Do you have ads running on TV or the radio? Maybe a billboard? Reaching clients in this field requires more than traditional advertising tactics. In a highly digital world where potential clients can find insurance lawyers at the touch of a button, a comprehensive online presence is a must. From claims disputes to liability issues, potential clients are searching online for legal experts who understand the complexities of insurance law, and it’s time to present your firm as their top choice.

Targeted digital marketing can help insurance lawyers showcase their expertise, attract ideal clients, and build a strong online reputation. This approach isn’t just about online visibility. With the right approach, search engine optimization will help you connect with clients in moments of need and build trust through tailored content, engaging social media, and more. This is your firm’s opportunity to turn online interest into lasting client relationships, improving your reputation and your revenue.

Why Digital Marketing Is Important for Insurance Lawyers

With all your clients scrolling daily on their phones or tablets, investing in a digital marketing strategy to target them where they are is a no-brainer. By harnessing the power of online strategies, your law firm can connect with potential clients more effectively. Understanding the importance of digital marketing can transform how insurance lawyers promote their services and engage with their audience, ultimately leading to greater success and client satisfaction. The benefits include:

Increased Visibility: Digital marketing enhances online presence, making it easier for potential clients to find insurance lawyers through search engines and social media.

Targeted Audience Reach: Digital channels allow insurance lawyers to target specific demographics, ensuring their services reach individuals most likely to need them.

Cost-Effective Marketing: Compared to traditional marketing methods, digital marketing is often more affordable, allowing firms to maximize their budgets.

Enhanced Client Engagement: Online platforms facilitate direct communication with potential clients, fostering relationships through timely responses and valuable content.

Analytics and Insights: Digital marketing provides measurable data, enabling insurance lawyers to assess campaign effectiveness and adjust strategies accordingly.

Building Trust and Credibility: A strong online presence, including client testimonials and informative content, helps establish trust with prospective clients, increasing conversion rates.

By increasing visibility, targeting specific audiences, and fostering client relationships, insurance lawyers can drive growth and enhance their reputation with digital marketing. In an increasingly digital-focused world, the legal industry must adapt, too, tapping into online tactics to build a successful, long-lasting practice.

Comrade Digital Marketing Agency can help you with the above if you’re unsure how to go about it. Schedule a free consultation.

What Budget I Should Allocate for Digital Marketing as an Insurance Lawyer

For insurance lawyers, an effective digital marketing budget often ranges between $2,000 to $10,000 per month, depending on firm size and goals. Smaller practices may start with around $2,000 to $5,000 monthly, which can cover essentials like SEO, basic PPC advertising, and social media management. This approach builds brand awareness and targets specific leads within a local market.

Larger firms or those aiming to expand into broader regions should consider allocating between $7,000 to $10,000 monthly. This investment can support advanced strategies, including highly targeted PPC campaigns, comprehensive content marketing, and frequent social media engagement.

Additionally, consider setting aside a portion (around 10-20%) for testing new campaigns, allowing for refinement based on performance data. Allocating a budget in this range ensures that your digital marketing efforts reach and convert high-value clients effectively.

6 Essential Digital Marketing Tactics for Insurance Lawyers

As an insurance lawyer, navigating the complexities of online marketing can be challenging. However, implementing the right strategies can help you connect with potential clients and build a strong online presence. To get you started on the right track, our experts are diving into six essential Internet marketing tactics designed to help insurance lawyers succeed in a competitive market. Keep reading to unlock the potential of these tactics and take your practice to the next level!

1. Search Engine Optimization (SEO) for Insurance Law Websites

SEO is a fundamental strategy for insurance lawyers looking to improve online visibility and attract potential clients. By optimizing your website for search engines, you increase the chances of appearing in search results when users search for terms like “insurance claim lawyer” or “bad faith insurance attorney.”

Start improving your SEO by conducting thorough keyword research to identify high-traffic keywords specific to insurance law. Then, incorporate these keywords into your website’s content, title tags, meta descriptions, and headers to boost your chances of ranking higher in search engine results pages.

