Today’s legal clients eat, sleep, and breathe online.

96% of people start their search for a lawyer on Google or an AI tool like ChatGPT.

Referrals will only take you so far these days. One month, they’ll keep you slammed, the next… crickets. That’s no way to run a business.

Here’s a little tip: Your biggest competitors get clients day and night because they treat digital marketing like a core part of their practice.

Today, we’re breaking down 15 top-tier digital marketing strategies to help you swim past your competitors in this shark-eat-shark arena. P.S. This playbook has delivered returns of 800% or higher! Let’s dive in.

What is Law Firm Digital Marketing?

Law firm internet marketing (or digital marketing) uses online channels like SEO, Google ads, email, social media posts, and more, to attract clients and grow your practice.

Over 80% of potential clients check out a firm’s website before making a decision. If yours isn’t visible (or impressive), watch out!

At its heart, digital marketing relies on consistent online engagement. We’ll repeat that… consistent online engagement.

That could mean getting a 5-star review on Google that builds instant trust with a nervous client, or raising brand awareness on LinkedIn, and positioning your lawyer website as the first choice on Google with SEO.

While there are dozens of tactics, the 4 pillars every firm should start with are:

- Search engine optimization (SEO)

- Pay-per-click advertising (PPC)

- Social media marketing

- Email marketing campaigns

Do these first, and you’ll have a solid base to attract new clients to hire your legal representation.

Top 15 Digital Marketing Ideas for Lawyers

Stressed about digital marketing? Don’t be! These 15 ideas are proven to help law firms attract clients, gain visibility, and grow faster.

Make sure to scroll to the end, as we have a great shortcut you can take.

1. Understand Your Law Firm’s Target Audience

The internet has 5.66 billion users, and naturally, not all of them are your clients.

Digital marketing only works if you know exactly who you’re trying to reach. Enter the fabled client persona!

A client persona is a simple profile of your “ideal client”: their age, situation, location, and pain points.

With a client persona, you stop wasting time on the wrong audience and focus on the prospective clients most likely to hire you.

For example, John, 45, injured in a car accident, is most likely searching for a personal injury lawyer, not a divorce lawyer.

Once you have a few personas mapped out, you can tailor your content, keywords, ads, and even social media targeting to match.

And voilà! Just like that, your law firm marketing is now more precise, cost-effective, and far more likely to bring in qualified leads.

2. Set SMART Marketing Goals for Your Legal Practice

Okay, now let’s get SMART! Online marketing for lawyers is like a bullseye. You need to know the target. What are you aiming at?

“Get more clients” is too vague. It sets you up to spin your wheels in the air. Instead, use the SMART framework: goals that are Specific, Measurable, Achievable, Realistic, and Timely.

For example, rather than “grow my caseload,” set targets like:

- Personal Injury Law: Get 15 new qualified leads per month within six months.

- Family Law: Grow website traffic to 5,000 local visitors per month within 90 days.

- Estate Planning: Generate 50 new email subscribers each month through a free eBook.

- Criminal Defense: Rank top 3 in Google Maps for “DUI lawyer [city]” within 6 months.

That clarity keeps your strategy focused, whether you’re on social media, improving your website, or refining SEO.

TLDR: Great marketing is ultra-ultra-ultra specific with what it wants to accomplish… no matter if you’re a personal injury attorney or an immigration law firm.

3. Choose the Best Legal Marketing Channels Based on Strategy

Now let’s talk about channels! There is a laundry list of ways to market your firm online: social media, email, podcasts, ads… which do you choose first?

That’s the catch with law firm digital marketing: not every channel fits every goal.

- Want to look like a thought leader? Lean into podcasts, videos, or blogs. For example, The Game Changing Attorney Podcast (by Crisp) has built massive audiences by blending legal insight with practical business tips.

- Need fresh leads? SEO (search engine optimization), content marketing, and webinars are your best bet. Barr & Douds, a California trust and estate litigation firm, saw 937% more qualified leads after investing in SEO.

