Imagine a sleek, modern lawyer site that ranks at #1 on Google, and books consultations 24/7.

Wouldn’t that be amazing? The truth is, 96% of people search online when they need a lawyer. That’s a LOT of potential eyeballs on your website.

But here’s the catch: most visitors decide in just 3–5 seconds whether to trust you or not. The best family law websites instantly ease their stress, and persuade them to hit that shiny “Contact Us” button.

Here are 30 standout family law website examples from 2026 to help you build a site that books consultations while you sleep.

Ready to 3x Your Law Firm's ROI?

Join 300+ law firms who've increased their caseload with our proven legal marketing strategies

30 Best Family Law Firm Website Designs

1. Hodgson Law Group

You know how stressful family issues can be. That’s why Hodgson Law Group’s site makes everything simple, supportive, and easy to navigate.

Take note of the fresh design that highlights their firm’s expertise without overwhelming visitors. It feels approachable, professional, and trustworthy — all in a matter of seconds.

The homepage headline: “Protecting What You Value Most,” sets the tone right away. Add in client testimonials, a child support calculator, and a visible “Free Consultation” button, and you’ve got a stellar site.

2. Yarborough Law Group

Family law cases are deeply personal. Yarborough Law Group’s website puts people at ease with a warm, welcoming design.

You can feel the difference the moment you land. The beige-and-blue color palette is calm and inviting, giving the whole design a friendly yet professional vibe.

Every service, from divorce and custody to adoption and fathers’ rights, is laid out clearly so visitors can quickly find the help they need. Add in payment plan options and a 24/7 call-or-text feature, and the site feels super practical.

It’s a great example of web design for family law, taking a modern and empathetic approach to family law matters.

3. Lishman Law Firm

You don’t have to spend even 5 minutes on Lishman Law’s site to see why it works. The design is striking, modern, and professional.

Visitors are greeted with the headline: “Facing a Family Challenge? We Are Here to Guide You,” which instantly puts them at ease. Even if you’re an experienced family law attorney, you could learn something from this site!

Pay special attention to the navigation. It’s straightforward, with divorce, custody, adoption, and support services easy to find. Plus, their testimonials add plenty of credibility while making it simple to take the next step… contact them.

Lishman’s website proves one thing: when you combine compassion and professionalism in your web design for family law firms, families will feel confident in contacting you.

4. Stange Law Firm

Have you seen Stange’s site yet? It’s impressive because it makes family law so much less intimidating. The bold headline — “Here to Help You Rebuild Your Life” — immediately sets a hopeful tone. As far as family law attorney websites, this one’s a winner!

Their design is warm and professional, offering smooth navigation, a “Your Case Tracker” client portal, and even a mobile app to keep people connected on the go.

Stange makes it clear they aren’t local. Their offices span 27 states, blending big-firm muscle with local attorney care.

With that mix of reach, reassurance, and clear action, this is web design for family law that easily stands out in a sea of “meh” sites.

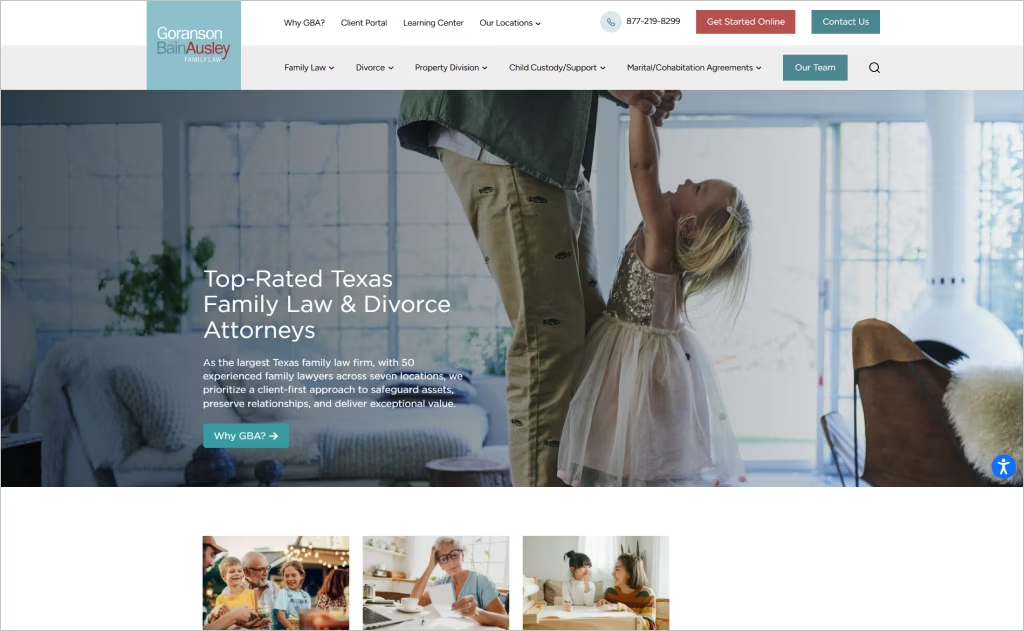

5. Goranson Bain Ausley

Big, bold, and polished. Goranson Bain Ausley’s site shows how a modern family lawyer website design can knock it out of the park.

What makes Goranson’s site stand out is the scope of its team. With 50 board-certified attorneys across seven offices, their website is nothing short of impressive.

The design is sleek and modern, with intuitive navigation that makes it easy to explore everything from divorce and custody to adoption and property division.

Bonus: A robust Learning Center full of blogs and resources gives their website visitors answers before they even step into a consultation.

This is a family lawyer website design at its best: professional, content-rich, and client-focused. No wonder GBA has been voted the #1 family law firm in multiple big cities!

Want to grow your family law practice? Dive into our article on PPC for family lawyers and start generating leads now!

6. Stanchieri Family Law

Want a minimalist site that gets right to the heart of your legal issues? That’s exactly how Stanchieri Family Law’s website feels the moment you land on it. The dark, sleek design gives it a contemporary edge, while the sparse copy makes it effortless to navigate.