On-page SEO practices such as optimizing site speed, enhancing mobile responsiveness, and creating a user-friendly navigation structure can also improve the user experience, which positively impacts your rankings. For example, a fast-loading, mobile-friendly website makes it easy for visitors to navigate through your services, increasing the likelihood they’ll stay on your site longer and convert.

Regularly updating your site with relevant content on insurance law topics, such as “How to File an Insurance Dispute,” can also help establish your expertise and attract search traffic.

Another important SEO element is backlink building. This is the process of obtaining links from reputable sites back to your own. Being featured in respected legal publications or local business directories not only drives traffic to your site but signals to search engines that your website is authoritative and trustworthy. The more quality backlinks you have, the more likely you’ll achieve higher search rankings over time.

At Comrade Digital Marketing, we specialize in SEO strategies for insurance law firms. Our team can help optimize your site, build valuable backlinks, and boost your online visibility to attract more clients actively seeking insurance legal assistance.

2. Content Marketing: Building Trust and Authority

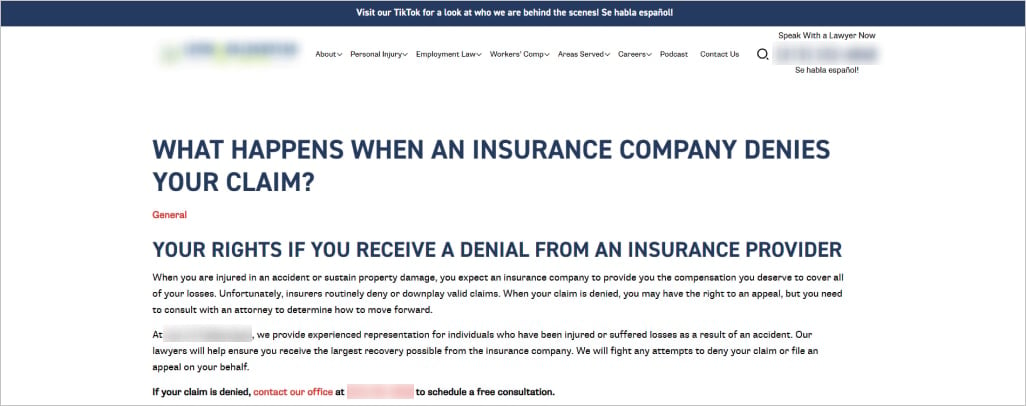

Make your website the go-to for insurance law-related information. With content marketing, your firm can establish authority, build trust with potential clients, and improve search engine rankings. By publishing informative and valuable content on your website, you can address common questions and concerns potential clients may have, such as “What to Do If Your Insurance Claim Is Denied.” These types of articles provide useful information and showcase your expertise, making it easier for users to trust your firm’s capabilities.

Blog posts, articles, and FAQs on specific insurance law topics can help attract organic traffic and keep clients engaged. For instance, creating a “Guide to Understanding Insurance Policy Terms” or “Common Insurance Claim Mistakes to Avoid” can draw in readers who may later convert into clients when they need professional help. Video content is also a powerful medium, allowing you to explain complex legal processes in a more approachable manner, which can be shared on social media and enhance your reach.

No matter what content form you invest in, it should always be optimized with relevant keywords and internal links to other pages on your site to further support SEO efforts.

For example, linking a blog post about “Insurance Bad Faith Claims” to your main practice area page increases site authority and improves user navigation. Consistently updating your website with fresh content also signals to search engines that your site is active, improving your chances of higher rankings.

With a team of copywriters, Comrade Digital Marketing can help you develop a content marketing strategy that positions your firm as a trusted authority in insurance law. Let us assist you in creating and distributing valuable content that resonates with clients and increases your online presence.

3. Targeted Pay-Per-Click (PPC) Advertising

To quickly attract high-intent clients, PPC advertising for insurance lawyers is the go-to solution. Unlike organic SEO, which takes time to build, PPC campaigns can yield immediate results by bidding on keywords like “insurance lawyer near me” or “help with insurance claim denial.” This allows you to target users who are actively seeking legal services, increasing the chances of immediate conversions.

Creating compelling ad copy that highlights your unique value, such as “Experienced Insurance Claim Lawyers” or “No-Win, No-Fee Representation,” can attract attention and drive clicks. Ad extensions, like call buttons or site links, also increase the visibility of your ad, making it easy for clients to contact you or navigate to specific service pages.

