Case Study: How Law Firm Digital Marketing Solutions Can Increase Leads by Nearly 200%

Many of our current and prospective clients ask how we deliver results for our clients. The best way to answer this very fair question is to provide a real-life example of our work in the form of case studies. It’s the best way to outline all that goes into a given marketing and/or web development project and show how that work directly impacts traffic, qualified leads, conversions, and of course, revenue. No matter what form of marketing avenue you’re considering for your business; no matter what type of agency you’re looking to hire, be sure to ask for case studies.

In this case study, we’ll outline how Comrade Digital Marketing, being a leading legal marketing agency, helped a law firm in San Francisco Bay Area overcome stiff competition in a localized online search. We’ll examine the problems the company experienced advertising online, many of which are precisely the same problems experienced by other smaller companies across the country, and how our full-service marketing agency helped to overcome them.

We’ll also explore everything Comrade Digital Marketing does differently, and how we set ourselves apart from other attorney internet marketing agencies.

What You Can Learn Here

- Website design methods that improve conversations for the legal industry.

- Effective long-term digital marketing strategies, and how they work.

- Law firm SEO tactics.

- Best pay-per-click (PPC) marketing methods.

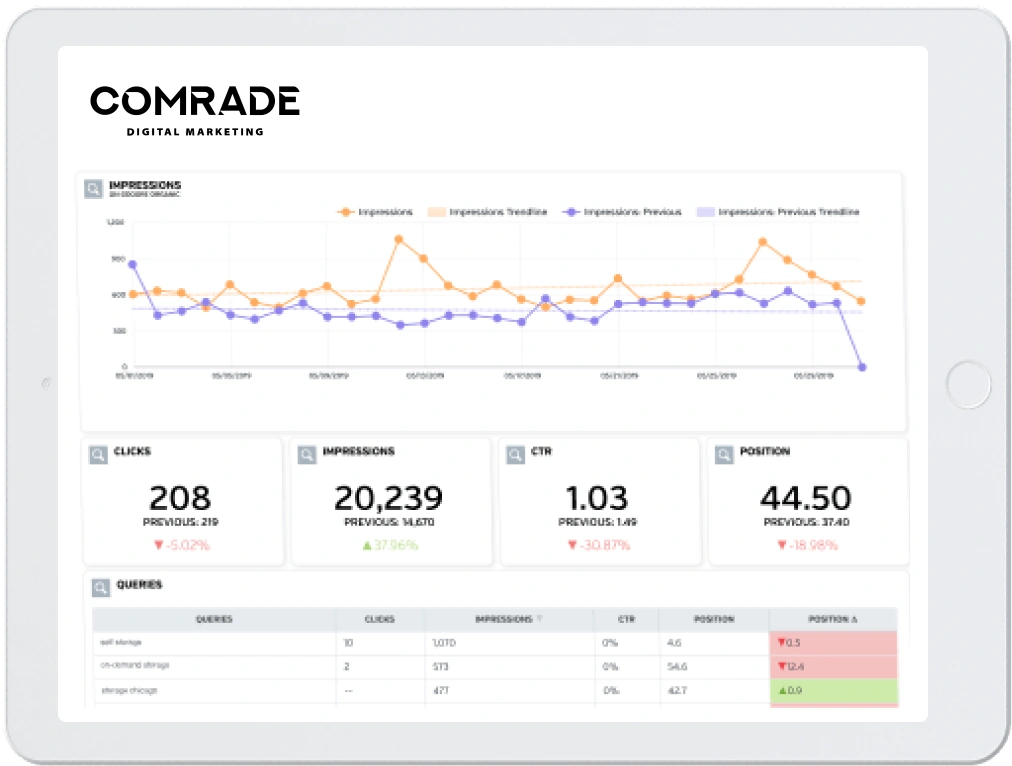

- Analytics and how to read them.

Digital Marketing Challenges for Lawyers

However, before we delve into the case study, we would like to address some of the challenges lawyers commonly encounter when initiating a digital marketing campaign on their own or when collaborating with legal marketing experts or a law firm marketing services agency for the first time.

1. Not Tracking or Understanding Law Firm Marketing Goals and Numbers

Having step-by-step short and long-term marketing plans is crucial for lawyers because your digital marketing won’t be productive without a clear direction. Moreover, with the assistance of lawyer marketing services, you should be able to obtain and evaluate monthly ROI, LTV, CPC (clicks), CAC (client acquisition cost), and website traffic data, as these metrics are key to the successful development of your digital marketing campaign.

2. Lawyer Websites Look Good but Are Not Converting Clients

We all know how important it is to have a website. It’s even more important to have a good-looking and fast website. But it’s most important to have a website that can convert your visitors into leads and clients. A lot of good law firms struggle with that part. Engaging a proficient digital marketing agency for law firms can make all the difference. With expert assistance, your website can not only be visually appealing and responsive but also optimized to effectively transform visitors into potential leads and, ultimately, loyal clients. This is where the right digital marketing agency’s expertise proves invaluable, helping law firms overcome these challenges and achieve their conversion goals. Content marketing plays a crucial role in engaging visitors and driving conversions.

3. Not Doing Lawyer SEO Properly

Finding a good SEO consultant for effective search engine optimization is tough. Really tough. Many consultants just can’t do basic things, like quality backlinking, keyword research, and producing high-quality content. Most likely, they will just overwhelm you with data without explanation in order to hide that no real progress has been made in the first 3 or 4 months.

4. Wasting Money on Attorney PPC

Clicks are expensive. We know it, you know, everyone knows it. But a lot of attorneys still try to get a lot of expensive keywords that don’t really convert into leads for them. In a rush to gain more clients, you will miss cheaper keywords that, when used properly, could achieve greater results for your firm.

5. Not Keeping Up With Social Media for Law Firms

Social Media Marketing for lawyers may seem like a waste of time. But if a law firm were to at least keep accounts updated, cross-post their content, give some advice and try to interact with other users, they would build confidence in your prospective clients and attract more people to seek legal help from them instead of their competitors.

About the Law Firm

Our client is a Northern California legal practice that manages estate planning, trust litigation, securities arbitration, and litigation, and oversees elder abuse and neglect cases, will contests, and all other probate matters.

Despite 20 years of experience, the firm faced competition from other practices and required a professional online presence that helped maintain a consistent flow of new customers looking for assistance with probate matters.

The law firm started with an average lifetime value for each client of $5,000, which rose to $30,000 within six months of implementing our new strategy.

Before Our Digital Marketing Plan

Before Comrade took control of the client’s online presence, there were various problems with the content on the website and its original digital marketing strategy.

Poor Law Firm Website

The law firm’s digital footprint went back to 2002 when it launched its very first website. Visually, it was very dated and did not take advantage of modern website features and functionality.

They paid a lot of money for the website, and it was re-designed several times, but in the end, got very few pages with an unprofessional, clunky design and a bad user experience with digital marketing strategy and their SEO efforts left much to be desired.