Check out their key sections — Services, Team, About, Contact — they’re all one click away. You’ll quickly see that this firm’s website positions itself to walk you through life’s toughest transitions.

From booking a consultation to learning about their legal team, everything is designed to make the process feel less exhausting.

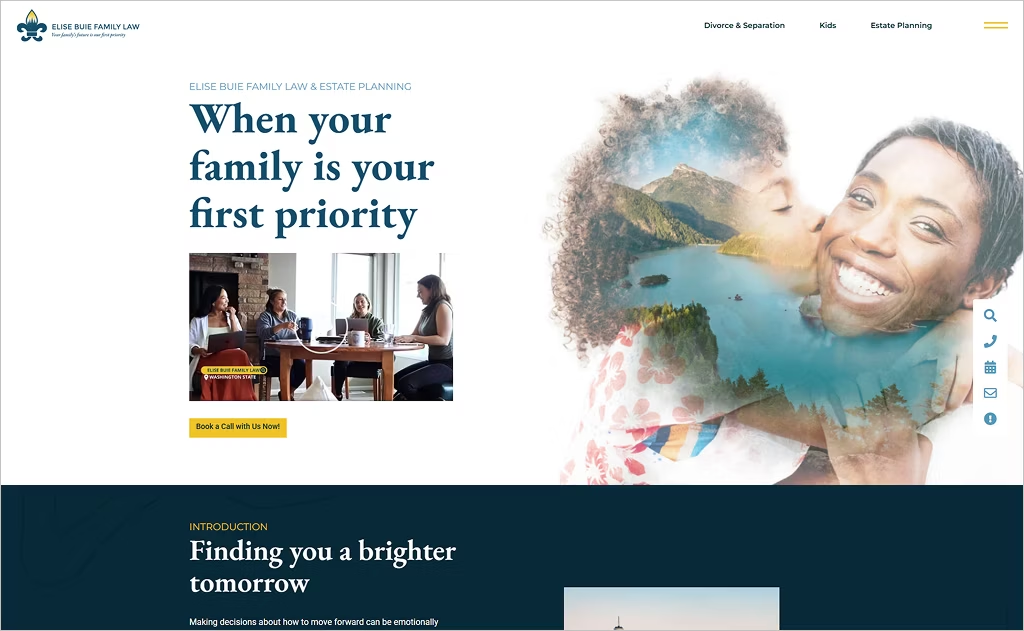

7. Elise Buie Family Law

Some family law websites feel cold and clinical. Not this one. Elise’s site welcomes you in with warmth and reassurance, showcasing familiar imagery of Seattle skylines.

What really stands out is the scope. They don’t just offer divorce and custody — they also tackle estate planning, relationship agreements, co-parenting support, and resources for life’s curveballs.

Take note of the blog as well. It’s packed with practical advice, from gray divorce to parenting plans, so visitors leave smarter than when they arrived.

Elise earns its keep in our list of the best family law websites!

8. Vaught Law Firm P.C.

Family law issues aren’t easy. Vaught Law Firm’s website makes reaching out feel less overwhelming. The moment you land, you’re met with, “We understand. We can help.” — a simple message that hits like a gut-punch.

The site keeps things clean and direct. Want to know about divorce, custody, or high-net-worth property division? It’s all organized and easy to navigate, without the legal clutter.

Don’t ignore the client reviews. They highlight real compassion, while award badges and credentials show that this firm means business.

Vaught’s rare client-centered approach makes the site a standout in family lawyer website design.

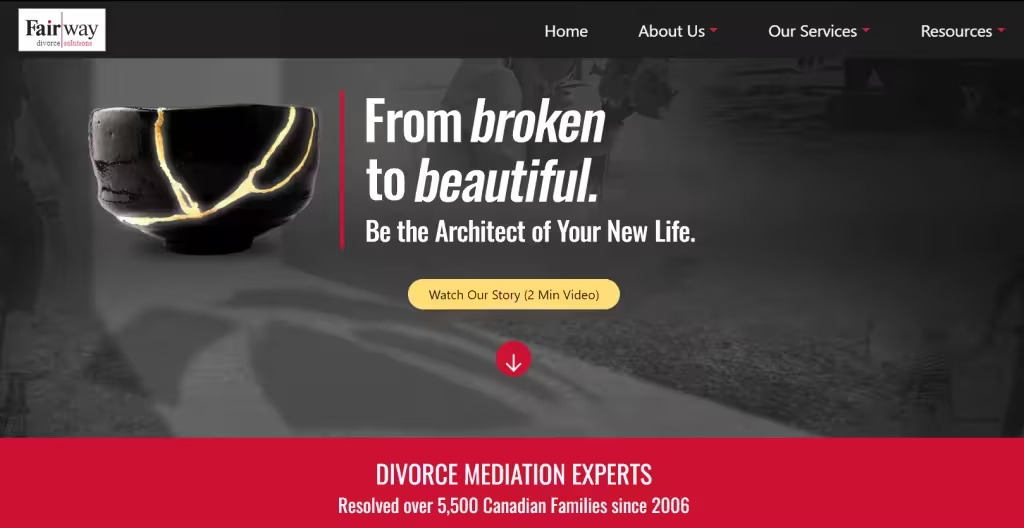

9. Fairway Divorce

Fairway Divorce’s website feels different. The bold black, white, and yellow color scheme instantly sets it apart. Instead of heavy legal jargon, the design is centered on solutions.

Their message is brilliant and charming: “Divorce the Fair Way.” With the Fairway Method™, couples can resolve cases in just 120 days at a fixed fee, saving time, money, and stress. That’s rock-solid messaging!

Their navigation is silky smooth, with clear sections on services, resources, and parenting support.

Divorce lawyer website designs don’t often get it right. This one does. It’s built to help families move forward with clarity and confidence.

Want a Beautiful Website of Your Own? We deliver top-ranking lawyer websites to fill your pipeline faster than ever!