- Trying to re-engage past leads? Email and newsletters work like a charm.

The key is knowing where your audience hangs out, testing, and doubling down on the channels that bring results.

| Marketing Goals | Marketing Channels |

| Thought Leadership | Podcasts, Videos, Content Marketing |

| Brand Awareness | Podcasts, Videos, Social Media |

| Audience Engagement | Podcasts, Videos, Social Media |

| Lead Generation | Content Marketing, eBooks, Webinars |

| Client Retention | Newsletters, Email Marketing |

| Building Credibility | Content Marketing, Webinars, eBooks |

| Online Visibility | Social Media, Videos, Infographics |

| Differentiation from Competitors | Infographics, Unique Content |

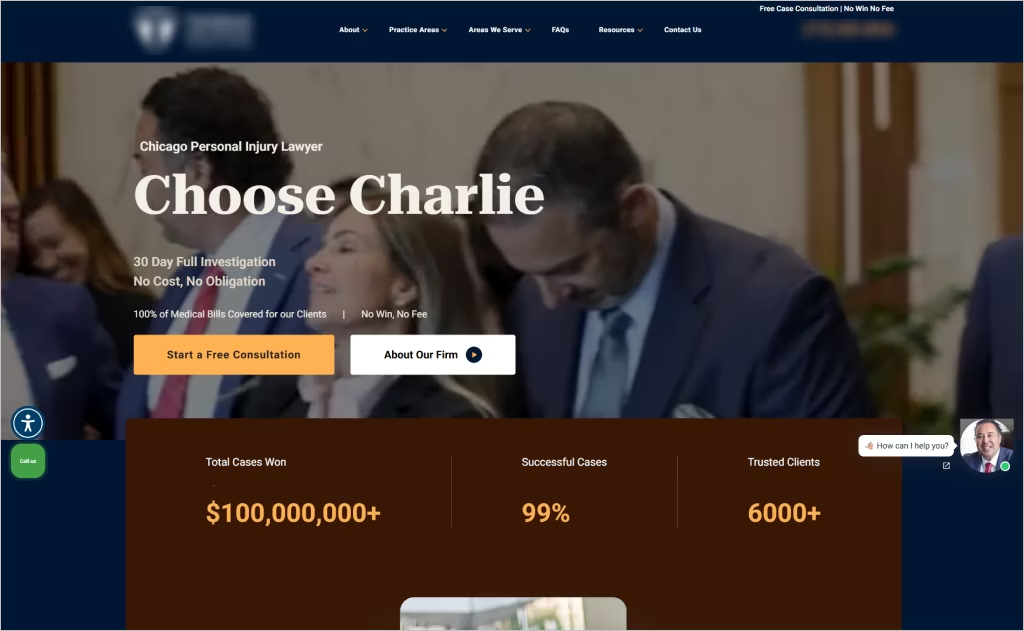

4. Create a High-Converting Law Firm Website

94% of law firms have a website… that’s some tough competition!

But having any site isn’t going to cut it. Your law firm website is powerful! It has the ability to pop up when clients are desperate, and guide them to contact you.

Your website should (at a minimum) do the following:

- Load in 3 seconds or less, and be optimized for mobile users (clients have the attention span of a goldfish).

- Use HTTPS and SSL certificates to signal security and credibility.

- Feature clean URLs, proper headings, and an XML sitemap so search engines can actually rank you.

- Include clear calls to action, case studies, FAQs, and values that reflect your firm.

Your law firm digital marketing strategy depends on a solid website. Everything else feeds into it. Do a little competitive analysis to gain inspo for your website!

Searching for lawyers websites that work? Get inspired by the best in the business!