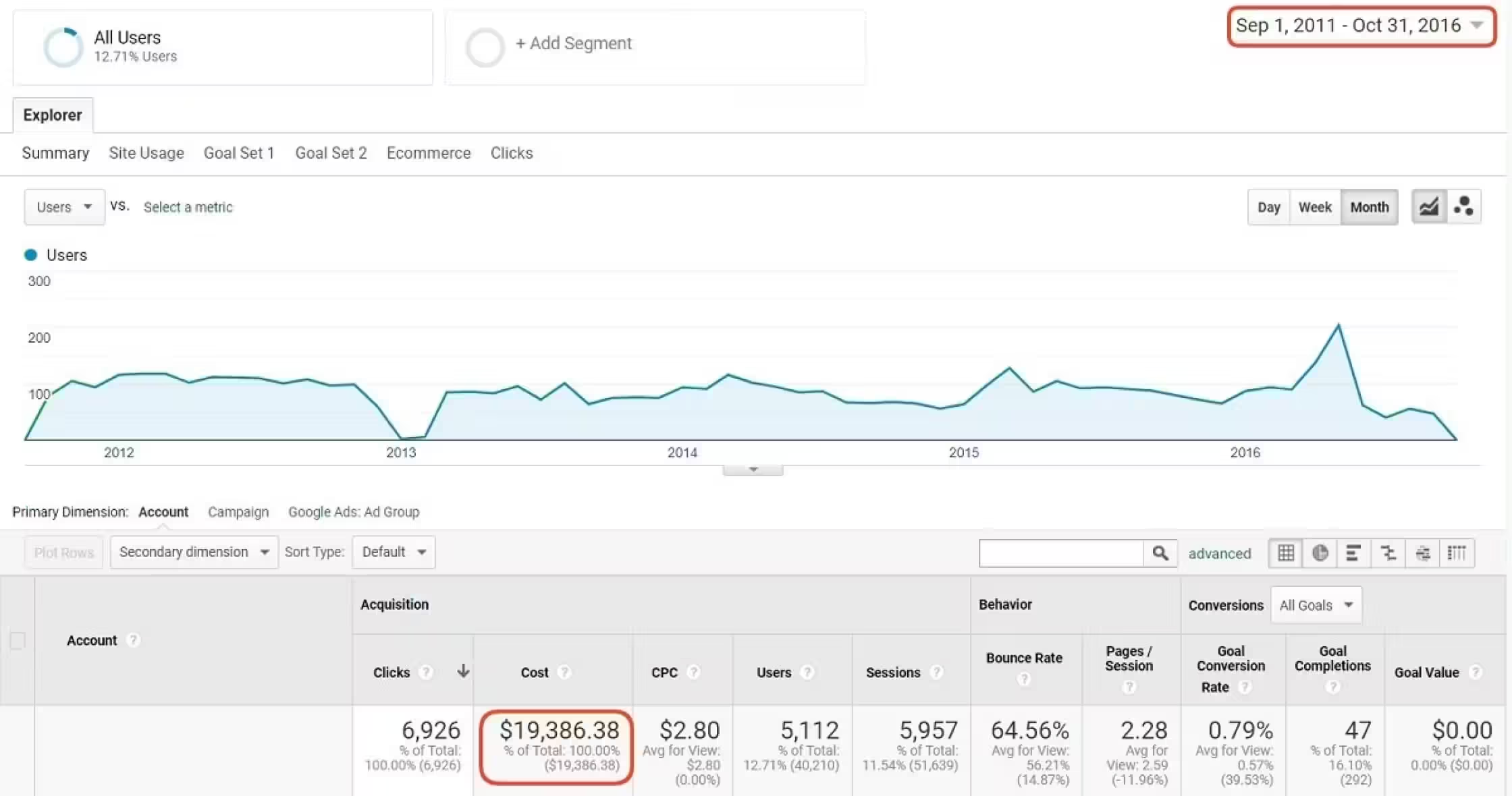

Wasting Money on Lawyer PPC Ads

Our client-first company launched a paid advertising campaign back in September 2011. Before we engaged with the client, they had spent more than $19,386 on PPC advertising, with 292 conversions. That offered a Cost Per Lead of $66, with most new leads being estate planning cases with low LTV. That was a fairly average rate in California for that kind of service.