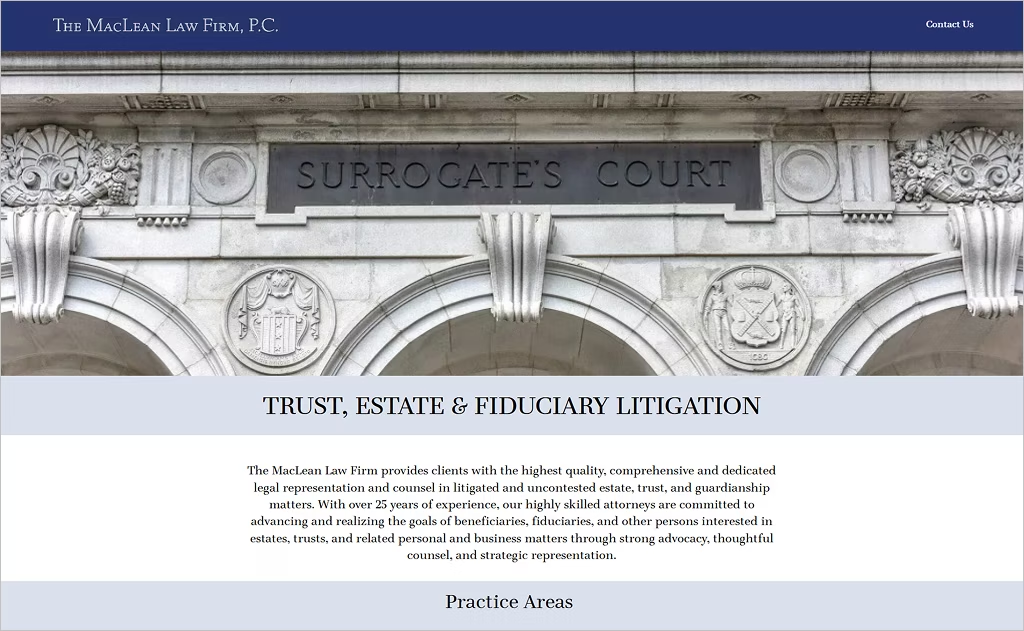

10. Maclean Law

MacLean Law’s website is a study in simplicity.

Seriously, check it out. The clean gray-and-white design gets straight to the point, highlighting trust, estate, and fiduciary litigation as its core focus.

How could you not love the minimalist aesthetic? It creates an air of professionalism, allowing the firm’s 25+ years of experience to take center stage.

Navigation is straightforward, making it easy for visitors to explore practice areas like probate, trust administration, estate planning, and guardianships.

If you want a rock-solid website design that proves minimalism works, give Maclean’s site a quick look.

11. New York Family Law Group

The second you land on NYFLG’s site, you’ll see it. The bold orange and white design pops right off the screen.

It feels modern, welcoming, and no-nonsense, just like the city it represents.

Their message is clever as well: “Helping Families Spend Time in the Living Room, Not the Courtroom.” And that sets the tone perfectly. You’ll find everything laid out simply (divorce, custody, child support, and protective orders).

This site makes you feel like you’ve found a legal team that actually gets it.

12. Women’s Divorce & Family Law Group

The first thing you see here is a mother and child — a reminder of what’s at stake and who this firm is fighting for.

WDFLG stands out as the first Chicagoland firm focused solely on women’s and mothers’ rights in divorce and child custody cases.

The site’s clean white design makes it easy to breathe, while bold touches of imagery and resources (like their step-by-step “Roadmap to Divorce”) keep things approachable.

Instead of getting lost in legal sauce, you get guidance on legal help that feels personal, supportive, and empowering.

It’s a website design for family lawyers that puts compassion first. Now, that’s compelling!

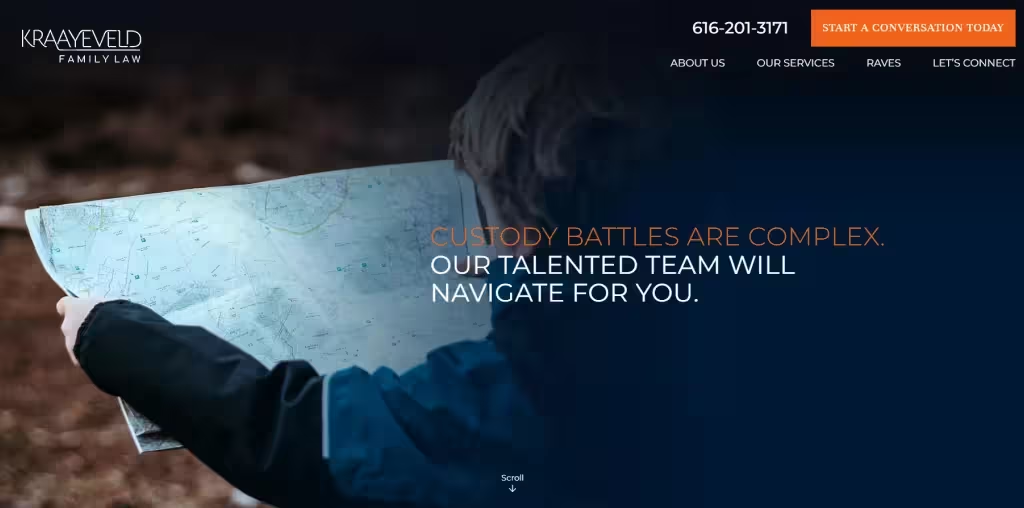

13. Kraayeveld Law Office

Some law firm websites feel cold and complicated. Not Kraayeveld Family Law!

You’ll notice it flips that script with a clean, approachable design that makes it easy to get help.

The site immediately reassures you with its promise: “We can help. Let’s talk.” From there, you’ll find a clear menu, straightforward answers to common divorce and custody questions, and resources like FAQs and blog posts.

What better way to break down intimidating legal topics than presenting them in plain English?