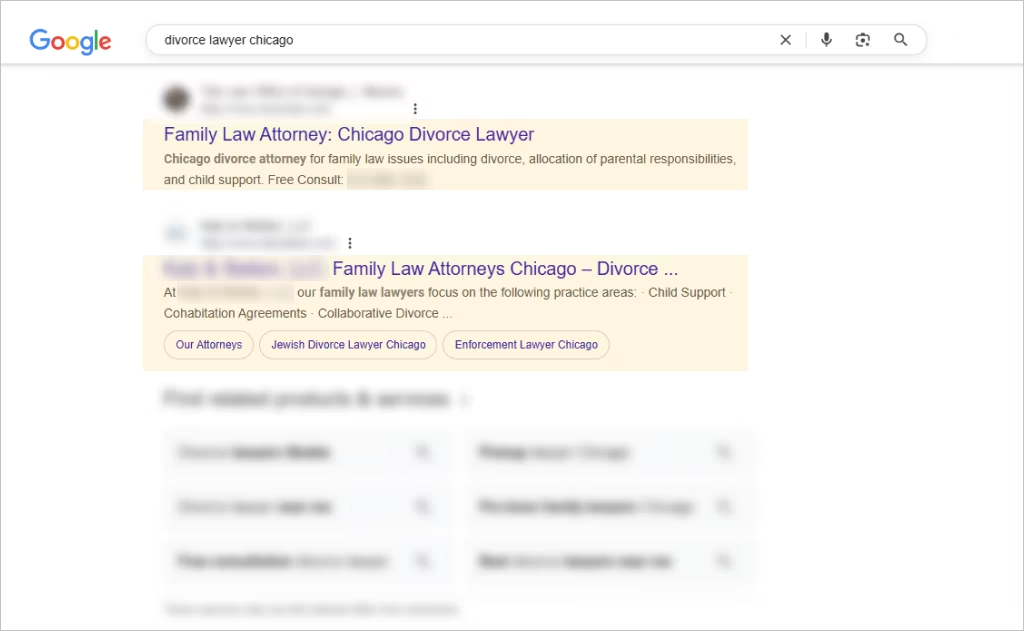

5. Use SEO to Drive More Leads to Your Law Firm

Attorney online marketing gets expensive, like fast!

Paid ads often cost $100–$200 per click. SEO (search engine optimization) is a more affordable and effective way to get leads.

Instead of paying for every visit, you can pull in thousands of clicks organically.

But ranking well isn’t just about keywords. A high-performing legal SEO strategy also means:

- Clear CTAs + phone number: Make it obvious how clients can reach you.

- Short, intuitive intake forms: Don’t scare people off with 20 fields to fill.

- Heatmaps + A/B testing: See what pages, buttons, and layouts actually work.

- Trust signals: Logos, testimonials, online reviews, and live chat all boost credibility.

Google’s rules may shift, but steady optimization keeps your firm visible and expands your client base.