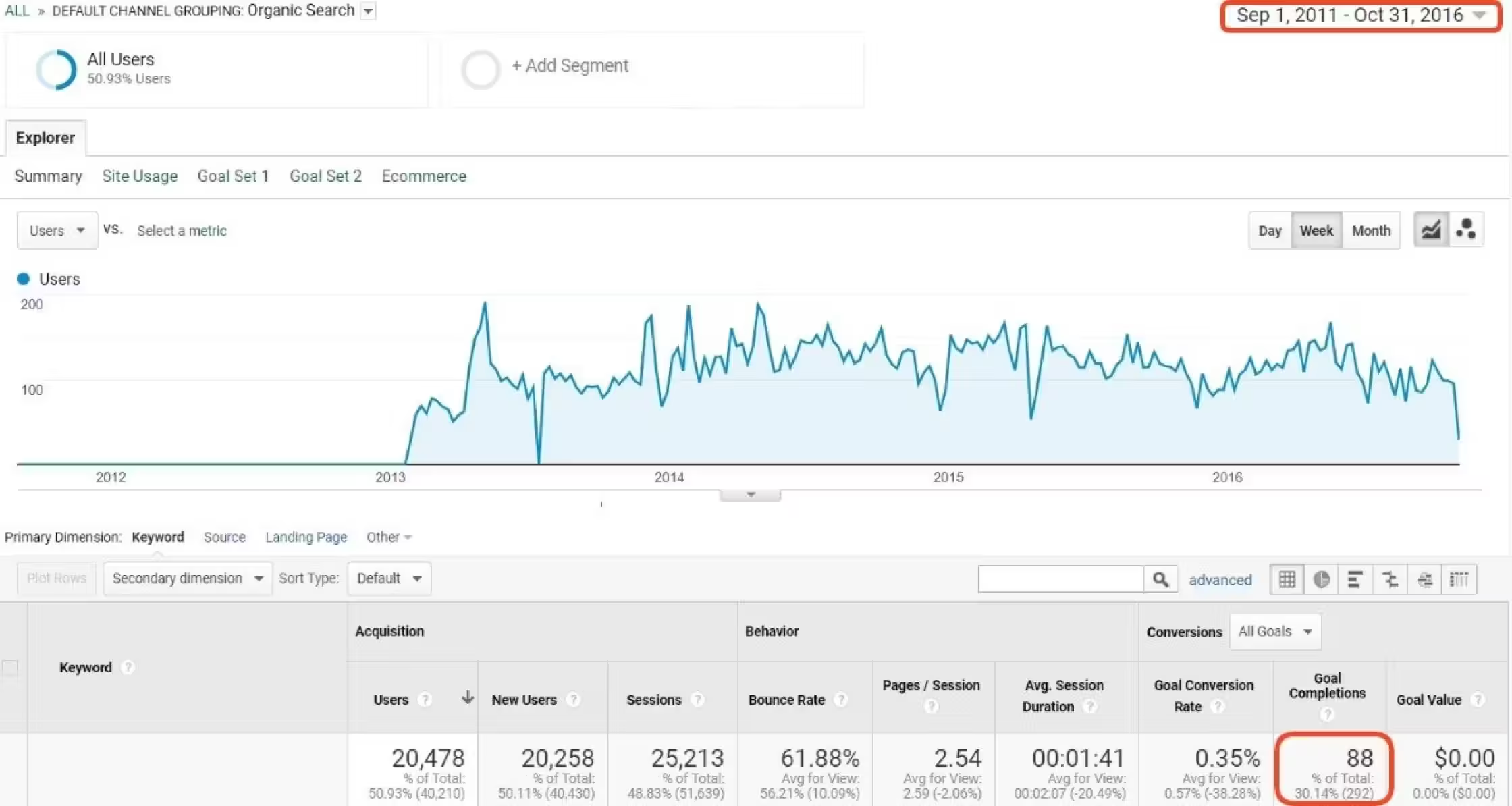

Ineffective Law Firm SEO Strategy

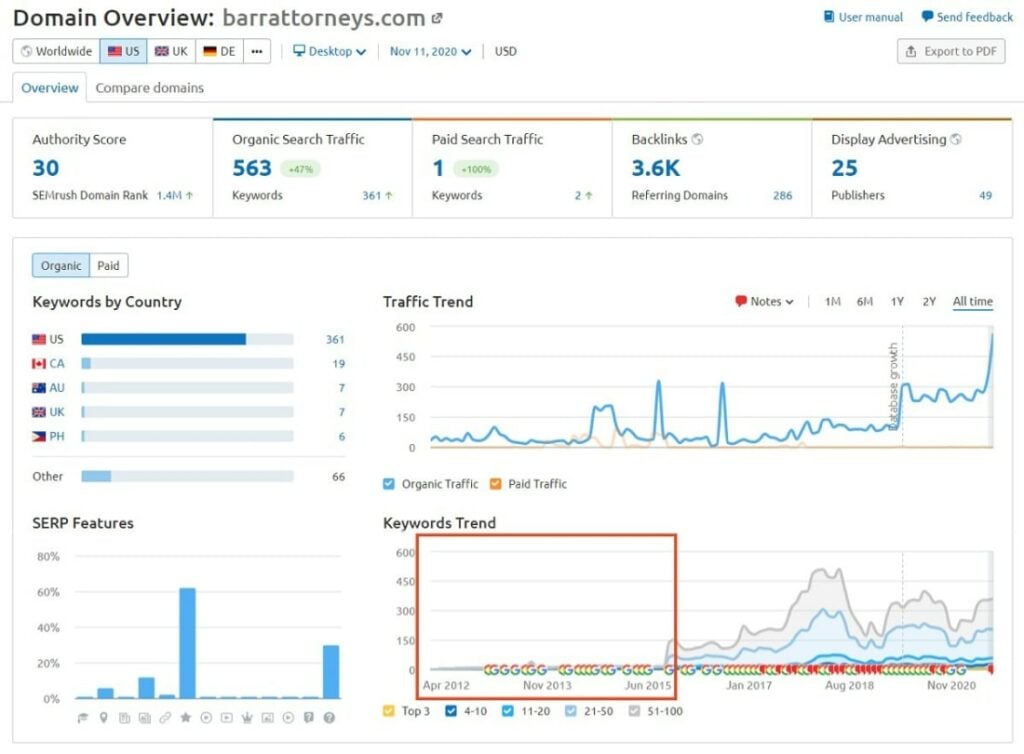

For over five years, our client invested large sums of money into a law firm’s SEO marketing strategy. As you can see below, our client saw only 88 leads from Organic Search results over that time.

What’s more, we can see there was a very low number of keywords and top local ranking results on Google, meaning the efforts they paid large sums for didn’t work out. The client, despite offering a fantastic local service, was losing out to other companies because of flawed digital marketing efforts. Appearing at the top of search engine results pages is crucial to increase online visibility and attract more clients.

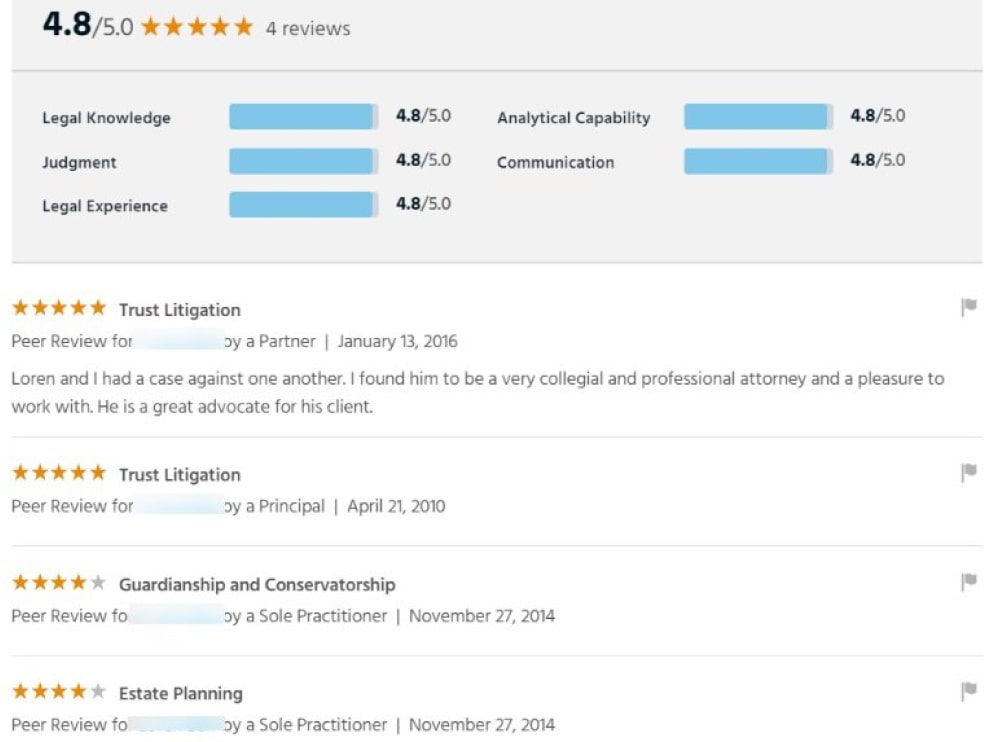

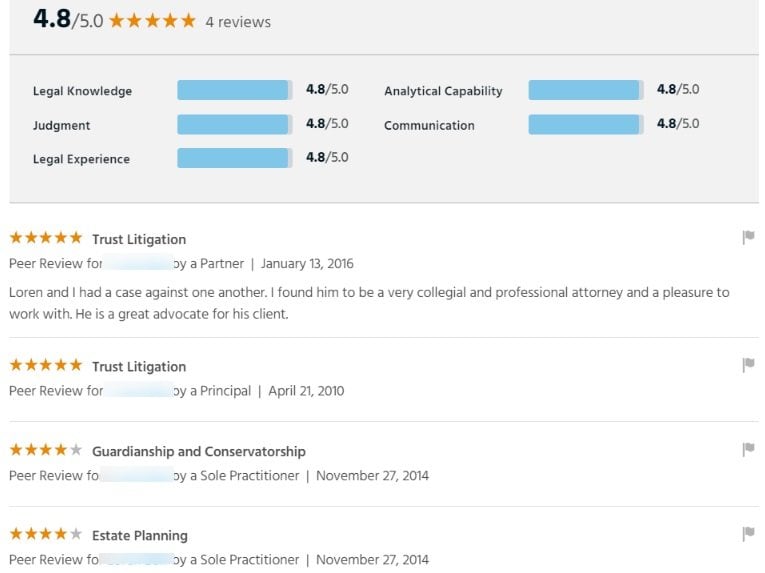

No Online Lawyer Reputation Management

The client had a great reputation throughout the community, with new customers often referred via word of mouth. But at the same time, they had virtually no online reputation at all. While listed in some popular law directories, there were no public reviews or testimonials from satisfied clients at all.

Attorney Content Issues

Our clients had virtually no content or resources for potential clients, other than a small blog. Potential customers had very little reason to visit the website, other than finding out the key services the law firm offered and finding their contact details.