On Kraayeveld’s site, what stands out most is the balance… professional enough to inspire confidence, but warm enough to feel human.

14. Arami Law, Inc.

Check out Arami Law’s site today. It’s a lesson in how to make complex information feel clear and approachable.

The design keeps the focus on the visitor with bold, client-centric messaging (“When Life Gets Complicated, We Help You Regain Control”) and multiple CTAs that make next steps obvious.

Note the navigation, too. It’s wickedly simple: divorce, custody, and family law lawyer sections are easy to find, supported by attorney bios, blog resources, and real Google reviews.

If you’re designing your own site, copy how Arami combines storytelling, social proof, and strong calls to action in one cohesive flow.

15. McClure Law Group

What’s the first thing you notice on McClure Law Group’s site? The friendly, smiling lawyers! Their site immediately feels approachable, while the white-and-red design packs serious authority.

If you want your site to strike a balance between warmth and professionalism, this family law website is worth checking out.

The magazine-style layout and subtle animations add movement and polish, while the confident color palette makes the whole site feel powerful.

At the same time, you can’t miss the awards, testimonials, and clear calls to action — proof that credibility and personality can live side by side.

It’s a reminder that great website designs for family lawyers don’t have to be stiff.

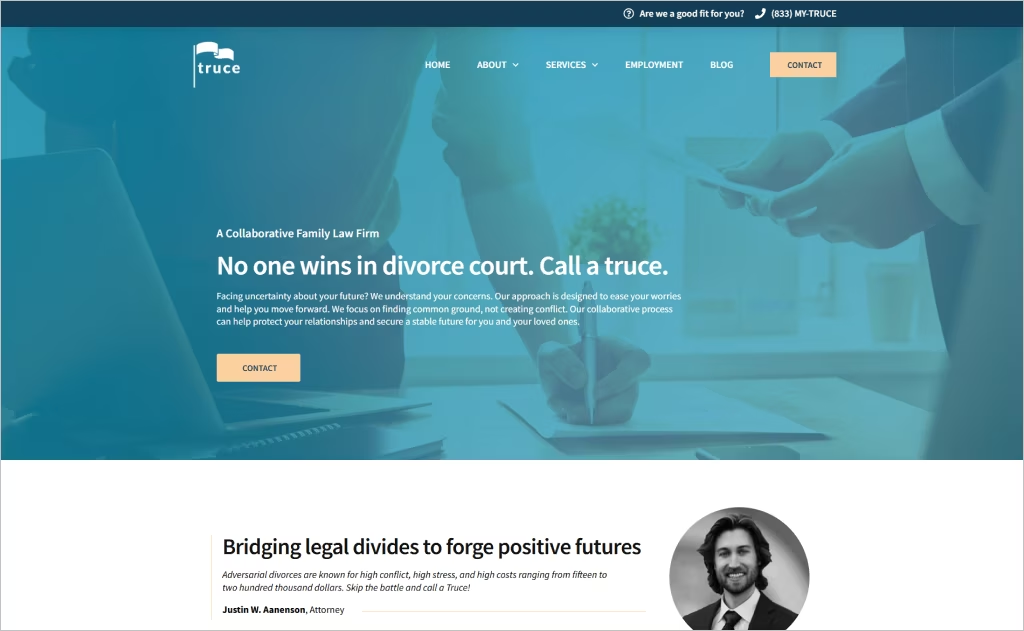

16. Truce Law

On Truce Law’s site, design echoes philosophy. From the first line — “No one wins in divorce court. Call a truce.” — the message is clear: this isn’t about fighting, it’s about resolution.

The website mirrors that ethos with soft colors, clean typography, and an uncluttered layout that puts users at ease.

Plus, don’t ignore their practical UX choices. Client-friendly features like secure online intake, e-signatures, and flexible meetings make the site reassuring and competent.

For lawyers looking at family law websites for inspiration, Truce Law should be at the top of your list.

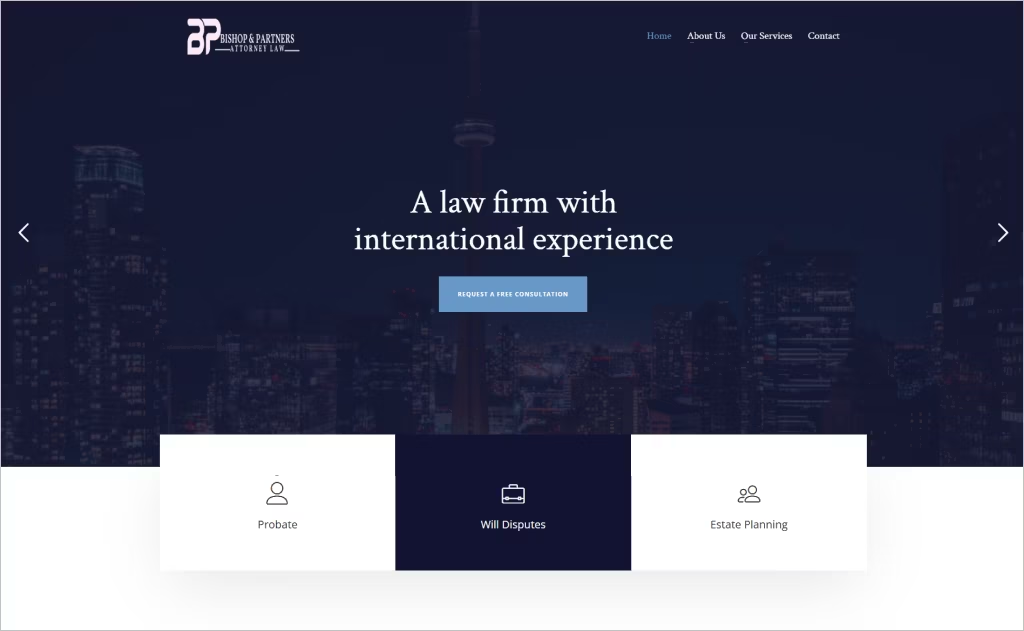

17. Bishop Law Office

Bishop Law Office nails down the “trust and clarity” vibe with a clean blue-and-white design.