Effective PPC campaigns balance cost-per-click with ad relevance, helping you reach a targeted audience without overspending.

Retargeting is another valuable tactic in PPC for lawyers. If a user visits your site but doesn’t convert, retargeting ads can remind them of your services, keeping your firm top-of-mind when they’re ready to make a decision. This strategy can lead to higher engagement rates, as retargeted users are already familiar with your brand and more likely to revisit.

To attract clients in a cinch, Comrade Digital Marketing offers PPC expertise to help insurance lawyers run successful campaigns that attract quality leads. Our team can optimize your ad spending and implement retargeting strategies to boost your visibility and convert potential clients into cases.

4. Social Media Engagement and Branding

Social media marketing for insurance lawyers is a powerful tool for insurance lawyers to build brand awareness and connect with potential clients. Platforms like LinkedIn, Facebook, and X allow you to share updates on relevant insurance law topics, post recent case successes, and demonstrate your firm’s expertise. For example, sharing a client success story or posting an article about “Understanding Insurance Claim Deadlines” can help establish your firm as a knowledgeable, trusted authority in the field. Social media can also humanize your firm by showcasing the team’s personality and dedication to clients.

To make the most of social media, consistency, and quality are essential. Regularly posting informative content not only keeps your audience engaged but also improves your firm’s credibility over time. Engaging with followers through comments and messages can create a personal connection and encourage potential clients to reach out directly.

Additionally, paid social media campaigns can further expand your reach by targeting users based on specific demographics, interests, or locations. This will help you reach clients actively seeking legal advice on insurance matters.

Social media also serves as a valuable channel for retargeting ads, reaching users who have previously engaged with your website or content. This consistent exposure to your firm increases the likelihood they’ll remember and choose you when they need legal assistance.

To help build a strong social media presence, our team at Comrade Digital Marketing will enhance your efforts through strategic posting, paid campaigns, and engagement tactics. Let us help you connect with a wider audience and strengthen your brand across social media platforms.

5. Email Marketing for Client Retention and Outreach

Email marketing for insurance lawyers is a highly effective way for insurance lawyers to stay top-of-mind with both current and potential clients. Regular newsletters or email updates allow you to provide valuable insights on insurance law, such as recent legal developments or tips for handling claims. By sharing useful content, like “Steps to Take When Your Insurance Claim Is Denied,” you can maintain a strong relationship with past clients, who may refer others or reach out again in the future.

Segmenting your email list is key to reaching the right audience with the right message. For example, sending targeted emails to former clients with updates on relevant insurance law changes shows them that your firm is knowledgeable and attentive. Automated email sequences can also nurture new leads by sending welcome messages, resource links, or consultation offers. These emails build trust and encourage recipients to engage with your services.

To make emails more engaging, incorporate clear calls-to-action (CTAs) like “Book a Free Consultation” or “Download Our Guide on Filing Insurance Claims.”

By regularly sharing valuable information and helpful resources, you keep your firm’s name in clients’ minds, making them more likely to return or refer others.

Comrade Digital Marketing can help you develop an email marketing strategy that builds client relationships, fosters referrals, and drives conversions. Our expertise can ensure your emails reach the right audience with the right message, maximizing engagement and retention.

6. Utilizing Legal Directories and Online Listings

Listing your firm on reputable legal directories like Avvo, FindLaw, and Martindale-Hubbell can significantly enhance your online visibility and credibility. Legal directories help potential clients find your firm while also improving your search engine rankings by providing quality backlinks. To maximize the benefit, ensure your listings are complete, accurate, and optimized with keywords related to insurance law, such as “insurance dispute lawyer” or “insurance claim attorney.” Including client testimonials and case results in your profiles can also boost your firm’s appeal to prospective clients.

Additionally, claiming your Google Business Profile is essential for appearing in local searches and map results. By listing your firm’s name, address, phone number, and operating hours, you make it easy for local clients to find and contact you. Regularly updating your Google Business Profile with posts about recent successes or law updates can also increase visibility and engagement.