An All-Round Ineffective Digital Marketing Strategy for Law Firms

By the end of a five-year engagement with another legal SEO company, our client was enjoying a few decent online leads per month. However, they were still not fulfilling their potential and their website needed a lot of work to begin attracting new customers who were actively searching for a reliable firm.

Law Firm Marketing Challenges

Before embarking on this project, we identified a number of challenges that would take some time and effort to overcome. These were:

- Our client had limited time to produce website content and multimedia that would engage and attract readers and potential customers.

- Our client required all content to be approved first, meaning we could not write any copy for the website on our own.

- We were asked to show SEO results and leads within the first six months, to demonstrate we had fundamentally improved their digital marketing strategy over previous efforts.

Law Firm Marketing Solutions

We worked to overcome these three challenges with a team of dedicated specialists who knew all the latest effective SEO for lawyers and PPC marketing methods.

New and Improved Law Firm Marketing Strategy

We agreed on a 12-month internet legal marketing plan with a KPI table and set about reviewing their competition.

After much deliberation, and discussion with our client, we agreed on a plan that focused on the following:

- As a legal marketing company, we designed a new, fast-loading functional website with modern graphics to significantly improve their branding, conversion rate, and SEO through better and improved UX.

- Performing a keyword-specific onsite SEO campaign that directed searchers straight to the client’s website.

- Through improved content, we would attract high-quality backlinks from trusted sources, ensuring Google (and prospective clients) knew other high-profile sources trusted/recommended their website.

- Building on and improving their PPC campaign without increasing their budget.

New High-Quality Law Firm Website

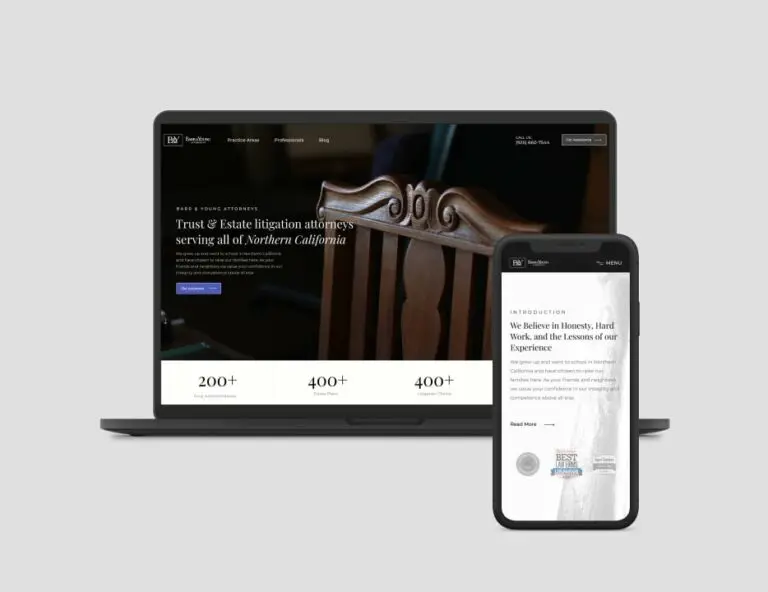

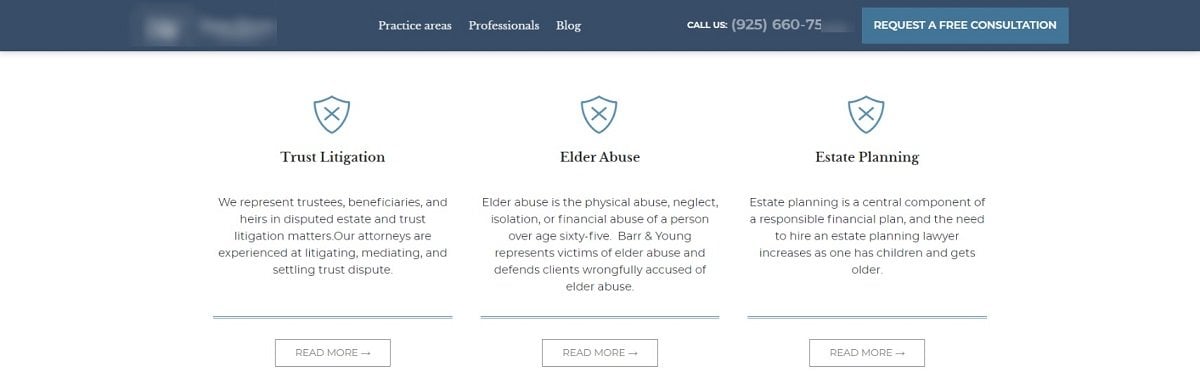

A new website was our first port of call. We knew that the client needed a new, user-oriented website with modern graphics and a professional feel. The year previous, they had a fresh redesign, but our legal SEO agency came up with a new version of the site that fine-tuned the new features and ensured prospective clients had a reason to browse or even return to the site. Legal marketing companies play a crucial role in improving website design and functionality, ensuring it meets the unique needs of law firms.

With a fresh look and new features, the user-focused design attracted thousands of new visitors very quickly. We built the website using WordPress, which is a versatile platform that allows users to easily add new content, blog posts, and pages once the website is built.

Here are just a few of the things we implemented on the new website:

- Buyer Personas Research, an Online Marketing-Oriented Buyer’s Journey and Content Architecture Integration

We analyzed the buyer personas of the law firm’s clients and found that focusing on trust litigation services with a higher LTV would be more beneficial than estate planning.

- Professional Design and UX

The more user-friendly a website is, the more likely it is that visitors will stick around, engage with the content, and learn.

Fast-loading websites also rank higher in search results, making this a two-pronged approach.

Our designers created an authentic wireframe that was implemented by our dev team, ultimately making a website that felt fluid and interactive.

- Calls-to-Action

A good call to action (CTA) turns visitors into qualified leads. With clear call-to-action buttons throughout the site, users are directed to the quickest and easiest ways to make a transaction or contact the company directly.

We, therefore, implemented a CTA button that directed people to seek free consultations with the firm, meaning more potential leads came their way.

- Badges from Directories

It’s important that visitors and prospective clients see that a company is listed in popular legal-specific directories, and is recognized in the form of awards, badges, and reviews.

We, therefore, submitted our client’s account in more than 50 online directors, including FindLaw and Avvo, and established a better online presence for this popular northern Californian law firm.