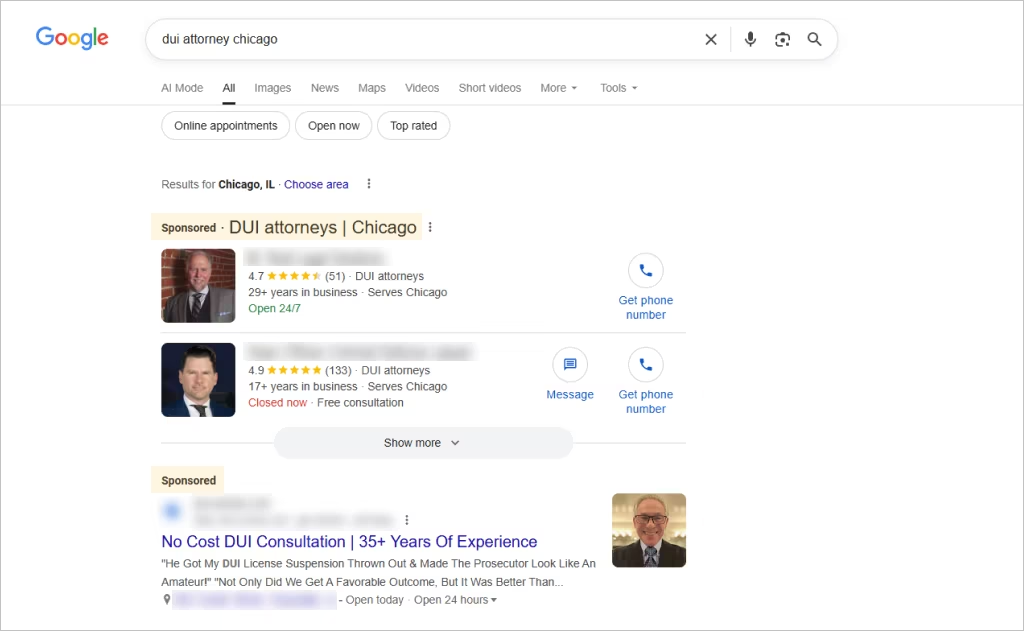

See Law Firm SEO in Action!

Competing in one of the most crowded legal niches wasn’t easy, but with the right SEO strategy, they climbed to #3 on Google for “DUI attorney.”

The payoff: 1,591% more leads with a 91% decrease in cost per lead!

There you go. Attorney online marketing delivers when you commit to the right strategy.

Get More Leads Fast in 2026. Comrade delivers up to 1,018% more leads for small to mid-size law firms.

6. Implement Content Marketing to Attract Legal Clients

Content marketing for lawyers is a goldmine.

Instead of shouting “call me!” in every ad, you answer the exact questions your future clients are already typing into Google at 2 a.m.

Take a divorce lawyer, for example. Clients constantly ask about:

- Child custody and parental rights

- How alimony is calculated

- What the divorce process looks like

If you turn those conversations into blog posts, suddenly, you won’t be just another lawyer: you become a trusted friend.

And blogs are just the beginning. You can mix it up with:

- Podcasts – Real talk on legal issues, straight from you.

- Videos – Quick explainers that make complicated topics simple.

- Newsletters – Friendly check-ins that keep past clients connected.

- Infographics – Visual breakdowns of tough legal concepts.

- eBooks – Deep-dive guides you trade for an email address (AKA a future lead).

Over time, every blog, video, or guide you publish becomes a little digital breadcrumb that leads clients right back to your office.

7. Use Local SEO to Grow Your Law Firm’s Online Presence

46% of all Google searches are looking for local info.

That’s nearly half the people on Google who could be trying to find a lawyer right in your backyard.

Local SEO pushes your firm in those results: whether it’s “DUI lawyer near me” or “divorce attorney in [your city].” For small and mid-sized firms, this levels the playing field against bigger, national competitors.

A strong local SEO strategy includes:

- Optimize your Google Business Profile (GBP): Add photos of your office, list your hours accurately, post updates weekly, and choose the right legal categories (e.g., “Personal Injury Attorney,” not just “Lawyer”).

- Leverage local reviews: Ask every happy client for a Google review. Reply to each one as Google counts engagement as a ranking factor.

- Use hyper-local keywords: Don’t just target “divorce lawyer.” Target “divorce lawyer in Dallas” or even neighborhood terms like “Uptown Dallas custody lawyer.”