Directories often allow for paid premium listings, which can further increase exposure by placing your firm in prominent positions within search results.

Combining premium directory listings with organic SEO efforts can provide a comprehensive approach to reach potential clients.

At Comrade Digital Marketing, we can manage your online listings and directory profiles to ensure they’re optimized for visibility and credibility. Contact us to learn how we can help your firm build a strong digital presence across multiple platforms.

How Do You Know If Your Digital Marketing Efforts Are Effective

Understanding how to use Google Analytics effectively can help insurance lawyers make the most of their digital marketing strategies. By setting clear goals, tracking key metrics, and analyzing visitor behavior, you’ll gain insights into what drives client engagement. To assist, this step-by-step guide outlines each essential step, helping you gauge the success of your internet marketing efforts with precision and ease:

Set Up Google Analytics Account: Go to analytics.google.com, sign in, and create an account for your website.

Install Tracking Code: Go to “Admin” > “Tracking Info” > “Tracking Code,” then copy the code and paste it into the HTML of your website.

Define Goals: Navigate to “Admin” > “Goals” > “New Goal” to set up goals that align with conversions, like contact form submissions or clicks on specific pages.

Track Traffic Sources: Go to “Acquisition” > “All Traffic” > “Source/Medium” to see where your visitors are coming from, helping you assess which channels are effective.

Monitor User Behavior: Click on “Behavior” > “Site Content” > “All Pages” to analyze how users interact with content, such as blog posts or landing pages.

Measure Conversion Rate: Go to “Conversions” > “Goals” > “Overview” to see how many visitors completed your goals, showing your digital marketing success in terms of conversions.

Use Audience Insights: Visit “Audience” > “Demographics” and “Interests” to understand visitor characteristics and tailor content to your target audience.

Set Up Custom Reports: Go to “Customization” > “Custom Reports” to create personalized reports focusing on key metrics for insurance lawyers, like leads or traffic from specific regions.

Review Real-Time Data: Click on “Real-Time” > “Overview” to monitor active users on your site and see the immediate effects of campaigns or new content.

With Google Analytics, insurance lawyers can transform data into actionable insights, refining their strategies and achieving better results. Monitoring traffic sources, user behavior, and conversions allows you to make data-driven decisions, enhancing your outreach and engagement. By consistently tracking these metrics, you can optimize your approach, build trust with clients, and ultimately increase leads and conversions.

Conclusion

From effective SEO to email marketing to a robust social media strategy, there are a lot of different tactics to invest in as part of an effective digital marketing strategy. These strategies can cement your firm as a trusted resource for clients who need your specialized expertise.

Using targeted SEO, PPC, and content marketing, you can connect meaningfully with clients who are ready to hire you. As a result, your practice will continue to expand, ensuring your long-term success. Sounds worthwhile, right?

Our team at Comrade Digital Marketing certainly thinks so. We will put our expertise to work and increase your firm’s visibility to attract the right clientele. Contact us today to learn how we can develop and execute a digital marketing strategy tailored to the unique needs of insurance law professionals.

Frequently Asked Questions

-

Is it necessary to hire a digital marketing agency for my law firm?

Hiring a digital marketing agency can be highly beneficial, especially if your firm lacks in-house expertise. Agencies bring specialized skills in SEO, PPC, content creation, and social media, which can accelerate growth. While it’s not strictly necessary, an agency can streamline efforts, improve ROI, and help reach clients faster, freeing you to focus on legal work.

-

How long does it take to see results from digital marketing efforts?

The timeframe varies by strategy. SEO typically takes 4-6 months to show noticeable ranking improvements, while online advertising can yield leads within days of launching. Social media campaigns may see engagement growth within a few weeks. Most local law firms experience solid, trackable results across channels within 6 months to a year, but ongoing optimization is key.

-

Is it possible to start digital marketing on a limited budget?

Yes, starting on a limited budget is possible with targeted strategies. Prioritize cost-effective tactics like local SEO, Google My Business optimization, and content marketing. Paid search (PPC) can be scaled with small daily budgets, and social media engagement can be grown organically. As your budget increases, you can expand into more comprehensive campaigns and advanced targeting options to maximize reach.