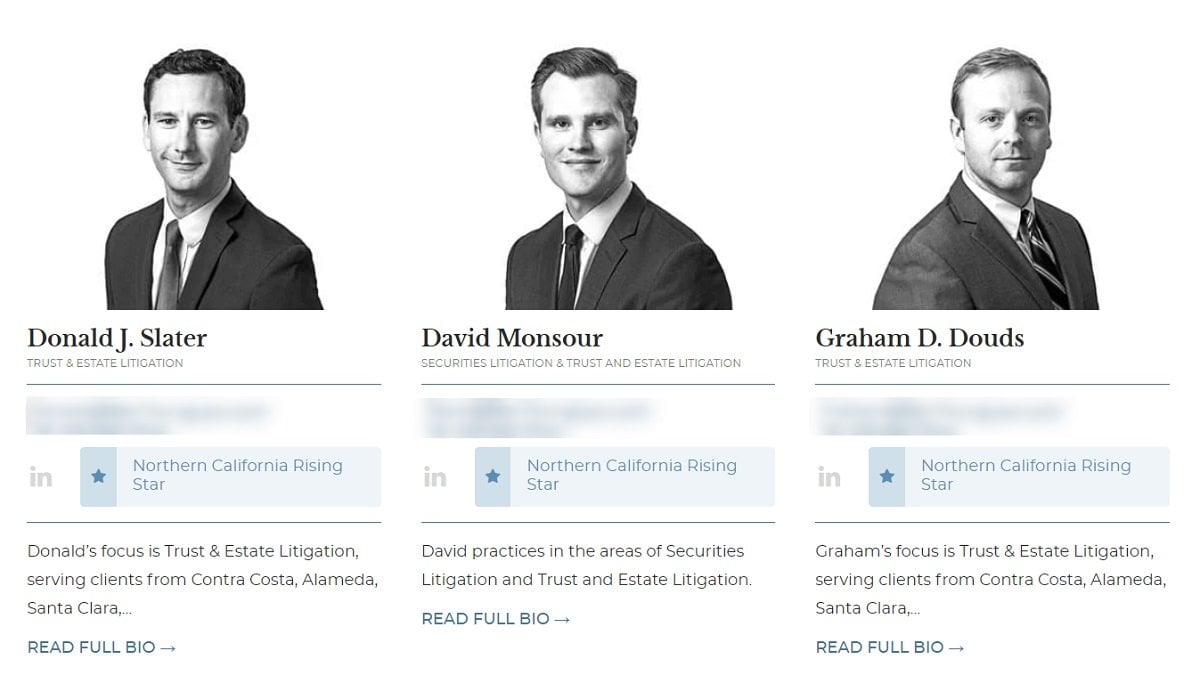

- Attorney Pictures, Quotes, and Bios

People like to see who they’re working with and connect better with other people over brands. That’s why we thought it important to include detailed biographies of the attorneys working at the client’s firm.

We also demonstrated the specific field that every attorney specializes in, giving prospective clients an idea of who they might work with if they brought their case to the client.

By introducing these biographies, we created a personal connection between attorneys and prospective clients, giving people the confidence to click a CTA button.

- Services and FAQs

We expanded on the details of each practice area, laying out precisely what services our client offered, and their expertise in each field. We also provided answers to the most popular questions that our clients received from their prospective clients, allowing us to minimize the time they spend answering questions over the phone or via email.

By answering frequently asked questions, our client increased the chances of every phone call or email becoming a paying client.

Introducing these service and FAQ pages were also fantastic search engine marketing solutions for law firms boost, helping them to rise in search results for every legal service they offer.

- Why Choose Us Section

We think businesses should do everything they can to gain the trust of prospective clients, right from the moment they access a company website. The best way to do that is to demonstrate why other businesses trust them already, and the services they offer that make them the best option.

We used our client’s website to give clear explanations for why they trump their competitors and boasted a few reasons why clients should choose them over other law firms. It’s a simple yet extremely effective method of encouraging prospective clients to get in touch.

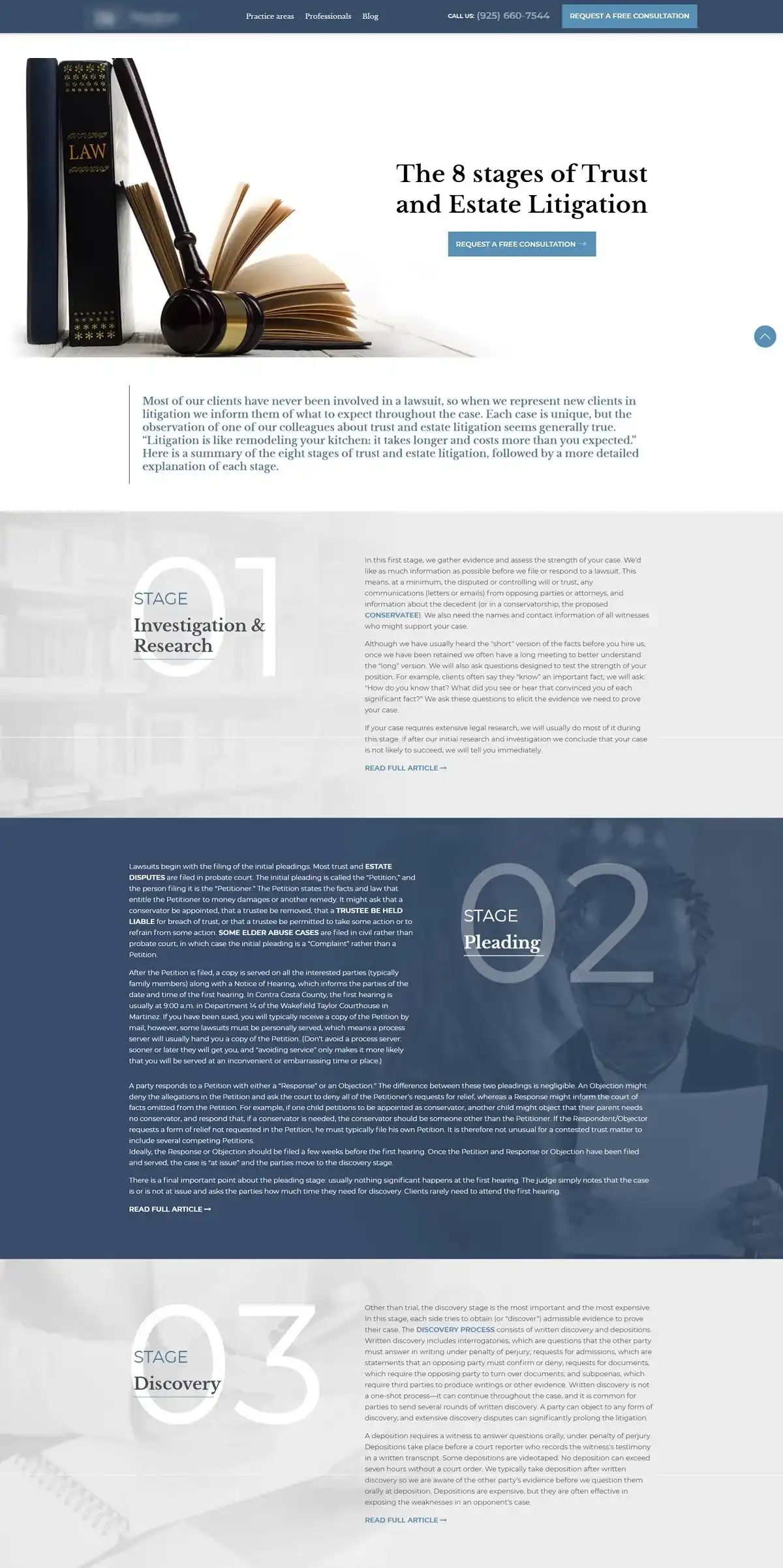

- Professional Blog

We built on our client’s professional blog, producing long-form blogs that contained genuinely useful information. These blogs gave people a reason to stick around on the website, continue browsing other posts, and even come back in the future.

Every blog post was designed to promote certain keywords, too. By carefully maintaining this balance, we produced regular content that kept our client high up in the search engines rankings, while ensuring people kept coming back to the site or spent more time browsing once finding the site.

New Attorney PPC Campaign

With pay-per-click advertising, we split our approach into three. We tackled optimized keywords, specific campaigns, and ad optimization.

- Optimized Keywords and Bidding Strategy

Starting with keywords, we analyzed our client’s current target keywords and then created a large list of long-tail keywords. We then divided the long-tail keywords into groups, allowing us to focus specific pages on certain keywords.

This helped with competition but also ensured that individual pages were targeted towards specific search queries.