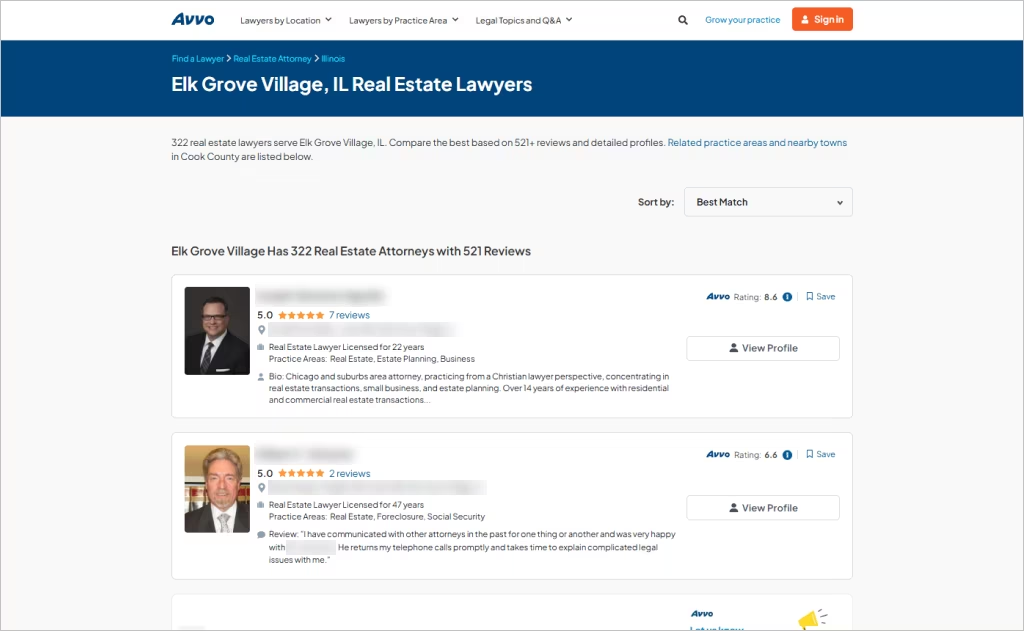

- Consistency matters: Keep your NAP (name, address, phone) identical across Google, Yelp, Avvo, Justia, and legal directories. Even tiny mismatches can hurt rankings!

- Local backlinks: Get cited in local news, sponsor community events, or join your Chamber of Commerce.

- Location pages: If you serve multiple cities, create a unique, content-rich page for each location (not just copy-paste with a city swap).

Combined with website marketing for attorneys, local SEO tells search engines (and potential local clients) that you’re the law office to call.

Attract clients with effective local SEO strategies for lawyers – Learn how to boost your firm’s visibility in your area!

8. Use PPC Advertising to Drive Immediate Legal Leads

Every day without leads = lost revenue. The fastest way to get clients is with PPC marketing for lawyers.

With pay-per-click, your firm shows up at the very top of Google the instant someone types “injury lawyer near me.” While you wait months for SEO to kick in, PPC can start the same day your campaign goes live!

The best part is that you’re in control. You set the budget, pick the keywords, and decide exactly who sees your ads.

And here’s the trick with PPC ads: Google rewards relevance. If your ad copy matches what people are searching for, you’ll rank higher and often pay less per click!

Unlock the right lawyer PPC keywords to attract your ideal clients – Discover the essential lawyer keywords for your website!

9. Build High-Quality Backlinks

Say hello to link building. Backlinks are like your “reputation makers” across the internet.

The #1 result on Google usually has 3.8x more backlinks compared to results in spots #2–10.

When credible sites link to your law firm’s website (backlinks), Google takes notice and bumps you higher in its search results! Pretty cool, right?

Here’s the not-so-cool part: Getting backlinks is one of the toughest parts of digital marketing for law firms. But hey, it’s also one of the most rewarding.

The trick is quality. A single backlink from a respected source can outweigh 100+ from random blogs or low-value directories. That’s why legal directories are gold. Platforms like:

…already have strong authority, so a well-maintained profile there not only improves your rankings but also sends potential clients directly your way!

Those backlinks can make the difference between being buried on page two or occupying the top of Google.

10. Reach New Clients with Social Media Marketing for Lawyers

Social media is where your clients already sp end 60% of their time. In fact, more than 1/3 of lawyers who use social media professionally have landed new clients from it.

But not every platform is worth your time, so focus on the ones that match your audience:

- LinkedIn – Share insights, build authority, and connect with professionals.

- Facebook – Perfect for local ads, reviews, and community updates.

- Instagram & TikTok – Quick videos, FAQs, and relatable stories clients actually watch.