The site feels calm, professional, and easy to use. You can click straight into probate, wills, or estate planning without feeling like you’re wading through a maze.

What you’ll really want to steal here is how they make the experience feel approachable. Their “Obligation Free Consultation” button pops up at the right spots, and their team page adds a personal touch that big, stuffy firms often miss.

If you’re building your own family law website, you could copy their simple color scheme, direct calls to action, and client-first messaging.

18. Jones Divorce & Family Law

The first thing you notice on Jones Divorce Law’s site is the bold orange-and-white color scheme. It instantly sets them apart from the sea of gray-and-navy law firm websites.

But it’s not just the look. The copy for their legal services leans into empathy and clarity — “A Different Divorce Experience” tells visitors they’re about more than paperwork.

Every section is designed to guide you, with services broken down into clear categories like divorce, family law, and resolution. Plus, they highlight 195+ years of combined experience… that’s impressive!

If you’re brainstorming your own family law website, take note: this design proves how a client-focused angle can make even heavy topics feel approachable.

19. Neal Ashmore Family Law Group

This is another example of brilliant web design. The Neal Ashmore Family Law Group site immediately feels polished with its dark blue, gold, and white color palette.

The design gives off a calm authority — exactly what you’d want in a family law firm when seeking legal representation!

We love that the navigation is simple and intuitive! Practice areas like divorce, custody, adoption, and probate are just a click away. Board-certified credentials and decades of experience are front and center, while testimonials and FAQs bring a personal, relatable touch.

If you’re looking for family law website design inspiration, this one proves how color and layout can work wonderfully together.

Launch a Website That Lands Cases Comrade is your partner in crime! Get in touch and let's unleash a flood of new leads.

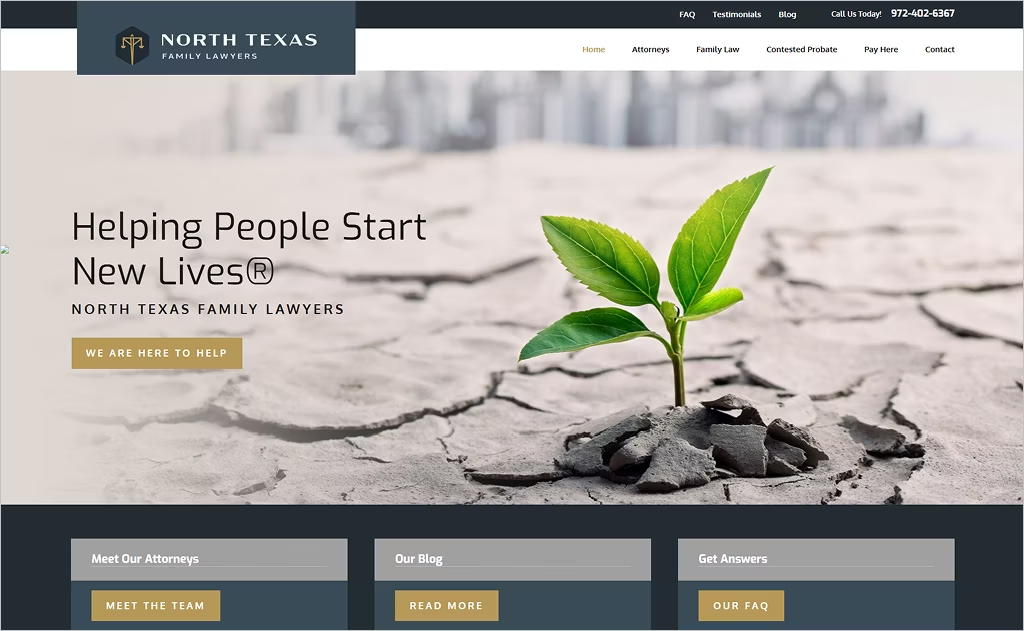

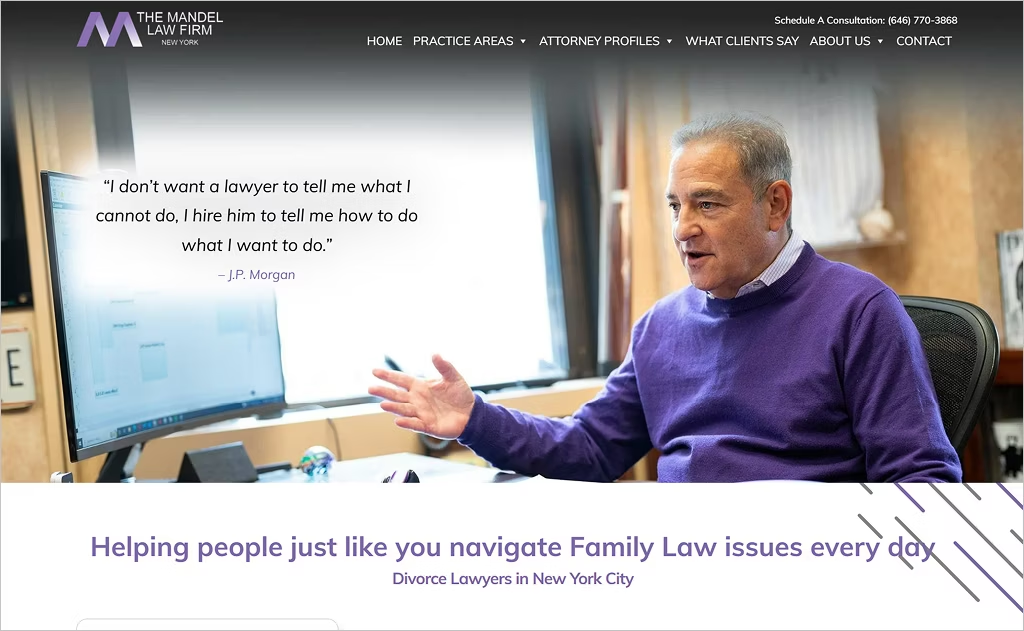

Get Your Free Growth Plan20. The Mandel Law Firm

The Mandel Law Firm’s website wastes no time hooking you.