- Integrated Separate Campaigns for Different Locations and Services

With a better grip on keywords, we found that certain locations and services produced better performance. We directed more financial resources towards those pages and services, building on the demand for specific legal services in certain parts of California.

- Optimized Ad Extensions, Negative Keywords, and Re-marketing Campaigns

When it came to optimizing advertisements, we found that remarketing was our most effective method.

Despite most legal problems requiring urgent service, we discovered that most prospective clients are still not ready to commit to contacting a lawyer immediately. Remarketing solved that problem.

Improving the Law Firm’s Digital Marketing Strategy

Long-Form Blogs Helped Site a Lot

Our decision to introduce long-form blogs really worked. Each blog post covered industry-related topics, using keywords with the highest search volume.

It was a two-pronged approach that prospective customers loved, and dramatically improved traffic to the website.

SEO Content with Keywords Still Matters

SEO content was key to increasing search engine rankings and traffic. Partnering with a legal marketing company, we researched and implemented keywords that prospective clients were searching into all service-specific landing pages and tags.

We performed cross-linking and other proven SEO tactics, establishing our client’s website as a trusted source for information and industry-related news, moving it up the Google search rankings, and creating an online presence as good as their reputation in the local community.

Off-page SEO Is Important Too

As well as improving the content on our client’s site, we attracted backlinks from other popular industry-specific guest blogs. We wrote our own guest blogs for other popular law-focused platforms and also implemented backlinks on more than 50 popular legal directories.

This firmly established our client’s website as a trusted source.

Reputation Management is Crucial for Lawyers

We updated our client’s profile on popular legal directors and reached out to existing clients to get new, positive reviews to publish on various online platforms.

Legal Marketing Results After Two Years:

After two years, we saw fantastic results for our client. Their new website delivered increased traffic, improved sales, and allowed their business to grow.

- Since the engagement, our client’s staff grew more than 200% thanks to increased case volume and revenue.

- Overall ROI increased.

- The lifetime value of each client increased by 500%, thanks to a new focus on litigation cases.

- A 95% increase in total leads after just one year.

- A 188% increase in qualified leads from SEO after only two years.

- Overall Cost Per Lead: $66 (with the lifetime value of a client: $5K) when we began our work.

- $33 (with the lifetime value of a client: $30K) after two years of our digital marketing services.

Let’s Talk Specific Law Firm Marketing Results

During the first year, we built a new SEO base and acquired new referring domains. We also optimized keywords, performed link building, and created a solid base on which we could build with new content in the following year.

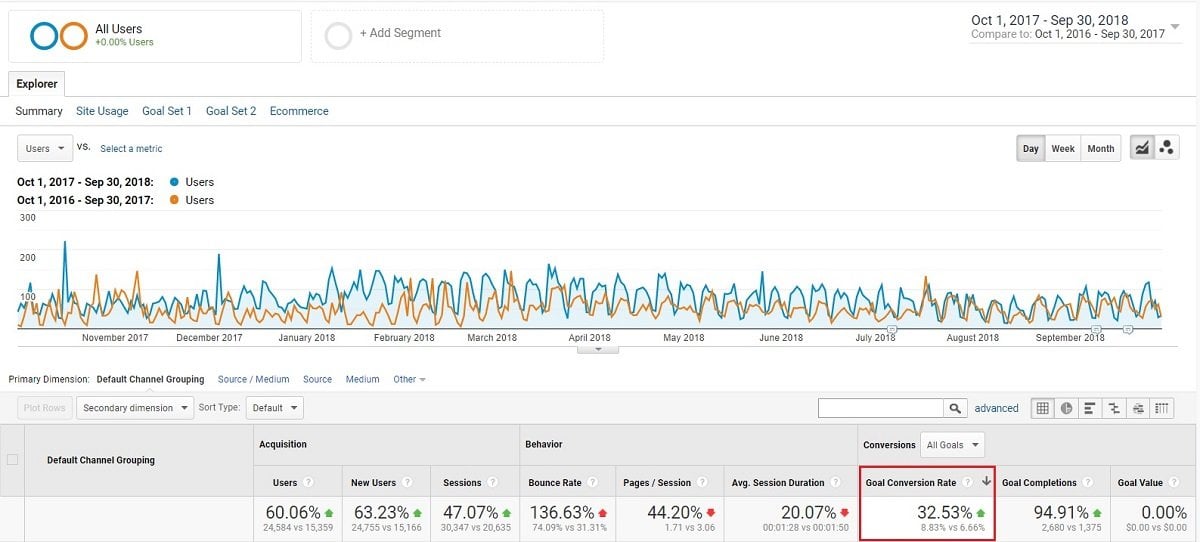

During the second year, we gained considerable traffic and a large increase in conversions.

Law Firm’s Website Started Generating More Leads

The new website looked professional, was easy to use, and answered all likely questions from potential clients. It provided information about key services and biographies of attorneys at the law firm. It performed much better than the previous website, with a conversion rate of 6.66% in the first year, and 8.66% in the second year.

That’s one of the best conversion rates in the industry and meant that out of every 12 visits, there was one lead.

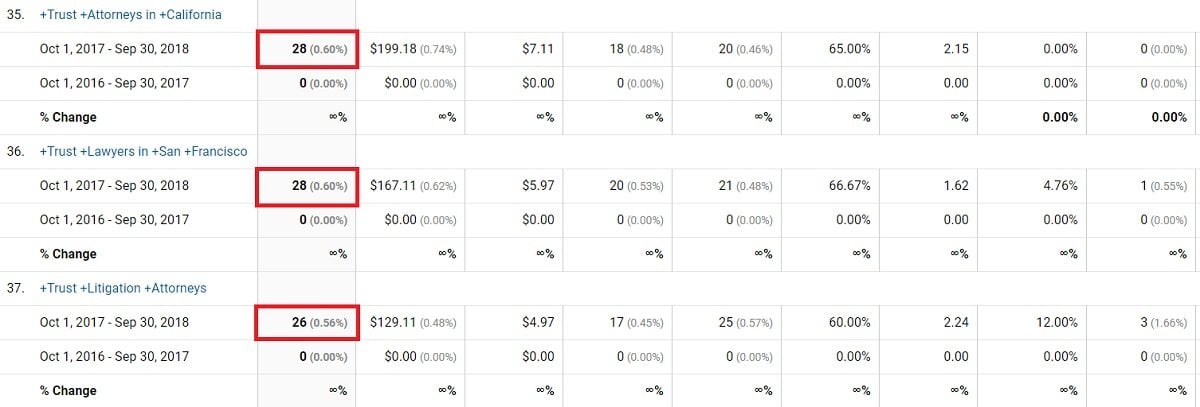

Digital Advertising Lifetime Value Grew

We increased the lifetime value of clients through PPC by 500% by targeting potential clients seeking trust litigation assistance.

In the snapshot below, you can see the increase in “trust litigation” clicks, which led to an increase in the LTV of clients compared to the old approach of targeting estate planning clients.