- YouTube – Deeper dives like explainers, webinars, or case studies.

Use social media regularly, and you’ll keep your firm top of mind, whether you’re running PPC ads or just posting consistently.

Harness the power of social media for law firms to expand your reach – Find out how!

Pop Up Exactly Where Your Clients Look! Comrade gives you prime visibility at the #1 spot on Google.

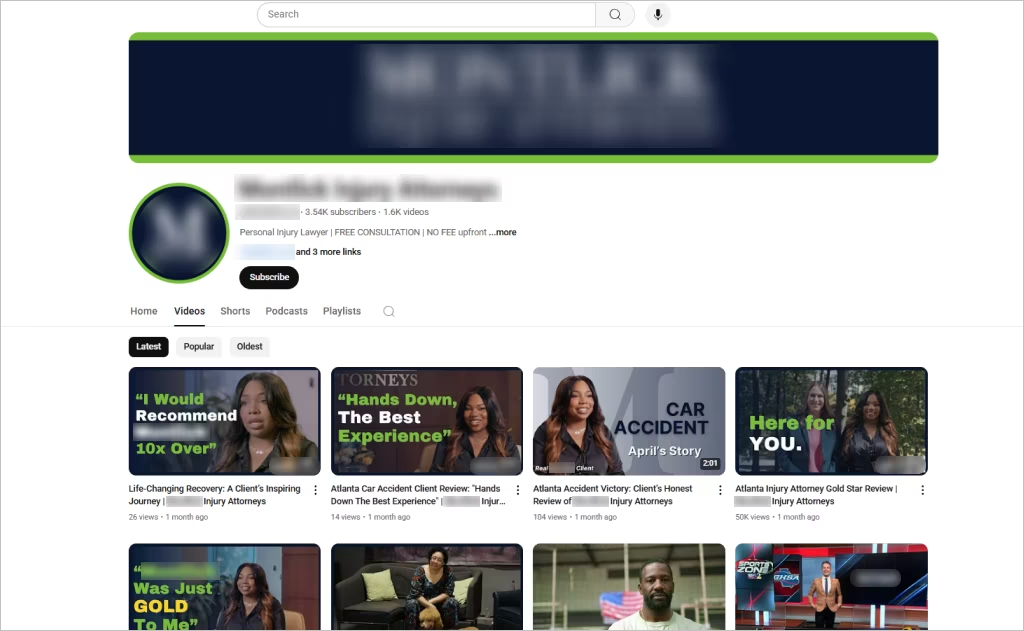

11. Use Video Marketing for Lawyers

Video is wildly more effective than plain text.

People retain 95% of information when watching a video versus just 10% when reading the same content. Kinda mind-blowing, right?

For web marketing for lawyers, video does 3 things really well: it boosts engagement, keeps visitors on your pages longer, and helps you be remembered.

Some video types that work especially well for law firms:

- Lawyer introductions and bios: put a face and voice to your name

- Client testimonials: real people tell real stories

- FAQs: address common questions upfront

To get even more mileage: optimize your video titles and descriptions so Google and YouTube know what it’s about. When prospects remember you, the leads follow.

12. Leverage Email Marketing to Stay Top-of-Mind

What’s so amazing about email marketing is that it generates an average $36 return for every $1 spent! Read that again. It is one of the highest-ROI marketing tools in digital marketing!

For law firms, email works best when it’s consistent and valuable:

- Monthly newsletters with legal updates or tips

- Follow-up sequences for leads who reached out but didn’t hire

- Client check-ins to keep past clients warm

The goal with any digital marketing for lawyers’ strategy is to drive value. Spamming inboxes won’t serve you well. Do not spam! Focus on nurturing trust.

Email marketing has the power to keep your firm top-of-mind so when clients (or their friends) need legal help, you’re the first name they think of.

13. Manage Your Law Firm Online Reputation

Are you worth hiring? Your online reputation answers that question.