Right from the start, you’re greeted with bold quotes (check out the website header). They are masters of direct messaging that feels human.

The design balances authority with approachability. Take note of the sharp typography, straightforward navigation, and content that speaks to real people facing divorce, custody, or support battles.

Testimonials, FAQs, and attorney profiles are woven seamlessly into the site, giving visitors a sense of trust and clarity from the first click.

If you’re looking to create a truly standout family law website, Mandel is proof that clarity beats clutter every time.

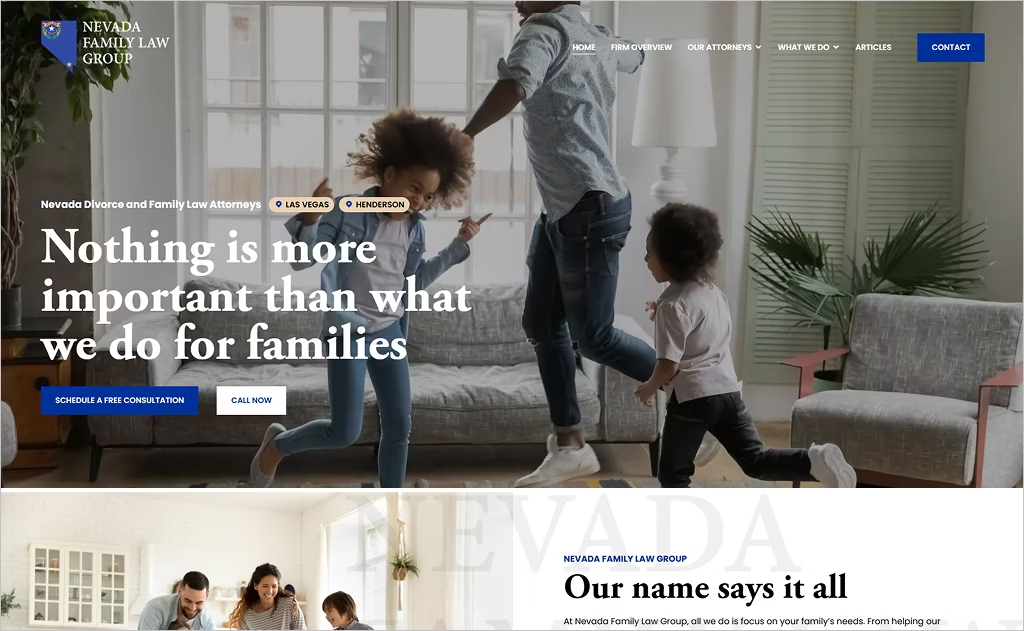

21. Nevada Family Law Group

This gets a lot right! Nevada Family Law Group’s site kicks off with a bold promise: “Nothing is more important than what we do for families.”

The clean blue-and-white design feels calm and trustworthy, while clear calls-to-action guide you straight to a free Nevada Divorce Guide. That’s a clever move… offering value upfront!

Navigation is simple, with practice areas, FAQs, and testimonials easy to find. Plus, each section emphasizes experience without drowning you.

For lawyers designing their own family law website, this is a strong example of balancing authority with a human tone.

22. Seastrom Tuttle & Murphy

What hits you first on Seastrom Tuttle’s website? Authority. The homepage leads with bold headlines, a crisp white-and-navy palette, and a no-nonsense callout: “We Measure Our Success By Yours.”

This site is designed to impress from the start.

Plus, their navigation is clean, and the practice areas, attorney profiles, and accolades are just one click away. The copy has subtle nods to high-stakes family law case experience, all framed in a way that inspires confidence.

We wish all family law websites would take note: this is how you project prestige without showing off!

23. Vacca Family Law Group

Most divorce sites feel heavy the moment you land. Not Vacca Family Law Group.

Their website is calm and approachable — almost like a trusted friend is walking you through what’s next. Instead of walls of legal gobbledygook, you’ll see clear explanations, easy navigation, and even a free eBook that spells out how collaborative divorce works.

The testimonials and media mentions build credibility, sure, but the real standout is tone.

It talks to you, not at you. When building a family law website, this is a great reminder: people in tough situations want warmth as much as expertise.

24. Eiges & Orgel Law Offices

In a mile-a-minute world, every second counts. When you land on Eiges & Orgel’s site, it gets right to the point.

Right up front, they say, “60+ Years of Serving New York Families”. That kind of track record is undeniably compelling! Plus, they add case results and client reviews throughout.

Instead of feeling like a cold law firm website, the site highlights decades of experience in divorce and family law while keeping the language clear.

All family law websites should remember: real results and real voices speak louder than buzzwords. The best lawyer websites keep this in mind.

25. Cohen Family Law

On Cohen’s site, you’re greeted by a warm, relatable image of a mother playing with her baby, instantly setting the tone. Pair that with the tagline “Helping Families Since 1982” and you’ve got credibility and empathy in a single glance.

The site keeps things clean with a white-and-red palette and easy navigation across services like custody, mediation, adoption, and domestic violence.

You’ll also see awards and recognitions displayed upfront — they do a brilliant job of reinforcing trust. Clear CTAs like “Get Your Free Consultation” make the next step obvious.

Take a page out of Cohen Family Law’s book. Use real, human imagery and straightforward copy to connect emotionally with your target audience.

26. Morris Sockle

Morris-Sockle’s site packs a punch right from the go! It opens with “Tenacious Attorneys. Strategic Approach.” That tagline is no-nonsense and ready to tackle the tough stuff.

For us, their Toolkit section is a standout — packed with practical downloads like a divorce guide, military divorce guide, video explainers, FAQs, and even “dos and don’ts.” It’s not flashy, but it offers real value.