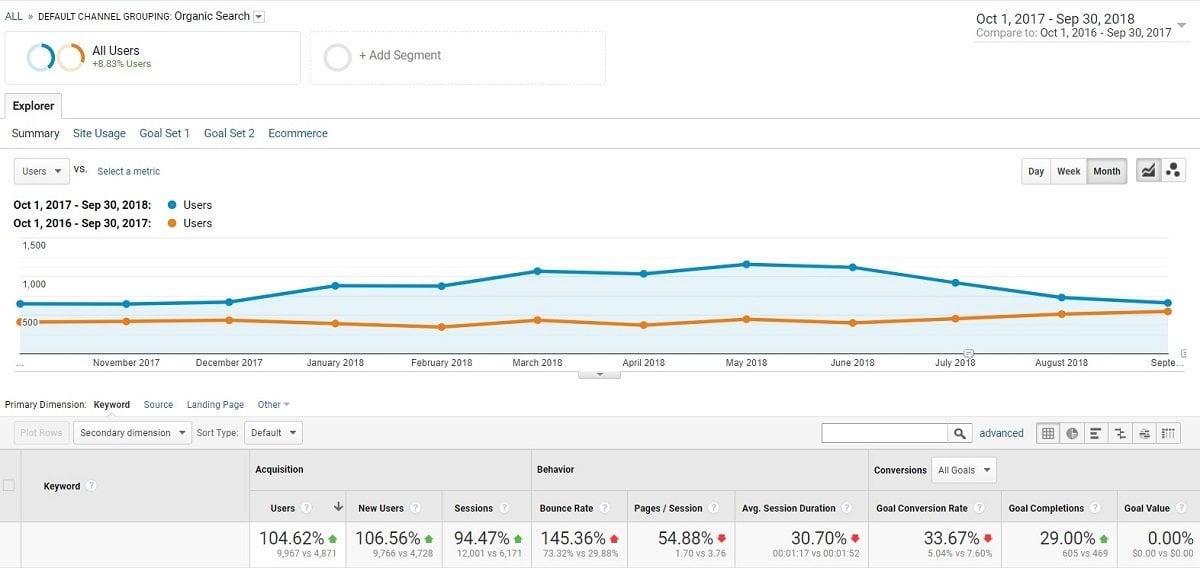

Organic Search Improvements

Our SEO experts managed to achieve remarkable results in terms of organic search. During the first year with our client, we saw exactly what any attorney digital marketing service would expect, which was a relatively stable amount of traffic that didn’t dramatically increase. This is common in SEO, as it takes time for even the most effective SEO strategies to work.

What we did see, however, is that traffic grew pretty substantially as more time passed. In the first year, we attracted 4,871 users. The next year, that more than doubled to 9,967. That’s a 104.62% increase in traffic. And, thanks to the implementation of CTA buttons and various measures to increase trust with visitors, that also meant a large increase in leads.

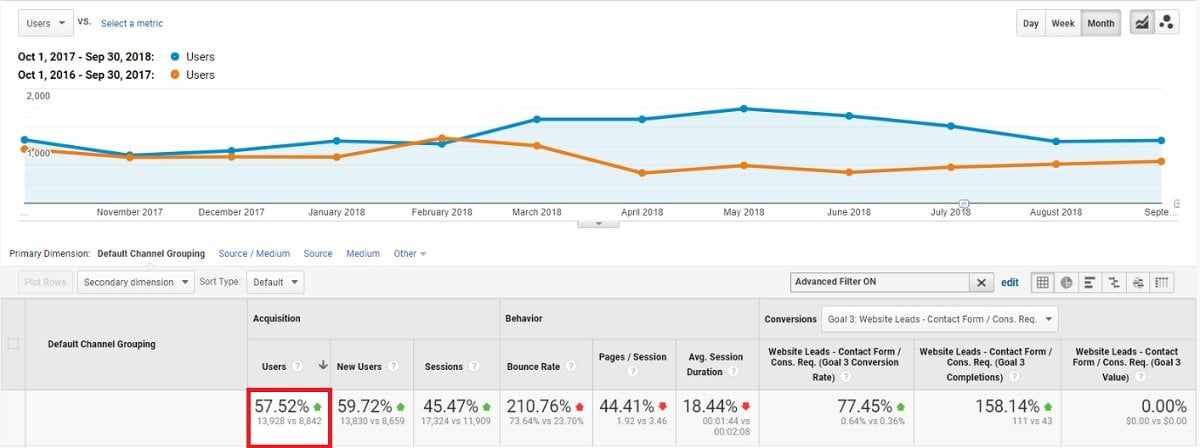

- Oct 1, 2017 – Sep 30, 2018, vs Previous Year

Organic + Direct Traffic Growth

We saw a similar trend when combining organic and direct traffic, with 13,928 total users, compared to 8,842. It was another substantial increase of 57.52%.

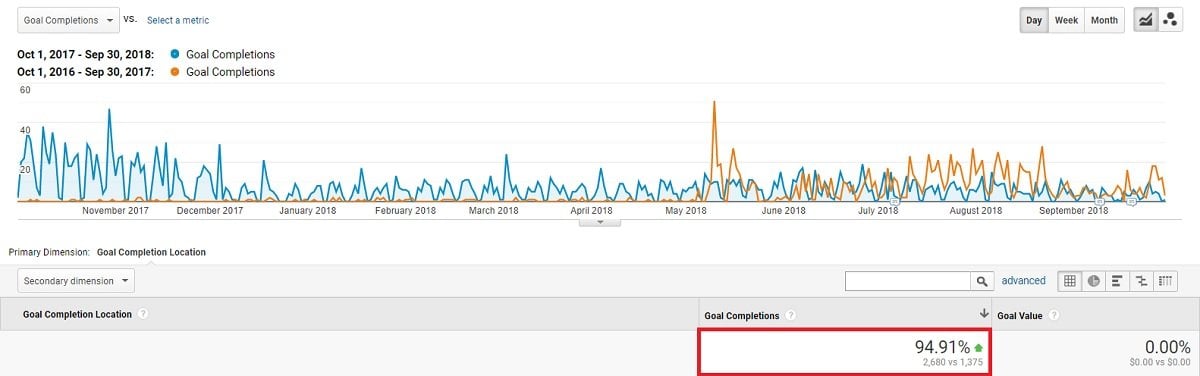

Overall Leads Growth

Overall leads grew by 95% in the first year alone, dramatically increasing the law firm’s client base.

Overall Cost Per Lead Went Down

The overall cost per lead declined from $66 with a lifetime value of $5k for clients when beginning our work, down to $33 with a lifetime value of $30k per client after two years of our services.

We slashed the cost of finding new clients in half, while also increasing the value of new clients.