Sites like Google, Avvo, Justia, and Yelp act as today’s word of mouth. Your profile and client reviews on those platforms influence whether your firm shows up in Google’s local pack.

Here’s how to make reviews work for your attorney web marketing:

- Ask for reviews: Use quick follow-up emails or texts after a positive case outcome.

- Prioritize key platforms: Start with Google, then build profiles on Avvo, Justia, and Yelp.

- Respond to feedback: Thank happy clients and reply calmly to negatives, it shows professionalism.

- Mind the ratings: Nobody hires a 2-star lawyer, but a perfect 5.0 can look suspicious. The “trust sweet spot” is usually 4.7–4.9 stars.

- Showcase testimonials: Feature reviews on your website and social channels.

Consistent, authentic reviews (funnily enough, those little stars online) can drive more calls to your firm.

14. Build Legal Partnerships to Expand Your Reach

No law firm is an island. It’s cliché, but it’s true! Why not team up with other lawyers?

Whether it’s cross-referrals, guest blogs, or co-hosted webinars, the right partnerships fuel growth faster than anything else.

For instance, platforms like JD Supra let firms co-author articles or publish guest posts, gaining exposure to entirely new audiences!

Partnerships like this can help you:

- Boost visibility: Show up in more searches and directories.

- Strengthen credibility: Clients see you as more authoritative.

- Generate reviews: Happy clients leave feedback for both firms.

- Gain backlinks: These are valuable links to your site that help boost Google rankings.

To get the best results, be sure to align your partnerships with your digital marketing for lawyers strategy.

15. Track Your Law Firm’s Marketing Budget and ROI Effectively

After all of that hard work, don’t keep throwing money at marketing without tracking results.

It’s time to look at your marketing performance. The key to digital marketing for attorneys is knowing not just what you’re spending, but what you’re getting back.

Start by monitoring core KPIs:

- Your website’s organic web traffic – Are more people finding you through search?

- Lead-to-client conversion rate – Are clicks turning into signed cases?

- Bounce rate – Are visitors sticking around or leaving instantly?

Use tools like Google Analytics, Search Console, Clio Grow, and CallRail to track performance across every channel.

Just as important: measure results individually by channel! This is what makes your digital marketing beneficial.

SEO, PPC, email, and social media each drive leads differently, so knowing what pulls its weight helps you adjust your budget smartly.

Effective ROI tracking is key. Do it today and you’ll thank us later!

Time to Get More Clients... Ready? Don't suffer alone. Our marketing services yield an up to 800% ROI!

Benefits of Digital Marketing for Law Firms

Whew! We just covered 15 big tips!

Now, let’s zoom out and look at why all that back-breaking work matters.

When you invest in digital marketing for law firms, you can track a client’s journey from their very first Google search to the moment they sign with your firm.

That means you can literally engineer a higher ROI month after month. In fact, companies that align marketing and sales see a 20% annual growth. Nice!

Here’s what digital marketing brings to the legal industry:

- Increased visibility: Show up where clients are already looking.

- Targeted reach: Focus only on the clients who matter most and will ultimately hire you.

- Higher engagement: Build trust through useful content and connections.

- Measurable results: Know what’s working with real data.

- More leads and sales: Convert clicks into paying clients.

Word-of-mouth alone can’t sustain a law firm. In 2026, digital marketing creates steady visibility and predictable growth.

Ready to Sign More Clients in 2026? Get a Digital Marketing Strategy That Pays for Itself.

What if your practice could bring in $1M to $5M+ a year, without relying on referrals?

Join forces with the marketing team at Comrade! We’re a top-tier Chicago law firm marketing company, specializing in SEO, PPC, and web design.

Our strategies put high-value cases on your calendar guaranteed! Here’s what firms see when they partner with us:

- Up to 1,018% more qualified leads

- 400%–800% ROI on SEO, PPC, and web marketing campaigns

- 100% transparency on every dollar spent and what it brings back

Law is one of the most competitive industries. Don’t leave your growth to chance.