What really works here is the credibility: decades of experience (40+ years) paired with testimonials, both of which build trust before that call is even made.

Morris-Sockle’s site 100% earned its place on our list of the best family law websites.

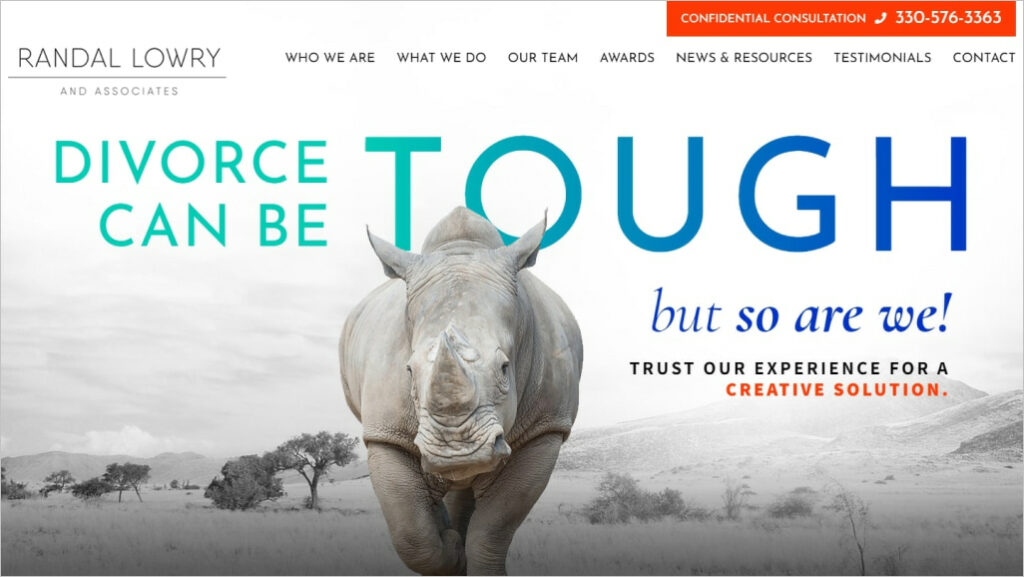

27. Randal Lowry

Step into Randal Lowry’s website and you’re met with a clean color palette: turquoise and white, which is deeply soothing to the eye.

The homepage leads with experience, highlighting Lowry’s 47+ years in family law and his role in shaping Ohio domestic relations law.

Awards, recognitions, and affiliations are centered in a brilliant way.

Plus, the navigation is simple: from “Why Choose Us” to “What We Do,” prospective clients don’t waste time hunting for answers. Randal Lowry’s site communicates strength and accessibility in equal measure.

We love it! This is a family law website done right.

28. Ward Family Law

You can’t help but be impressed with Ward Family Law’s site. They greet you with a bold statement: “Divorce Can Be Tough, But So Are We.” That tagline is direct and confident… just what clients need to see.

The design keeps things professional, using clean layouts, simple navigation, and strong CTAs like “Schedule a Free Consultation” to guide visitors.

The “What Sets Us Apart” section humanizes the firm with values like support during difficult times and making the law work for you.

For your site, consider a powerful tagline paired with clear service breakdowns like Ward. This is what every family law website should aim for.

29. Denver Family Lawyers

Denver Family Lawyers’ website makes a strong first impression with its bold headline — “Denver’s Premier Family Law Firm Since 1997” — paired with a clean, straightforward layout.

What do you notice about the design? It’s professional and accessible! Take note of the client testimonials, awards, and case results… all presented as clear as day.

What really works here is the emphasis on attorney William “Bill” Thode’s decades of courtroom experience, presented alongside real client voices that humanize the brand.

Looking to design a compelling family law website? Denver Family Lawyers should be on your vision board.

30. Chorowski Clary

Chorowski’s family law website is a masterclass in prestige and approachability.

The site highlights the firm’s powerhouse team with multiple Board-Certified attorneys and Fellows of the AAML, all while keeping the design straightforward and client-friendly.

Instead of overwhelming visitors with heavy legal jargon, they lead with clear values: experience, dedication, and results.

All of that, paired with bold calls to action, makes it easy to schedule a consultation!

If you’re a lawyer looking to build authority online, this family law website serves as a great example.

Family law digital marketing can make a huge difference for your firm. Check out our expert advice to help you succeed!

Next Step: Get a Stellar Website of Your Own. Our top-ranking legal sites deliver up to 1,018% more leads. Get a Free Consultation

Top Family Law Firm Website Design Tips

Whew, that was quite a journey! We just looked at 30 family law websites that nailed it. From clean layouts to bold colors to client-friendly content, we hope you feel inspired.

But inspiration is not enough. When it’s time to build (or revamp) your site, you’ll want a game plan. To make life easier, we pulled together a quick Family Law Website Checklist.

User Experience & Design

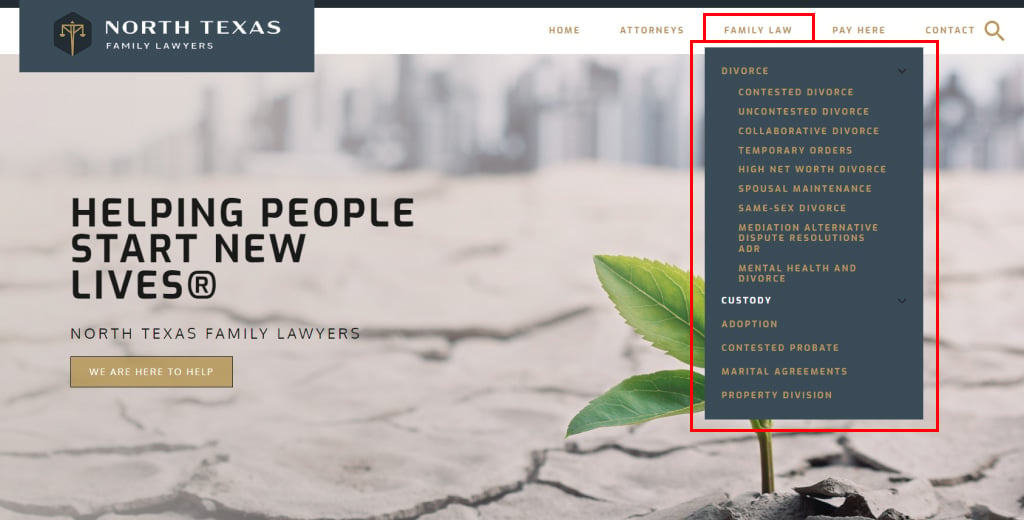

- Clear & Intuitive Navigation: Use a logical menu structure with clearly labeled tabs for services, attorney profiles, blog, and contact. Visitors should be able to find what they need in two clicks or less.