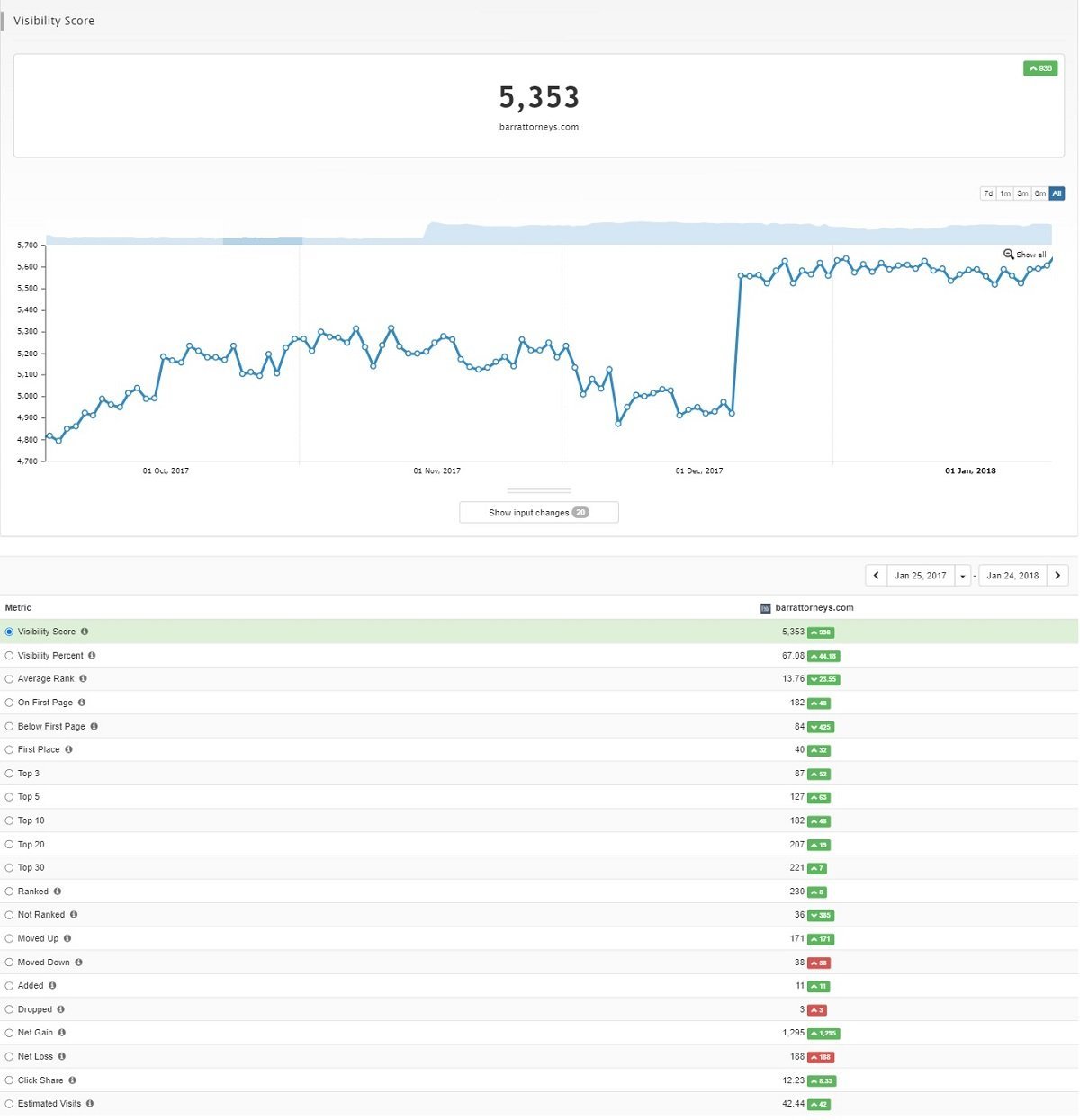

Visibility Score and Keyword Rankings Improved

- Jan 25, 2017 – Jan 24, 2018

As you can see in the above snapshot, the improved visibility score for our client’s website significantly, changing their long-term downward trajectory to an increasing one. Through all our measures, ranging from SEO to improving the content on their website, we were able to direct more people to this site and maintain a pattern of increasing and steady traffic and rising in the search engines rankings.

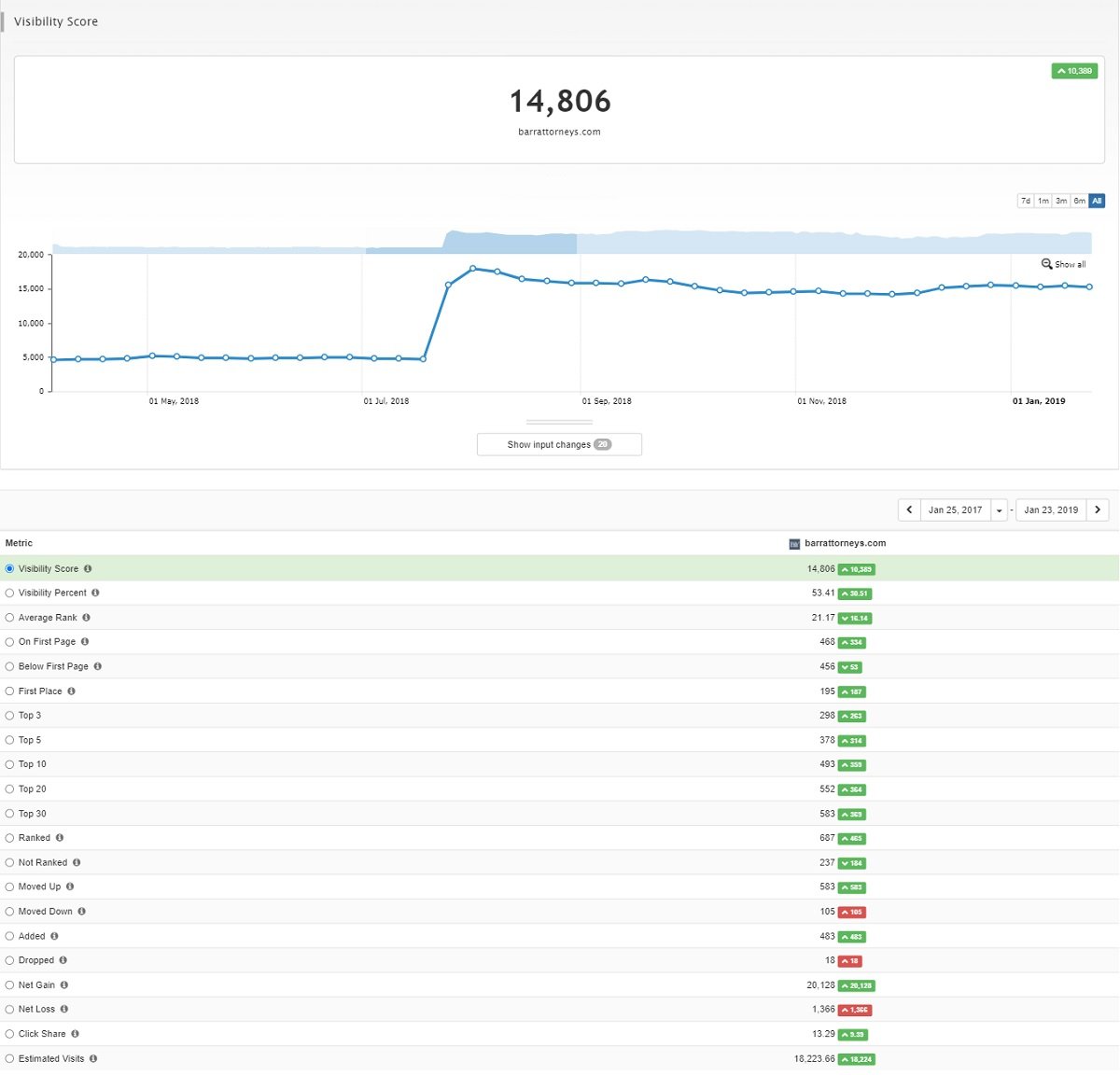

- Jan 25, 2017 – Jan 24, 2019

Successful Link Building Campaign via Backlinks and Referring Domains

Our backlinks strategy worked well, with referring domains roughly tripling towards the end of 2020.

A Law Firm Success Story

By all metrics, the fortunes of our client improved and their website ranked higher.

Through a combination of SEO marketing strategies, improved visuals and functionality of their website, and our work ensuring blog posts were informative and approved by our client, we transformed this Northern California law firm’s prospects.

Building from a positive local reputation and years of experience and establishing the same kind of reputation online increased our client’s revenue, allowed them to hire new staff, and expand.

We have fine-tuned our strategies as a law firm SEO agency and can implement these same strategies to change the direction of all varieties of businesses.