEO dominance |

| Criminal Defense | Urgent, time-sensitive client searches | Emphasis on fast-loading mobile pages + local visibility |

| Family Law | Sensitive and emotionally driven search intent | Compassionate, trust-building content + reputation management |

| Corporate Law | Complex services with lower search volume | Thought-leadership content + LinkedIn visibility |

| Immigration Law | Multilingual audiences and varied demographics | Multilingual SEO + geo-targeted campaigns |

Each legal field demands precision, not just in keywords, but in tone, messaging, and technical optimization.

By aligning SEO strategy with the nuances of your practice and with top-tier web design, Comrade ensures law firms connect with the right clients at the right time.

Conclusion

When it comes to ranking law firm websites, success depends on a strategic, ongoing SEO effort that aligns with how clients search and how Google evaluates authority. From local visibility to content marketing and technical optimization, the path to more qualified leads is paved with smart, ethical SEO practices designed specifically for legal professionals.

Comrade Digital Marketing has helped law firms across the country grow their caseloads with tailored strategies and marketing services rooted in data and deep industry knowledge. Based in Chicago, our team understands the competitive nature of legal marketing — and we’re ready to help your firm stand out where it matters most: in search results.