- Mobile-Optimized Design: Most clients start their search on a phone. Make sure your website adapts seamlessly to all devices for a frustration-free experience.

- Professional but Empathetic Visuals: High-quality team photos and images of families (not just courtrooms) create a sense of trust and compassion.

- Clean Layout: A simple, uncluttered design with plenty of white space improves readability and reduces overwhelm during a stressful time.

- Highlight Practice Areas: Make it easy for potential clients to see at a glance if you handle divorce, custody, adoption, mediation, or high-asset cases.

- Client-Centered Content: Offer blog posts, FAQs, and guides (like “What to Expect in Custody Hearings”) that directly address client pain points.

- Testimonials & Reviews: Showcase authentic client feedback to add social proof and credibility.

- Attorney Bios with Personality: Credentials matter, but so do stories. Humanize your attorneys with approachable bios that highlight both experience and values.

- Prominent Calls-to-Action: Every page should gently push visitors forward, whether it’s “Book a Free Consultation” or “Call Today for Help.”

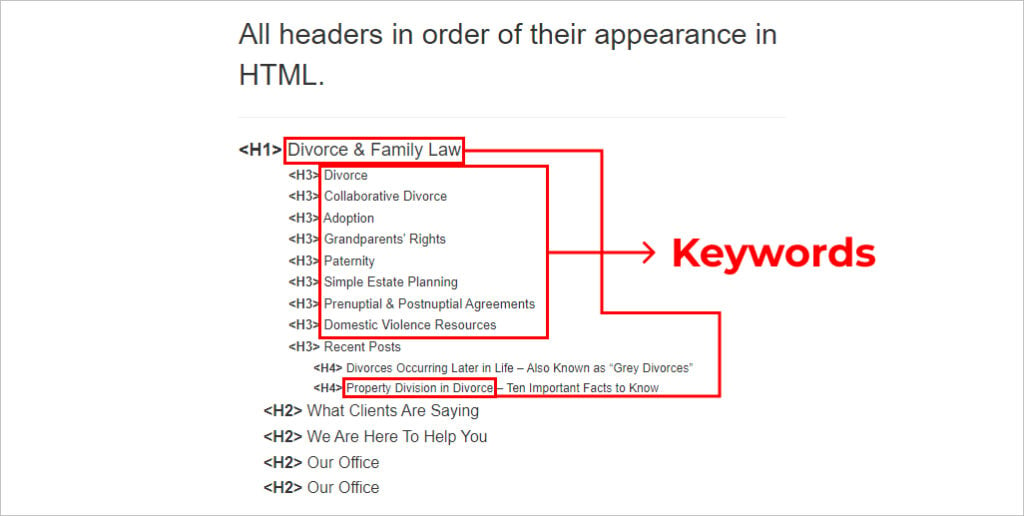

- SEO Best Practices: Pick relevant keywords from the family law industry, and naturally spread them throughout your copy, meta tags, and headings.

Technical Considerations

- Easy-to-Find Contact Info: Keep your phone number, email, and consultation link prominently displayed on every page. All the best websites do this.

- User-Friendly Forms: Make intake forms short and simple so potential clients don’t abandon them halfway through.

- Ongoing Maintenance: Regularly test your site for broken links, slow load times, or outdated plugins. A glitch-free site reflects professionalism.

This was a pretty comprehensive guide! If you feel overwhelmed right now, don’t worry. We have a shortcut. Keep reading.

Join Forces with Comrade: Your Family Law Website Design Partner

Building a legal website is harder than you think. There are well over 20+ technical elements that you must master, and frankly… do you have the time?

In 2026, you’re fighting off dozens of skilled lawyers for the same leads. The only way to dominate a competitive market is with a professional law firm website!

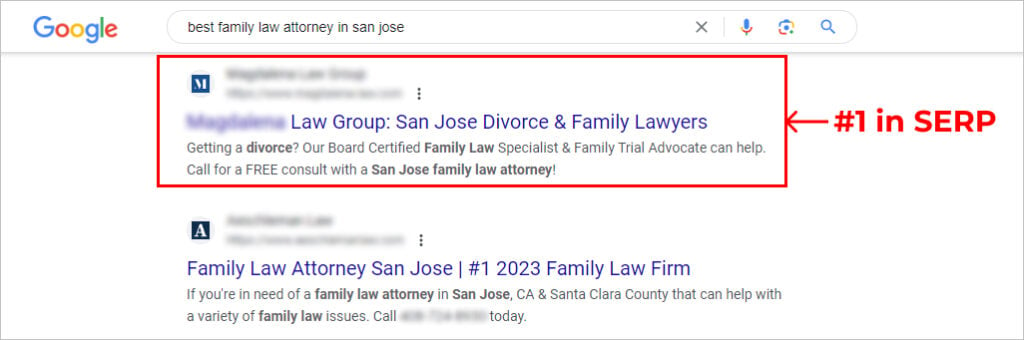

Comrade has a stellar 17-year track record with creating family law websites that rank at #1 on Google, convert visitors into clients, and drive revenue, month after month.

Our clients routinely see 400%–800% ROI in just the first year. Join in the action!